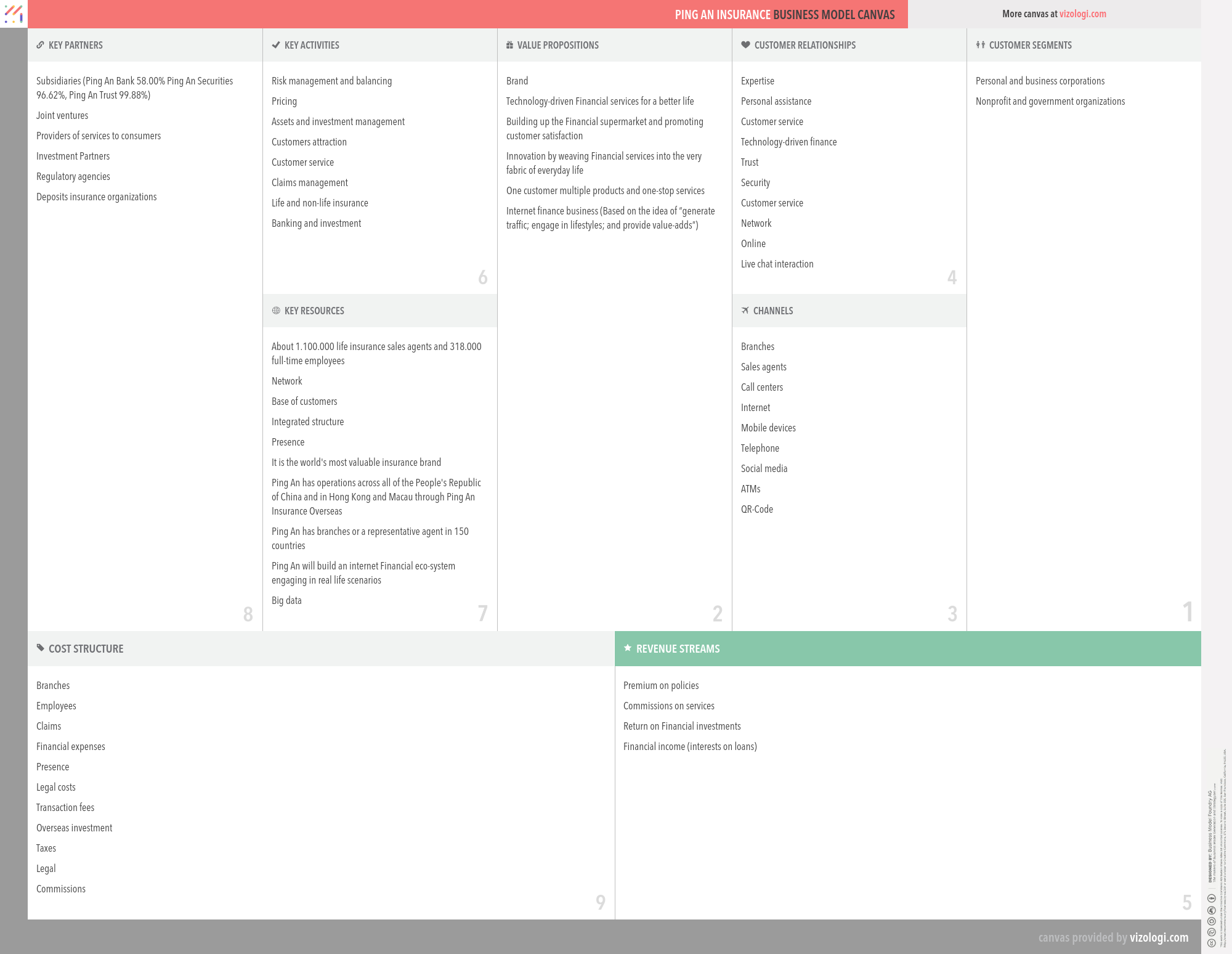

Why Ping An Insurance's Business Model is so successful?

