Why BNP Paribas's Business Model is so successful?

Get all the answers

BNP Paribas’s Company Overview

BNP Paribas is a leading French multinational banking and financial services company with its global headquarters in Paris. As one of the largest banks in the world, BNP Paribas has established a formidable presence across Europe and operates in 72 countries with nearly 200,000 employees. The bank's roots date back to the year 2000, following the merger of Banque Nationale de Paris (BNP) and Paribas, a renowned investment bank. BNP Paribas offers a comprehensive range of banking, investment, and financial services, catering to both individual and corporate clients. The company is continuously committed to fostering innovation, sustainability, and responsibility in banking, having integrated sustainable finance as part of its core mission to drive positive impact on the environment and society.

BNP Paribas utilizes a universal banking model that seamlessly integrates retail banking, corporate and institutional banking, investment solutions, and specialized financial services. This model allows the bank to offer a diverse set of products such as savings and current accounts, loans, mortgages, asset management, insurance, and wealth management services. The bank’s retail banking network is extensive, covering established markets in Europe, as well as growing markets in the Asia-Pacific region and the Americas. BNP Paribas leverages digital technology and innovative solutions to enhance customer experience, streamline operations, and remain competitive in a rapidly evolving financial landscape. This approach provides the foundation for BNP Paribas's commitment to excellence in customer service and operational efficiency.

The revenue model of BNP Paribas is multifaceted, comprising various streams that contribute to a robust financial foundation. Primarily, the bank generates income through traditional banking activities, including interest income from loans and mortgages, and fee-based income from maintaining customer accounts. Additionally, BNP Paribas earns revenue from asset management fees, advisory services, and transaction-based activities within its investment banking division. The bank also derives income from insurance premiums through its extensive portfolio of insurance products. By maintaining a diversified revenue stream, BNP Paribas ensures financial stability and sustained growth, enabling it to navigate market fluctuations and maintain its position as a global banking leader.

Headquater: Paris, France, EU

Foundations date: 1848

Company Type: Public

Sector: Financials

Category: Financial Services

Digital Maturity: Fashionista

BNP Paribas’s Related Competitors

EXOR Group Business Model

UniCredit Group Business Model

J.P. Morgan Chase Business Model

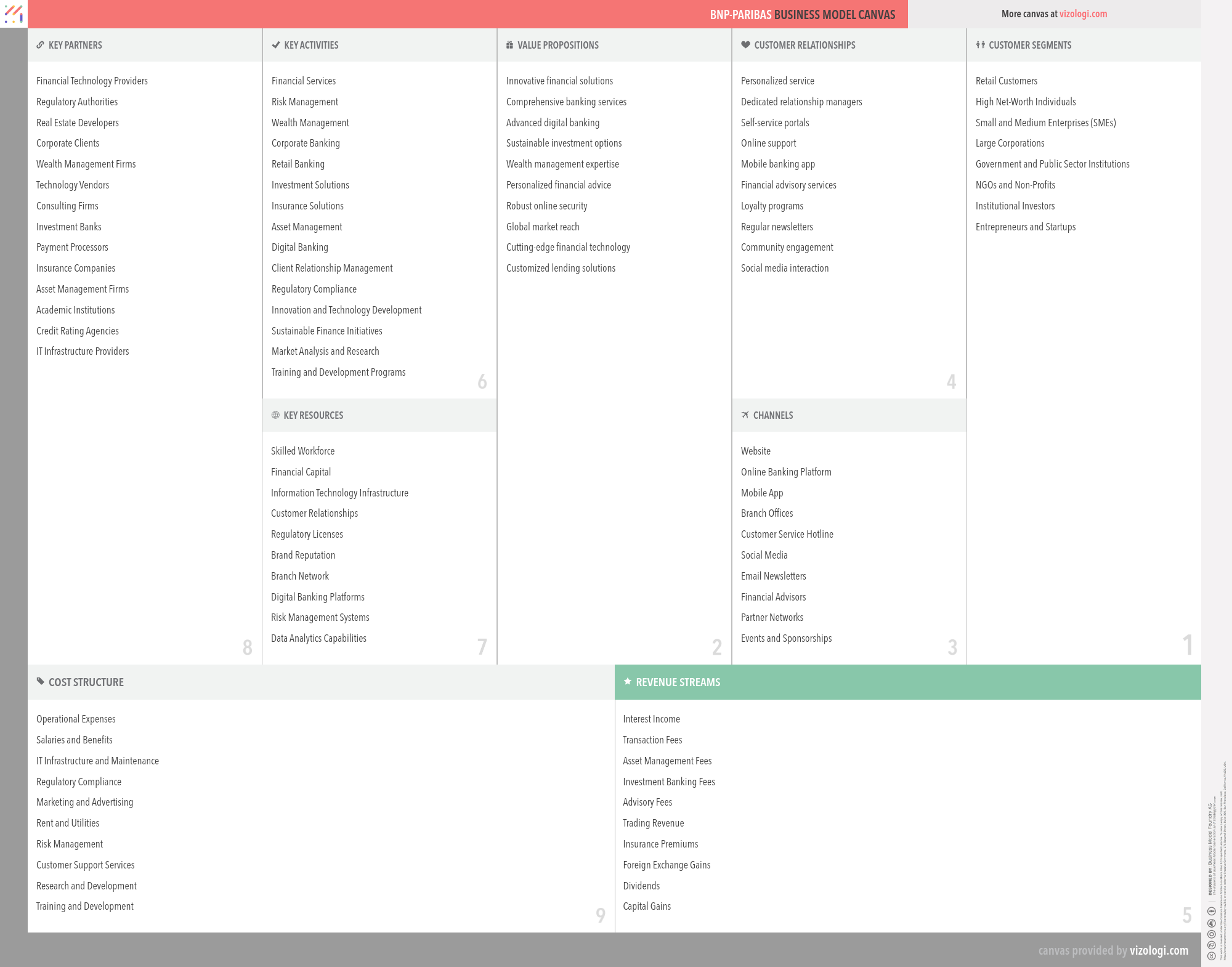

BNP Paribas’s Business Model Canvas

- Financial Technology Providers

- Regulatory Authorities

- Real Estate Developers

- Corporate Clients

- Wealth Management Firms

- Technology Vendors

- Consulting Firms

- Investment Banks

- Payment Processors

- Insurance Companies

- Asset Management Firms

- Academic Institutions

- Credit Rating Agencies

- IT Infrastructure Providers

- Financial Services

- Risk Management

- Wealth Management

- Corporate Banking

- Retail Banking

- Investment Solutions

- Insurance Solutions

- Asset Management

- Digital Banking

- Client Relationship Management

- Regulatory Compliance

- Innovation and Technology Development

- Sustainable Finance Initiatives

- Market Analysis and Research

- Training and Development Programs

- Skilled Workforce

- Financial Capital

- Information Technology Infrastructure

- Customer Relationships

- Regulatory Licenses

- Brand Reputation

- Branch Network

- Digital Banking Platforms

- Risk Management Systems

- Data Analytics Capabilities

- Innovative financial solutions

- Comprehensive banking services

- Advanced digital banking

- Sustainable investment options

- Wealth management expertise

- Personalized financial advice

- Robust online security

- Global market reach

- Cutting-edge financial technology

- Customized lending solutions

- Personalized service

- Dedicated relationship managers

- Self-service portals

- Online support

- Mobile banking app

- Financial advisory services

- Loyalty programs

- Regular newsletters

- Community engagement

- Social media interaction

- Retail Customers

- High Net-Worth Individuals

- Small and Medium Enterprises (SMEs)

- Large Corporations

- Government and Public Sector Institutions

- NGOs and Non-Profits

- Institutional Investors

- Entrepreneurs and Startups

- Website

- Online Banking Platform

- Mobile App

- Branch Offices

- Customer Service Hotline

- Social Media

- Email Newsletters

- Financial Advisors

- Partner Networks

- Events and Sponsorships

- Operational Expenses

- Salaries and Benefits

- IT Infrastructure and Maintenance

- Regulatory Compliance

- Marketing and Advertising

- Rent and Utilities

- Risk Management

- Customer Support Services

- Research and Development

- Training and Development

- Interest Income

- Transaction Fees

- Asset Management Fees

- Investment Banking Fees

- Advisory Fees

- Trading Revenue

- Insurance Premiums

- Foreign Exchange Gains

- Dividends

- Capital Gains

Vizologi

A generative AI business strategy tool to create business plans in 1 minute

FREE 7 days trial ‐ Get started in seconds

Try it freeBNP Paribas’s Revenue Model

BNP Paribas makes money by combining different business models. Below, you will find the list of the different monetization strategies identified for this company:

- Private level banking

- Make more of It

- Solution provider

- Disruptive banking

- Best in class services

- Brands consortium

- Cross-subsidiary

- Sponsorship

- Digital

- Digital transformation

- Cash machine

- Ingredient branding

- Innovative retail banking model

- Brokerage

- Self-service

- Lock-in

- Cross-selling

BNP Paribas’s Case Study

BNP Paribas's CASE STUDY

Introduction

At BNP Paribas, we stand at the intersection of innovation and tradition, blending a rich history with a forward-thinking approach that has positioned us as a global leader in banking and financial services. Our robust portfolio, diverse presence, and unwavering commitment to sustainable and responsible banking are a testament to our enduring success. By dissecting our journey, strategies, and unique attributes, we uncover the essence that makes BNP Paribas a beacon in the financial sector.

The Genesis of BNP Paribas

Our story dates back to 1848, marked by the inception of Banque Nationale de Paris (BNP). Following the merger with Paribas in 2000, a powerhouse in investment banking, BNP Paribas was born. This transformation allowed us to leverage the strengths of both entities, creating a banking behemoth with roots deep in European soil but branches stretching across 72 countries. Today, we employ nearly 200,000 dedicated professionals, each contributing to our mission of driving positive impacts on the environment and society through sustainable finance (source: www.bnpparibas.com).

Universal Banking Model

At BNP Paribas, we employ a universal banking model, a framework that seamlessly integrates retail banking, corporate and institutional banking, investment solutions, and specialized financial services. This model empowers us to offer an extensive array of services, from saving and current accounts to loans, mortgages, and beyond. By harnessing digital technology, we've been able to enhance the customer experience, streamline operations, and keep pace with the rapidly evolving financial landscape.

One of our standout features is our comprehensive range of products tailored to meet different customer needs. Whether through savings accounts that help our clients grow their wealth or loans that enable dreams to become reality, our solutions are diverse yet personalized. This approach ensures we meet both the functional and emotional needs of our clientele, making money for them while reducing anxiety and simplifying their financial tasks.

Revenue Model

The diversity in our revenue streams is crucial to our resilience and sustained growth. Our primary sources of income include:

- Interest Income: Generated from loans and mortgages. - Fee-based Income: Derived from maintaining customer accounts and transaction fees. - Asset Management Fees: From advisory and wealth management services. - Insurance Premiums: Through our extensive insurance product portfolio (source: Annual Financial Report 2022).

These multifaceted revenue channels not only ensure financial stability but also allow us to navigate market fluctuations effectively. In 2022, our diverse revenue streams led to a combined revenue of approximately €47 billion, a notable demonstration of our financial solidity (source: Annual Report 2022).

Innovation and Digitalization

We pride ourselves on being at the forefront of digital transformation in banking. By investing heavily in technology and innovation, we have developed cutting-edge digital banking platforms. Our mobile app and online banking services offer a seamless and secure way for customers to manage their finances.

According to a recent study by Finextra, the adoption rate of digital banking services at BNP Paribas is one of the highest in Europe, with over 75 percent of our retail banking customers utilizing online or mobile platforms for their banking needs (source: Finextra 2023).

Sustainable Finance and Corporate Responsibility

Sustainability is at the core of BNP Paribas's strategy. We aim to drive positive change by integrating sustainable and responsible finance into our operations. In 2021, we committed to financing €210 billion in renewable energy projects by 2025, underlining our dedication to a greener future (source: BNP Paribas Sustainability Report 2021).

Additionally, our corporate social responsibility efforts are reflected in our support for various community projects and philanthropic activities. BNP Paribas Foundation's initiative to fund educational programs and social entrepreneurship in underserved communities is a prime example of our commitment to making a difference.

Customer-Centric Approach

Our success is deeply anchored in our customer-centric strategy. We offer personalized services through dedicated relationship managers and self-service portals. Our comprehensive CRM systems ensure that we maintain strong, personalized relationships with our clients, thus driving loyalty and satisfaction.

Research by McKinsey & Company has shown that companies that excel in customer experience grow revenues 4-8 percent above their market (source: McKinsey & Company). At BNP Paribas, our customer-centric approach not only retains our existing clientele but also attracts new customers, fostering growth and profitability.

Global Reach and Market Penetration

Our global footprint is vast, covering major markets in Europe, Asia-Pacific, and the Americas. This extensive reach enables us to mobilize resources and expertise from around the world, providing our clients with unparalleled services. Furthermore, our strong presence in emerging markets allows us to tap into new growth opportunities, vital for long-term success.

Conclusion

BNP Paribas’s journey is a remarkable blend of innovation, strategic foresight, and unyielding dedication to sustainability and customer satisfaction. By maintaining a diversified revenue stream, embracing digital transformation, and committing to sustainable finance, we have crafted a unique value proposition that sets us apart from our competitors. Through this case study, it is clear that our model not only responds to contemporary challenges but also anticipates future trends, positioning BNP Paribas as a resilient and forward-thinking leader in the global financial landscape.

For those seeking to understand the intricacies of a true multinational banking giant, BNP Paribas offers a quintessential model of excellence, adaptability, and enduring success. Through our continued efforts, we aspire to not only meet but exceed the expectations of our clients, stakeholders, and society at large.

If you enjoyed this content, you’re in for a treat! Dive into our extensive repository of business model examples, where we’ve dissected and analyzed thousands of business strategies from top tech companies and innovative startups. Don’t miss out!