Breaking Down the Steps of Risk Evaluation Analysis

Risk evaluation analysis is a process used to assess potential hazards and make informed decisions. It involves breaking down the steps of risk assessment to determine the likelihood and potential impact of various risks. Understanding this process helps individuals protect themselves and their investments.

In this article, we will explore the steps of risk evaluation analysis and how they can be applied in real-world situations. Whether you’re a business owner or looking to make better decisions in your personal life, understanding risk evaluation analysis is a valuable skill.

What is Risk Evaluation?

Qualitative methods can identify risk areas related to normal business functions. They help organizations understand potential risks without needing precise numerical data.

Quantitative methods use factual and measurable data to present precise results about the value of risks.

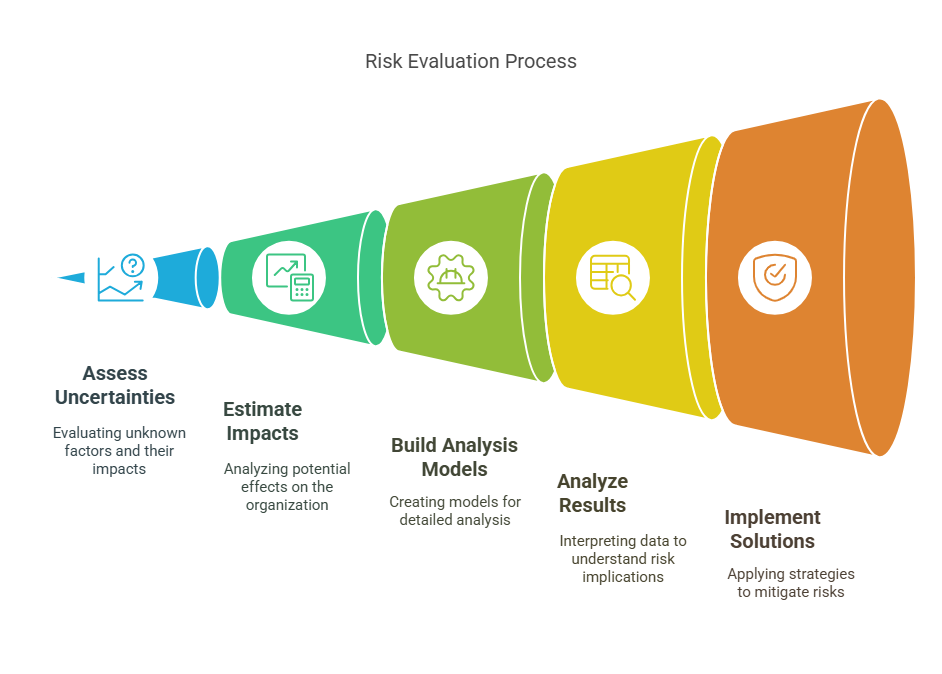

When evaluating risks, entities typically follow six common steps:

- Identifying risks and uncertainty.

- Estimating impact.

- Building analysis models.

- Analyzing results.

- Implementing solutions

These steps help organizations prioritize and manage potential risks effectively.

This applies to financial decisions, project implementations, or overall business operations.

Different Kinds of Risk Evaluation Explained

Quantitative risk analysis provides specific and measurable data for decision-making, while qualitative risk analysis quickly identifies potential risk areas in normal business functions.

Evaluating risks can benefit decision-making, protect organizational interests, and improve process efficiency. However, it also has drawbacks, such as the need for high-quality data and subjectivity in qualitative analysis.

Evaluating risks involves identifying risks and uncertainty, estimating impact, building analysis models, analyzing results, and implementing solutions.

The Pros and Cons of Evaluating Risks

The Pros of Evaluating Risks

Evaluating risks in a business or project can help identify potential benefits and opportunities. It can also pinpoint areas of concern that may negatively impact the organization.

For example, risk evaluation can inform decisions about pursuing new projects or investments and help plan for potential adverse events.

Furthermore, evaluating risks can help entities anticipate and mitigate potential challenges. This can lead to improved performance and project success.

By identifying and minimizing potential risks through effective risk analysis, businesses can safeguard their interests and make informed decisions. This ultimately contributes to the organization’s overall success and stability.

The Cons of Evaluating Risks

Evaluating risks can sometimes make decision-makers excessively worried about potential problems. This can cause them to miss opportunities, spend more money, and lose their competitive edge. Personal biases and subjective judgment can also affect risk evaluations, making the results unreliable.

As a result, decisions about managing risks and safety measures might be inappropriate. Lastly, evaluating risks can take up much time and resources, which could otherwise be used for important business activities and projects, leading to less profit.

Steps to Evaluate Risks

Finding What Could Go Wrong

Potential negative outcomes or consequences that could occur:

- Financial losses

- Project delays

- Reputational damage

- Legal issues

Methods such as quantitative risk analysis can assess uncertainty and likelihood of risks. This method uses simulation or deterministic statistics to assign numerical values to risks.

Factors that need to be considered in evaluating and understanding risks include:

- Assets

- Processes

- Threats

- Vulnerabilities

- Impact of potential risks on the organization

Both qualitative and quantitative risk analysis are necessary to:

- Quickly identify risk areas

- Provide precise results for decision-making

By adopting a combined approach, organizations can:

- Enhance the effectiveness and efficiency of the risk assessment process

- Conform to the organization’s requirements

Figuring Out Uncertain Things

There are different kinds of risk evaluation. Some include risk-benefit analysis, needs assessment, business impact analysis, and root cause analysis.

Each method helps understand potential benefits and associated risks, evaluate current gaps, predict the impact of potential risks, and eliminate processes causing issues.

Evaluating risks has pros, including making informed decisions, managing potential risks effectively, and protecting organizations’ interests. However, the cons include the need for high-quality data, a well-developed project model, and time investment for more accurate quantitative risk assessment.

Qualitative risk analysis quickly identifies risk areas related to normal business functions, while quantitative risk analysis provides more objective and accurate data for decision-making. Using both approaches can improve process efficiency and help achieve desired security levels. However, qualitative risk analysis is quick but subjective, while quantitative risk assessment relies on factual and measurable data but requires more time and resources.

Guessing the Effect of Risks

One can understand the impact of risks by identifying and measuring their likelihood. This involves estimating the potential events and minimizing their negative effects through hedging or insurance.

Practical steps can be taken to evaluate risks, such as identifying uncertainties, estimating impact, building analysis models, analyzing results, and implementing solutions. These steps assist in prioritizing and managing risks effectively.

Guessing the effect of risks has advantages. It helps identify and manage potential risks to make informed decisions and protect organizations’ interests. Quantitative risk analysis is more accurate but requires high-quality data and a well-developed project model. Qualitative risk analysis, on the other hand, is subjective but quicker to perform.

Making a Model to Understand Risks

Making a model can help understand risks. Building a risk model using quantitative risk analysis provides numerical values for the risks, enabling organizations to assign a range of outcomes to potential risks.

Organizations can use this model to analyze various scenarios and produce sensitivity tables to gain insight into potential outcomes.

The steps involved in evaluating risks typically include:

- Identifying risks and uncertainties.

- Estimating the impact of these risks.

- Building analysis models.

- Analyzing the results.

- Implementing solutions or risk mitigation plans

Potential pros of evaluating risks include making informed decisions and protecting the interests of organizations.

However, a potential con is that qualitative and quantitative assessments may be subjective or time-consuming depending on the approach used.

Looking at the Model’s Answers

Evaluating risks helps organizations minimize potential adverse events through hedging or insurance. This process estimates the impact of risk events and effectively balances potential benefits and associated risks. However, prioritizing and managing risks effectively requires significant time and in-depth knowledge.

Qualitative methods quickly identify risk areas related to normal business functions, while quantitative methods provide more accurate data for decision-making. Using both approaches enhances process efficiency and yields desired security levels.

Preparing for a risk evaluation involves identifying risks and uncertainty, estimating the impact, building analysis models, analyzing results, and implementing solutions. These steps prioritize and manage potential risks effectively and make informed decisions to protect the organization’s interests.

Picking the Best Solution

Organizations evaluate risks to make informed decisions and protect their interests.

Qualitative risk analysis quickly identifies risk areas related to normal business functions. Quantitative risk analysis provides more objective and accurate data for decision-making.

Using both approaches can improve process efficiency and help achieve desired security levels.

To prepare for a risk evaluation, entities must ensure they have high-quality data, a well-developed project model, and prioritized risk lists for quantitative risk assessment.

They need to invest time and money into critical security issues for qualitative risk analysis.

By adopting a combined approach, organizations can enhance the effectiveness and efficiency of the risk assessment process and conform to their requirements.

Qualitative Versus Quantitative Ways to Evaluate Risks

How Qualitative Methods Can Help Understand Risks

Qualitative methods help understand risks by quickly identifying risk areas in normal business functions. They provide insight into risks’ potential impact and allow for a subjective assessment of the likelihood of adverse events.

The advantages of qualitative methods for evaluating risks are that they are quicker and provide a general understanding of potential risks. However, the disadvantages include their subjective nature and the lack of precise data for decision-making.

Qualitative methods offer a quicker assessment and a more subjective view of risks compared to quantitative methods. Quantitative methods rely on factual and measurable data, providing precise and objective results for decision-making.

How Quantitative Methods Can Help Measure Risks

Quantitative methods help measure risks by assigning numerical values to risk. This includes risk modeling using simulation and deterministic statistics. These methods use inputs like assumptions and random variables to generate a range of output, providing insightful data for risk managers. They also utilize scenario analysis and sensitivity tables to offer a broader perspective on potential risks.

The benefits of using quantitative methods include providing objective and accurate data for decision-making and precise results about risk value. However, it requires high-quality data, a well-developed project model, and prioritized risk lists. In contrast, limitations include the need for a significant investment of time and money and the complexity of the process.

Quantitative methods differ from qualitative methods in evaluating risks by relying on factual and measurable data to provide precise information. They offer more objective and accurate data than qualitative analysis, which can be subjective. Nonetheless, qualitative methods are quicker, making them more suitable for rapid risk assessment.

Getting Ready for Your Risk Evaluation

Risk evaluation includes six common steps.

- Identifying risks

- Assessing uncertainty

- Estimating impact

- Building analysis models

- Analyzing results

- Implementing solutions.

Quantitative risk assessment uses factual and measurable data to provide precise results. However, it requires high-quality data, a well-developed project model, and prioritized risk lists.

On the other hand, qualitative risk analysis is quicker but subjective. Combining both approaches can improve process efficiency and help achieve desired security levels.

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.