Get all the answers

Ping An Insurance’s Company Overview

Ping An Insurance (Group) Company of China, Ltd. is a holding company whose subsidiaries mainly deal with insurance, banking, and Financial services. The company was founded in 1988 and has its headquarters in Shenzhen and Shanghai. Píng Ān means "safe and well." Today, it has developed into a personal integrated Financial services group with three core businesses of insurance, banking, and investment, enjoying the parallel growth of its traditional and non-traditional Financial businesses.

www.pingan.comCountry: Shenzhen

Foundations date: 1988

Type: Public

Sector: Financials

Categories: Insurance

Ping An Insurance’s Customer Needs

Social impact:

Life changing: heirloom

Emotional: provides access, reduces anxiety, wellness

Functional: reduces risks, quality, reduces cost, variety, saves time, avoids hassles, simplifies, reduces effort, makes money

Ping An Insurance’s Related Competitors

Ping An Insurance’s Business Operations

Best in class services:

When a firm brings a product to market, it must first create a compelling product and then field a workforce capable of manufacturing it at a competitive price. Neither task is simple to perform effectively; much managerial effort and scholarly study have been dedicated to these issues. Nevertheless, providing a service involves another aspect: managing clients, who are consumers of the service and may also contribute to its creation.

Brokerage:

A brokerage firm's primary responsibility is to serve as a middleman, connecting buyers and sellers to complete transactions. Accordingly, brokerage firms are compensated through commission once a transaction is completed. For example, when a stock trade order is executed, a transaction fee is paid by an investor to repay the brokerage firm for its efforts in completing the transaction.

Bundling:

Multiple products or services have been bundled together to enhance the value. Bundling is a marketing technique in which goods or services are bundled to be sold as a single entity. Bundling enables the purchasing of several goods and services from a single vendor. While the goods and services are often linked, they may also consist of different items that appeal to a particular market segment.

Combining data within and across industries:

How can data from other sources be integrated to generate additional value? The science of big data, combined with emerging IT standards that enable improved data integration, enables new information coordination across businesses or sectors. As a result, intelligent executives across industries will see big data for what it is: a revolution in management. However, as with any other significant organizational transformation, the difficulties associated with becoming a big data-enabled company may be tremendous and require hands-on?or, in some instances, hands-off?leadership.

Corporate innovation:

Innovation is the outcome of collaborative creativity in turning an idea into a feasible concept, accompanied by a collaborative effort to bring that concept to life as a product, service, or process improvement. The digital era has created an environment conducive to business model innovation since technology has transformed how businesses operate and provide services to consumers.

Cross-subsidiary:

When products and goods and products and services are integrated, they form a subsidiary side and a money side, maximizing the overall revenue impact. A subsidiary is a firm owned entirely or in part by another business, referred to as the parent company or holding company. A parent company with subsidiaries is a kind of conglomerate, a corporation that consists of several distinct companies; sometimes, the national or worldwide dispersion of the offices necessitates the establishment of subsidiaries.

Customer data:

It primarily offers free services to users, stores their personal information, and acts as a platform for users to interact with one another. Additional value is generated by gathering and processing consumer data in advantageous ways for internal use or transfer to interested third parties. Revenue is produced by either directly selling the data to outsiders or by leveraging it for internal reasons, such as increasing the efficacy of advertising. Thus, innovative, sustainable Big Data business models are as prevalent and desired as they are elusive (i.e., data is the new oil).

Customer relationship:

Due to the high cost of client acquisition, acquiring a sizable wallet share, economies of scale are crucial. Customer relationship management (CRM) is a technique for dealing with a business's interactions with current and prospective customers that aims to analyze data about customers' interactions with a company to improve business relationships with customers, with a particular emphasis on retention, and ultimately to drive sales growth.

