Bookkeeping Basics for Extra Cash Flow

Bookkeeping is not the most exciting topic. But knowing the basics can help your small business. Understanding bookkeeping principles can guide your financial decisions. This can benefit your bottom line.

In this article, we’ll cover the basics of bookkeeping. We’ll offer practical tips and strategies to help you manage your finances. Whether you’re a small business owner or want to improve your financial skills, mastering bookkeeping basics can boost your cash flow.

Understanding a Bookkeeper’s Job

Daily Tasks of a Bookkeeper

A bookkeeper’s daily tasks involve recording financial transactions, updating statements, and checking records for accuracy. Working from home offers flexible work hours, which increases efficiency. Bookkeepers commonly use accounting software like QuickBooks or Xero for tasks like payroll management, invoice generation, and tracking accounts payable/receivable. These tools help keep financial records organized and easily accessible, and they support various types of bookkeeping services that cater to different business needs.

Work From Home: Can Bookkeepers Do It?

Bookkeepers can work from home and offer financial record-keeping services for people and businesses. This setup has benefits like flexible working hours, low start-up costs, and the ability to work with clients from different places. But, it also comes with challenges such as managing time, staying motivated, and handling data securely. To work from home, bookkeepers need accounting software, fast internet, and a dedicated workspace.

It’s also important to have virtual communication tools for client meetings and training resources for skill development.

What Do You Need to Start?

Craft Your Business Plan

Crafting a successful business plan involves several important components:

- Clearly defining the business’s purpose and goals.

- Conducting market research to identify potential opportunities and threats.

- Outlining the company’s organizational structure and management team.

- Articulating the marketing and sales strategy.

While prior experience can be beneficial, it is not always necessary. However, individuals with prior knowledge of bookkeeping may have a competitive advantage.

When creating a business plan, it’s important to consider:

- Evaluating the market demand for bookkeeping services.

- Identifying the target audience.

- Assessing the competition.

- Establishing realistic financial projections to attract potential investors or obtain financing.

Additionally, incorporating a contingency plan to address unexpected challenges is crucial to the long-term success of the business.

The Necessity of Experience: Yes or No?

Experience in bookkeeping isn’t necessary, but it can boost job opportunities and earnings. Skilled bookkeepers can earn $40,000+ annually. Startup costs are minimal, making the business accessible to anyone. However, experience can help build a client base and increase earnings. Understanding the roles of accountants and bookkeepers is important for taking advantage of certifications and skills needed for bookkeeping.

Experience reduces job training time and increases productivity, leading to career advancement. Training and resources can still equip prospective bookkeepers for a career change without prior experience.

Learning to Keep Books

Finding a Training Program or Course

When looking for a bookkeeping training program or course, individuals have different options available to them:

- Online courses

- Community college programs

- Vocational school curriculums

These options can be found through a simple internet search or by contacting local education centers.

Self-learning is different from formal education. For example, self-learning is ideal for those wanting to learn alongside work or other commitments, while formal education provides a more structured and comprehensive learning environment.

In a bookkeeping training program or course, individuals should expect to find instruction on:

- Basic accounting principles

- Financial software operation

- Virtual bookkeeping business guidance

These programs are designed to equip students with the necessary skills to become a successful bookkeeper, including:

- Applying for jobs online

- Gaining clients

Self-Learning Versus Formal Education

Self-learning has flexibility in time and resources, unlike formal education in bookkeeping. Online platforms like QuickBooks, Xero, or Excel offer access to bookkeeping skills without fixed schedules or locations.

Formal education provides structured learning leading to professional certifications, enhancing credibility. However, it involves significant financial costs and time commitment.

Choosing between self-learning and formal education impacts a person’s success as a bookkeeper. Both have unique benefits and drawbacks, and a combination of the two can be effective.

For instance, self-learning can provide practical skills, and then specific certification courses can validate expertise. Participating in internships or apprenticeships during formal education offers crucial hands-on experience for a successful bookkeeping career.

What’s in a Bookkeeping Course?

A bookkeeping course covers financial transactions, payroll management, tax preparation, and financial statement analysis.

Different courses may vary in content and approach. Some focus on software, while others emphasize accounting principles.

Benefits of formal education include structured learning, expert instructors, and recognized certification. Drawbacks may include higher costs and longer time commitments.

Self-learning offers flexibility, lower costs, and the ability to learn at one’s own pace. However, it may lack the depth and credibility of formal education.

Starting Your Bookkeeping Journey

First Steps for Newbies

New to bookkeeping? Here are some tips to get started:

- First, focus on gaining skills and training through online courses or mentorship.

- Consider forming a business and establishing an online presence.

- Look for initial clients through freelance websites and networking.

- Stay updated on bookkeeping practices and accounting software changes.

To increase earnings within a year:

- Specialize in a niche, like serving small businesses in a specific industry.

- Expand services and maintain high accuracy and efficiency to attract and retain clients.

- Invest in advanced bookkeeping software and automation tools for better earning potential.

Formal education isn’t always necessary. Self-learning from reputable online resources and mentorship can provide the needed skills. Obtain certifications from recognized bookkeeping associations for increased credibility and earning potential.

Tips for Earning More Within a Year

Bookkeepers can boost their earnings by taking on more clients and expanding their business reach. They can also consider raising their rates as they gain more experience. Acquiring additional skills like tax preparation and financial analysis can offer more value to clients. Marketing services online, creating a professional website, and using freelance platforms can help reach a broader audience and attract more clients.

Offering referral incentives to existing clients can lead to new business opportunities. Mastering these strategies can help bookkeepers grow their businesses and increase their earnings within a year.

Understanding Earnings and Costs

How Much Does a Beginner Make?

The starting salary for a beginner bookkeeper is between $17 and $25 per hour, which can be a good way to make money. Compared to other entry-level jobs, this pay is competitive and sometimes higher than what other remote jobs offer. There are many chances for beginners to earn more in bookkeeping if they get the right training and focus on getting clients. As they gain more experience and qualifications, along with using effective marketing, their income can increase even more.

How Much Does Learning Cost?

Formal education or training in bookkeeping can have a wide range of costs. Certificate programs average between $1,000 to $3,000, while an associate’s degree can range from $5,000 to $20,000 depending on the institution.

Additional costs to consider include study materials like textbooks and software, as well as certification exams ranging from $100 to $500. However, there are opportunities for free or low-cost education in bookkeeping.

Many online platforms offer free courses or tutorials, and community colleges and adult education programs often provide affordable classes in basic bookkeeping skills. Additionally, organizations offer scholarships or financial aid for those pursuing a career in bookkeeping but may not have the financial means for formal education or training.

Pros and Cons of Being a Bookkeeper

Top Benefits of the Job

Working as a bookkeeper can bring in high earnings, with hourly rates averaging between $17 to $25 or more. This makes it a good choice for those who want to work from home.

Starting a bookkeeping business doesn’t require a lot of money, which makes it an attractive option.

Bookkeeping also offers a flexible schedule, allowing individuals to manage their time effectively.

There are opportunities for professional growth and development in this career, with the potential to start and grow your own virtual bookkeeping business.

You can work with different types of clients and earn up to $40,000 or more per year from home. Bookkeeping is a promising option for those seeking financial independence and a rewarding career.

Downsides to Consider

Pursuing a career as a bookkeeper can have some downsides. This may include long, tedious hours spent on data entry and number crunching.

To address these downsides, aspiring bookkeepers can stay organized and use time management strategies. It’s also important to consider common challenges like working with difficult clients and managing strict deadlines.

Effective communication and stress management are essential skills for navigating these challenges in the day-to-day work of a bookkeeper.

Marketing Your Bookkeeping Services

Creating an Online Presence

A bookkeeper can create an online presence by developing a professional website. They can showcase their services and expertise and include informative content such as blog posts, articles, and case studies. This helps establish them as an authority in the field.

Utilizing social media platforms to share industry-related news, success stories, and client testimonials can also help increase visibility and engagement.

Key elements for establishing an online presence for a bookkeeping business include search engine optimization (SEO) to ensure the website ranks high in search results. Utilizing email marketing to stay in touch with current and potential clients, and creating a strong brand that reflects the bookkeeper’s values and mission are also crucial.

Engaging with online communities, forums, and discussion groups in the accounting and bookkeeping sector can help spread the word and build partnerships and collaborations.

An online presence can help a bookkeeper attract new clients and grow their business by creating trust and credibility. Potential clients can learn about the bookkeeper’s skills, expertise, and experience through their website and social media platforms. By showcasing their successes and satisfied clients, a bookkeeper can position themselves as a reliable and capable professional, thus attracting a larger client base and growing their business.

Frequently Asked Questions

Is a Degree Needed for Bookkeeping?

Many people wonder if you need a formal degree for bookkeeping. The truth is, a degree is not necessary. There are other ways to get the qualifications and training, like online courses, workshops, and self-study resources.

The Bookkeeper Launch course offers learning materials to gain bookkeeping skills and start a business without a formal degree. The blog post also talks about the potential to earn money from home as a bookkeeper, without needing to be an accountant.

With hourly rates from $17 to $25+, bookkeeping can be a good business to start from home with minimal startup costs. So, formal education isn’t the only way to have a successful career in bookkeeping. There are many opportunities available for those who are willing to pursue them.

Do I Have to Work Full-Time?

Part-time work is a good option for bookkeepers. Many people choose to work part-time as virtual bookkeepers. They might do this to make extra money or to have a flexible schedule.

People who do bookkeeping on the side can take on a few clients, manage their work, and set their own hours. A blog gives information about the average hourly rates of bookkeepers. It also shows that there are low startup costs, so it’s easy to start a bookkeeping business from home.

Because bookkeeping offers flexibility, part-time work is a practical choice for anyone looking to make money in this field.

Can I Be a Freelancer and Find Clients?

To become a successful freelancer and find clients, individuals should focus on developing their skills and expertise in their chosen field. This could involve getting relevant training, certifications, or gaining practical experience through internships or entry-level positions.

Networking and using online platforms to showcase their work and connect with potential clients is also crucial. Establishing a professional online presence, such as maintaining an up-to-date portfolio and actively engaging with industry-related groups and forums, can help freelancers effectively market their services.

Providing high-quality work and building strong relationships with current clients can lead to referrals and testimonials that can attract new clients. In addition, freelancers must be proactive in seeking out new opportunities and not be discouraged by rejection, as perseverance is often necessary to secure consistent work.

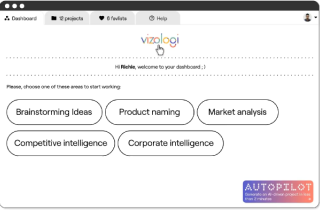

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.