Why China Guodian Corporation's Business Model is so successful?

Get all the answers

China Guodian Corporation’s Company Overview

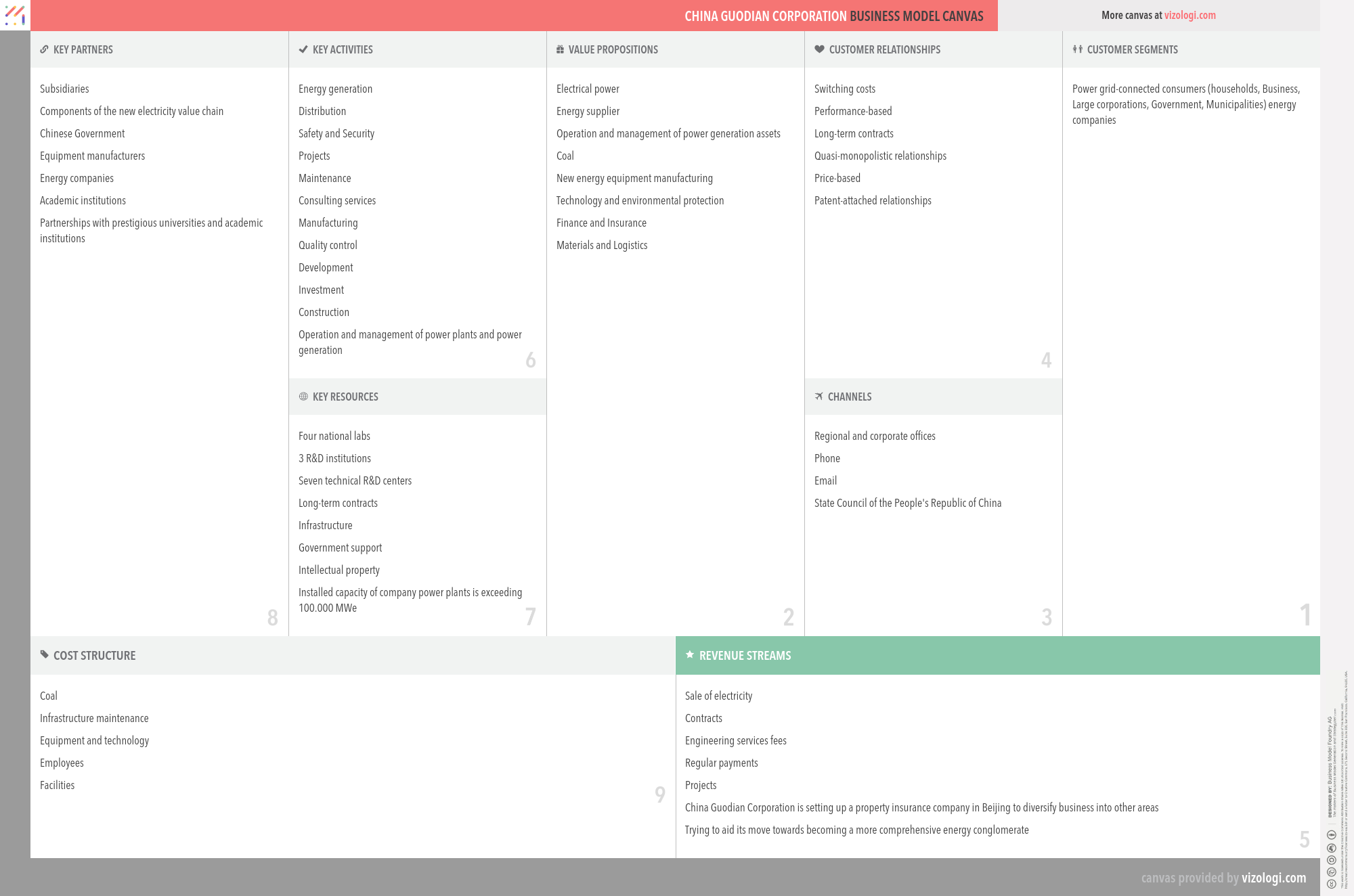

China Guodian Corporation is one of the five largest power producers in the People's Republic of China, administrated by SASAC for the State Council of the People's Republic of China. China Guodian Corporation operates as a power generation company in China. It primarily develops, operates, and manages power generation assets. The company generates a total capacity of 135 GW, including 94.637 MW of coal-fired, 16,447 MW of hydropower, 23.030 MW of wind power, and 890 MW solar power. It is also involved in the coal, new energy equipment manufacturing, technology and environmental protection, finance, insurance, materials, and logistics businesses. China Guodian Corporation was founded in 2002 and is based in Beijing, China.

www.cgdc.com.cnCountry: Beijing

Foundations date: 2002

Type: State-owned

Sector: Energy & Utilities

Categories: Energy

China Guodian Corporation’s Customer Needs

Social impact:

Life changing: heirloom

Emotional: provides access, badge value, reduces anxiety

Functional: integrates, connects, reduces risks, reduces effort, avoids hassles, quality

China Guodian Corporation’s Related Competitors

China Guodian Corporation’s Business Operations

Archetypes of business model design:

The business model archetypes include many business personalities and more than one business model linked to various goods or services. There is a common foundation behind the scenes of each unit, but from a management standpoint, each group may operate independently.

Cross-subsidiary:

When products and goods and products and services are integrated, they form a subsidiary side and a money side, maximizing the overall revenue impact. A subsidiary is a firm owned entirely or in part by another business, referred to as the parent company or holding company. A parent company with subsidiaries is a kind of conglomerate, a corporation that consists of several distinct companies; sometimes, the national or worldwide dispersion of the offices necessitates the establishment of subsidiaries.

Decomposition:

Simplifying many product kinds inside a product group or set of goods. A technique for doing business analysis in which a complex business process is dissected to reveal its constituent parts. Functional decomposition is a technique that may be used to contribute to an understanding and management of large and complicated processes and assist in issue solving. Additionally, functional decomposition is utilized in computer engineering to aid in the creation of software.

Direct selling:

Direct selling refers to a situation in which a company's goods are immediately accessible from the manufacturer or service provider rather than via intermediate channels. The business avoids the retail margin and any extra expenses connected with the intermediaries in this manner. These savings may be passed on to the client, establishing a consistent sales experience. Furthermore, such intimate touch may help to strengthen client connections. Finally, direct selling benefits consumers by providing convenience and service, such as personal demonstrations and explanations of goods, home delivery, and substantial satisfaction guarantees.

Dynamic pricing:

This pattern allows the business to adjust its rates in response to national or regional trends. Dynamic pricing is a pricing technique known as surge pricing, demand pricing, or time-based pricing. In which companies establish variable prices for their goods or services in response to changing market conditions. Companies may adjust their rates based on algorithms that consider rival pricing, supply and demand, and other market variables. Dynamic pricing is widely used in various sectors, including hospitality, travel, entertainment, retail, energy, and public transportation.

Energy:

Energy development is an area of study concerned with adequate primary and secondary energy sources to satisfy society's requirements. These activities include those that promote the development of conventional, alternative, and renewable energy sources and the recovery and recycling of energy that otherwise would have been squandered.

Integrator:

A systems integrator is an individual or business specializing in integrating component subsystems into a unified whole and ensuring that those subsystems work correctly together. A process is known as system integration. Gains in efficiency, economies of scope, and less reliance on suppliers result in cost reductions and may improve the stability of value generation.

Knowledge and time:

It performs qualitative and quantitative analysis to determine the effectiveness of management choices in the public and private sectors. Widely regarded as the world's most renowned management consulting firm. Descriptive knowledge, also called declarative knowledge or propositional knowledge, is a subset of information represented in declarative sentences or indicative propositions by definition. This differentiates specific knowledge from what is usually referred to as know-how or procedural knowledge, as well as knowledge of or acquaintance knowledge.

Make and distribute:

In this arrangement, the producer creates the product and distributes it to distributors, who oversee the goods' ongoing management in the market.

Pay as you go:

Pay as you go (PAYG) business models charge based on actual consumption or use of a product or service. Specific mobile phone contracts work on this principle, in which the user may purchase a phone card that provides credit. However, each call is billed separately, and the credit balance is depleted as the minutes are used (in contrast to subscription models where you pay a monthly fee for calls). Pay as you go is another term for pay & go, pay per use, pay per use, or pay-as-you-go.

Performance-based contracting:

Performance-based contracting (PBC), sometimes referred to as performance-based logistics (PBL) or performance-based acquisition, is a method for achieving quantifiable supplier performance. A PBC strategy focuses on developing strategic performance measures and the direct correlation of contract payment to success against these criteria. Availability, dependability, maintainability, supportability, and total cost of ownership are all standard criteria. This is accomplished mainly via incentive-based, long-term contracts with precise and quantifiable operational performance targets set by the client and agreed upon by contractual parties.

Solution provider:

A solution provider consolidates all goods and services in a particular domain into a single point of contact. As a result, the client is supplied with a unique know-how to improve efficiency and performance. As a Solution Provider, a business may avoid revenue loss by broadening the scope of the service it offers, which adds value to the product. Additionally, close client interaction enables a better understanding of the customer's habits and requirements, enhancing goods and services.

State-owned:

As rivals or subjects of study, Chinese businesses' emergence on the world stage necessitates or creates a new category of business models: state-owned enterprises. These enterprises typically do not exist for profit but rather to offer critical goods and services to society that cannot be supplied economically by established firms. This model is characterized by fixed pricing, monopoly access to consumers, an advantage in exploiting resources, minimal or no tax obligations, and recurring financial losses.

Supply chain:

A supply chain is a network of companies, people, activities, data, and resources that facilitate the movement of goods and services from supplier to consumer. The supply chain processes natural resources, raw materials, and components into a completed product supplied to the ultimate consumer. In addition, used goods may re-enter the distribution network at any point where residual value is recyclable in advanced supply chain systems. Thus, value chains are connected through supply chains.

Recommended companies based on your search: