Bubble . o O (Bobble)!

Bubble Bobble was a mythical arcade video game, typical of arcade machines, Bub and Bob were two dragons who set out to save their girlfriends from a world known as the Cave of Monsters. With each level increasing in difficulty, Bub and Bob had to defeat their enemies by trapping them in their bubbles and popping them.

Not even two months ago, we were talking about the situation of shortage of professionals and exorbitant salary increase that was occurring in the IT market, by contrast; Now, we are already thinking about how many layoffs there will be until the end of 2022, which a priori looks black for the technology sector, first you see the lightning and then you hear the thunder.

In this article, I will try to find out if the bubble is real or, on the contrary, if we are living a regularization in the market. Humans tend to use memory very selectively, allowing ourselves to be dominated by the emotion of the specific moment we are living.

Understanding that emotions and moods govern the market, we think it is something very mathematical, rational, and calculated when we look at graphs. Still, the truth is that both in periods of optimism and in periods of pessimism, what always reigns are human emotions.

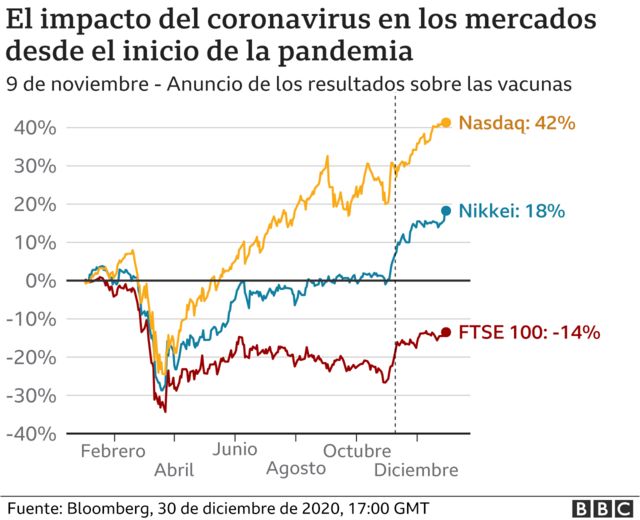

To understand the accumulated drop of more than 30% in 2022 of the Nasdaq (the main stock market index of the technology sector).

We must understand the 42% increase we were experiencing during Covid’s peak period.

Neither the rise was so high nor the fall is as terrible as it seems; today, with very worrying exceptions such as Netflix or Zoom, which are already close to a fall of 70%, the values have been restored a little above the state before the pandemic, indeed, the outlook is not at all flattering.

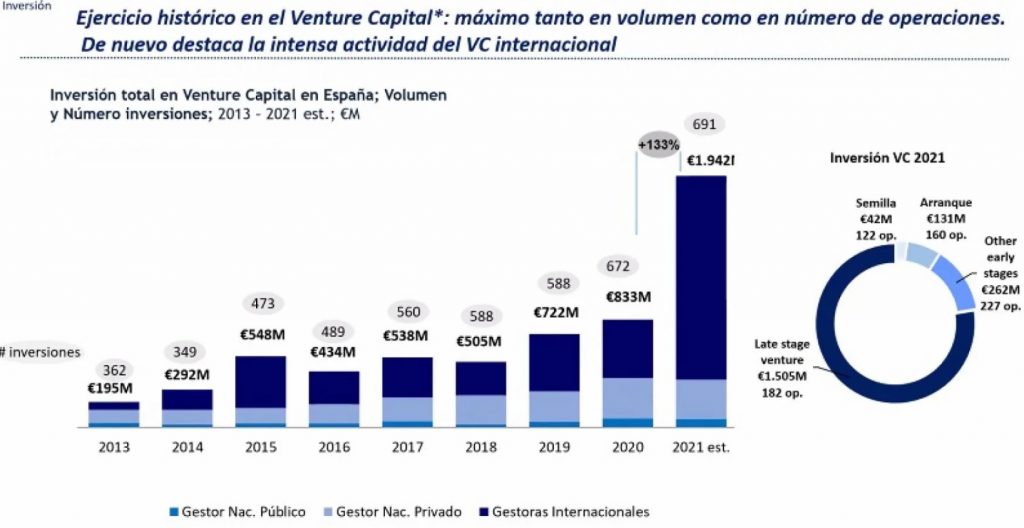

Let us understand then, that the factors that caused the Covid party we have had in the technology sector, were driven by different variables, the money printing press went up in smoke, interest rates fell to unprecedented levels, and the flow of investment capital was mostly concentrated in the technology sector, beating all records to date.

On the other hand, the factors that are bringing the tragedy forward refer to the fact that the printing press is stuck, interest rates will start rising to regularize inflation, and investment is already coming to a standstill.

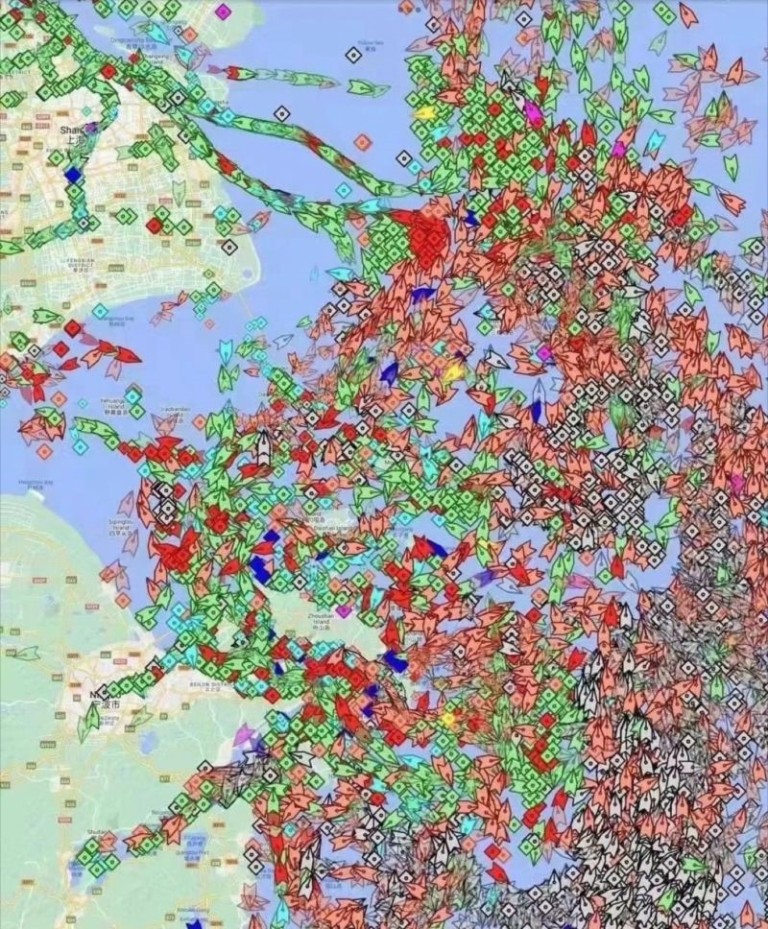

Let’s not fool ourselves; the global economic situation is not good. To the above points, I add the crisis in the supply chains; the image of the traffic jam in the port of Shanghai, in a way, illustrates the shortage problems we are experiencing this year, there are no new cars, laptops are scarce, and things are going to get very black with the wheat that has stopped supplying Ukraine. It is getting harder and harder to double park the boat.

Then fear begins to reign in the market, drastically reducing investment and closing ranks towards more conservative positions, closing, in a way, the tap of circulating capital.

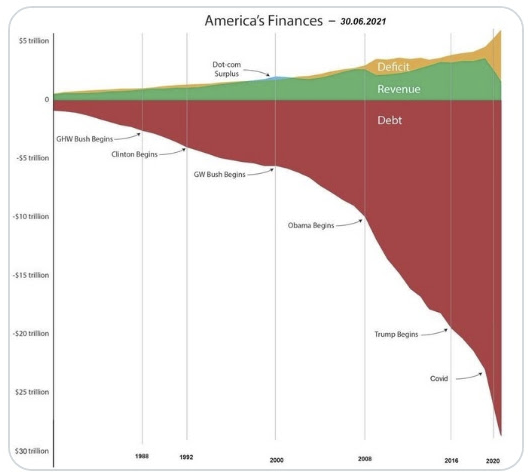

When the real economy is based on the theory of an “infinite” debt, which generates unreal valuations, it is when the real metaverse is created. I am not referring to the Facebook product but virtualization and complete market alienation. We are literally in a technical bankruptcy, which is appeased because all countries are more or less the same.

Globally, we are at debt levels similar to Greece’s before its bailout. If nation-states were families, they would be completely ruined, if they were companies, they would go bankrupt and enter into bankruptcy and insolvency proceedings.

But who knows, maybe there will be a plan B, a withdrawal will be proposed, and we will pivot towards this blockchain-centralized state; no doubt that there are already more than 90 countries that are creating their digital cryptocurrency, the digital dollar, the digital yuan, etc.

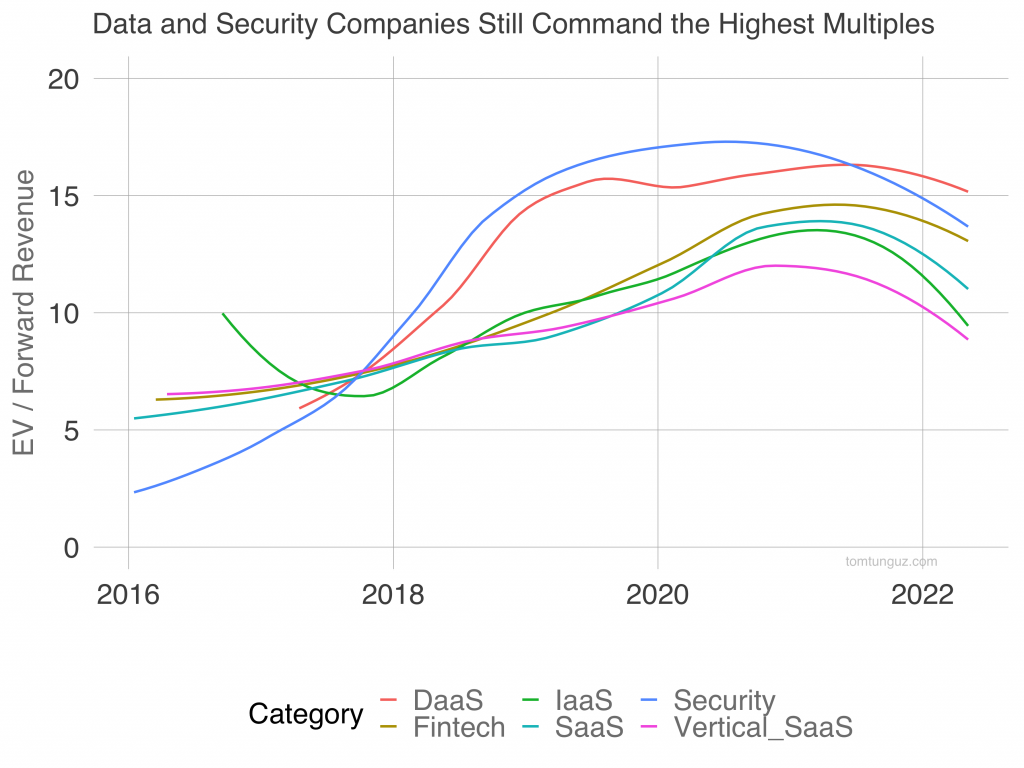

Without getting into quackery, it is worth pausing and reflecting on how we are valuing tech companies. Regardless of the punctual state of the market, valuations are still disproportionate, causing a toxic feedback loop, which is amplified when the tide goes out, and you see the shells left on the shore of the beach.

Understanding the recent valuation study by Tomasz Tunguz, comparing 2017 vs. 2022, the average company was trading at a multiple of 7x vs. the current 12.5x 2022. So then, in all likelihood, it is quite possible that by the end of the year, they will be halved.

For practical purposes, it should be noted that a slowdown is coming, which may turn into a recession, it will be accentuated from October, and 2023 looks like a complex and challenging year. Large multinationals such as Amazon will probably reduce their investment capital, leading to possible layoffs. We must bear in mind that they practically doubled their workforce during the pandemic period.

This does not mean that in the day-to-day operations of these companies, there will be a cataclysm because, despite the complex situation in the stock market, these giants continue to operate extraordinarily well, with cash flow and healthy accounts, so they will not lack credit.

It will affect them in the paralysis of the extra capital they use in intensive investment, but they will continue with enviable health in the core business.

If you are a startup owner who got a Series A in 2020 or 21, it looks terrible, the Series B will not appear in 2022 or 2023, and here is the risk; If you do not manage this Series A well, you will have a high risk, since you have sized yourself above the real possibilities that come, that Series A instead of exploding your startup outwardly, can implode inwardly.

A Series A can be a blessing or a punishment that puts your startup’s survival at risk, depending on how you manage it. But there will undoubtedly be some sifting, and the subsequent period will see the startups that generate value from those doped by the investment hype of the Covid period.

If you are a bootstrapping startup owner, as is my case, that is to say, you manage your startup with your kidneys, without external capital or investment, that you build from what you generate, without having acquired debt.

Continue creating more real value, not fictitious, ensure cash flow from 12 to 18 months, redesign your strategic plan, review your priorities, and remember that the important thing in the first years of a startup, is not to reach the million, but to survive at all costs, come what may.

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.