Digital:

A digital strategy is a strategic management and a business reaction or solution to a digital issue, which is often best handled as part of a broader company plan. A digital strategy is frequently defined by the application of new technologies to existing business activities and a focus on enabling new digital skills for their company (such as those formed by the Information Age and frequently as a result of advances in digital technologies such as computers, data, telecommunication services, and the World wide web, to name a few).

Digital transformation:

Digitalization is the systematic and accelerated transformation of company operations, processes, skills, and models to fully exploit the changes and possibilities brought about by digital technology and its effect on society. Digital transformation is a journey with many interconnected intermediate objectives, with the ultimate aim of continuous enhancement of processes, divisions, and the business ecosystem in a hyperconnected age. Therefore, establishing the appropriate bridges for the trip is critical to success.

Disruptive banking:

The banking industry's disruptors are changing the norms that have been in place for decades. These new regulations, however, will only be effective until the next round of disruption occurs. Banks and credit unions must thus be nimble and responsive. We need audacious tactics. 'Disruptive Innovation' is a term that refers to the process whereby a product or service establishes a foothold at the bottom of a market and then persistently climbs up the value chain, ultimately replacing existing rivals.

Ecosystem:

A business ecosystem is a collection of related entities ? suppliers, distributors, customers, rivals, and government agencies ? collaborating and providing a particular product or service. The concept is that each entity in the ecosystem influences and is impacted by the others, resulting in an ever-changing connection. Therefore, each entity must be adaptive and flexible to live, much like a biological ecosystem. These connections are often backed by a shared technical platform and are based on the flow of information, resources, and artifacts in the software ecosystem.

Experience selling:

An experience in the sales model describes how a typical user perceives or comprehends a system's operation. A product or service's value is enhanced when an extra customer experience is included. Visual representations of experience models are abstract diagrams or metaphors derived from recognizable objects, actions, or systems. User interfaces use a range of experience models to help users rapidly comprehend what is occurring in the design, where they are, and what they may do next. For example, a software experience model may depict the connection between two applications and the relationship between an application and different navigation methods and other system or software components.

Healthcare:

The prevention, treatment, and management of disease and maintaining mental and physical well-being via the medical and allied health professionals' services. It includes diagnostic, preventative, remedial, and therapeutic service providers such as physicians, nurses, hospitals, and other private, public, and volunteer organizations. Additionally, it comprises producers of medical equipment and pharmaceuticals, as well as health insurance companies.

Lease:

The item that's being sold is now available for rent on an hourly/daily/monthly/yearly basis. A lease is a contract that specifies the terms under which one can rent a property. It ensures the lessee, the tenant, access to an asset, and the lessor, the property owner or landlord, receives monthly payments from the lessee for a predetermined period of months or years. Both the lessee and the lessor risk penalties for breaching the contract's conditions.

Low touch:

Historically, developing a standard touch sales model for business sales required recruiting and training a Salesforce user who was tasked with the responsibility of generating quality leads, arranging face-to-face meetings, giving presentations, and eventually closing transactions. However, the idea of a low-touch sales strategy is not new; it dates all the way back to the 1980s.

Private level banking:

Private label banks allow any business with a sizable client base, brand, or unique technological solution to operating as a private label bank. Private banking refers to the customized financial and banking services to its affluent high net worth individual (HNWI) customers. HNWIs generally have more money than ordinary individuals, enabling them to access a broader range of conventional and alternative assets. Private banks' goal is to connect such people with the most suitable alternatives.

Subscription:

Subscription business models are built on the concept of providing a product or service in exchange for recurring subscription income on a monthly or annual basis. As a result, they place a higher premium on client retention than on customer acquisition. Subscription business models, in essence, concentrate on revenue generation in such a manner that a single client makes repeated payments for extended access to a product or service. Cable television, internet providers, software suppliers, websites (e.g., blogs), business solutions providers, and financial services companies utilize this approach, as do conventional newspapers, periodicals, and academic publications.

Recommended companies based on your search: