Why China Poly Group's Business Model is so successful?

Get all the answers

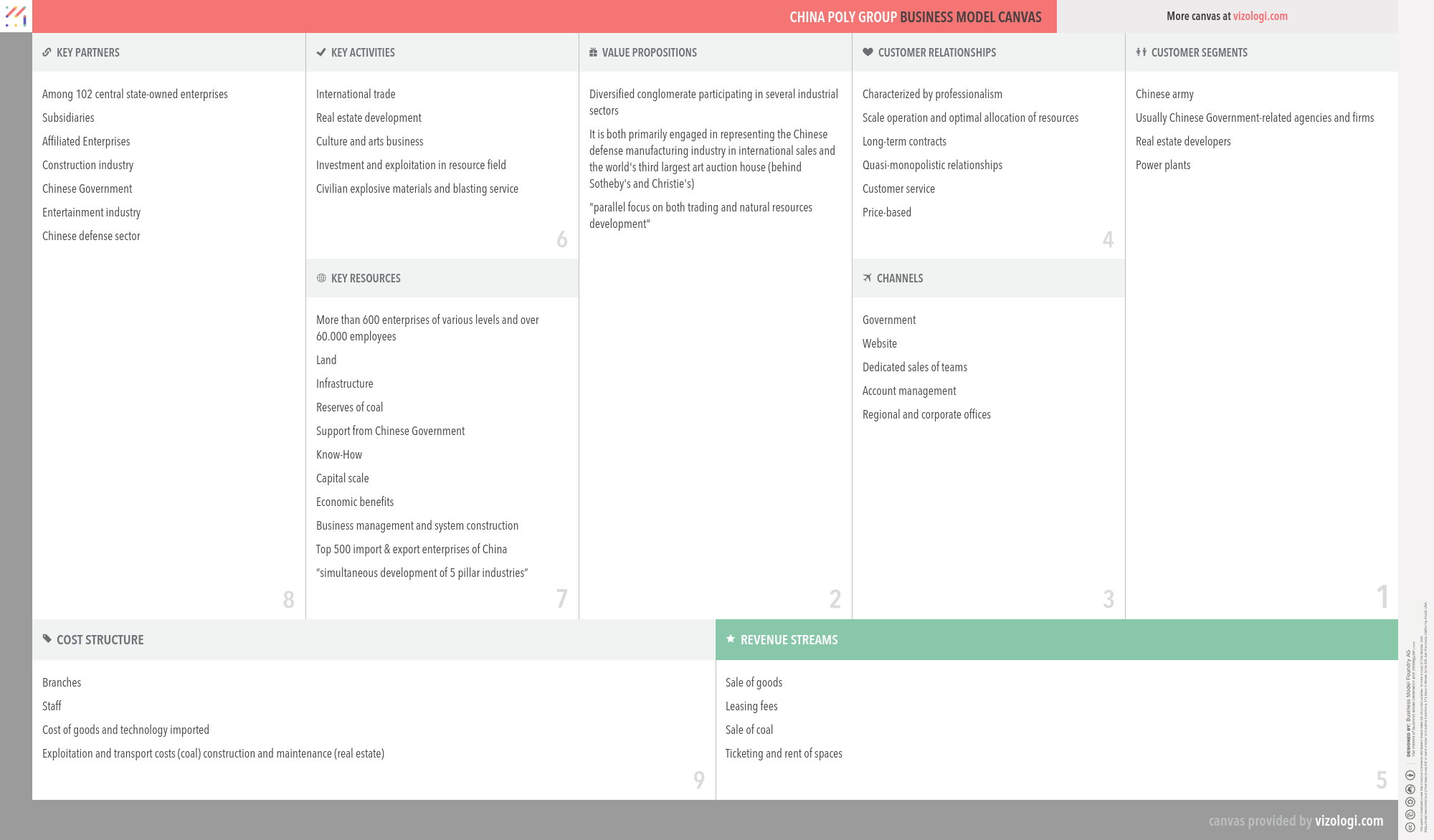

China Poly Group’s Company Overview

China Poly Group Corporation engages in the trade, real estate, culture and arts, energy, and civil explosive businesses in China and internationally. The company imports and exports various defense equipment for army, navy, air force, police, and anti-terrorism; and national defense and security system solutions. It is also involved in real estate development business, as well as performance and large-scale activities organization and planning, creative design production, theater management and construction consultation, cultural relic’s collections, artwork business and auction, cinema circuit, and cinema investment operations. In addition, the company invests and develops coal resources, as well as engages in coal mining, coal washing, coking, rail transportation, etc. Further, it is involved in explosive materials research, production, marketing, explosive engineering, and technical services, as well as provides emulsion explosives, expanded explosives, ammonium nitrate fuel oil explosives, electric detonators, detonator, etc. Additionally, the company offers blasting services. China Poly Group Corporation was founded in 1992 and is based in Beijing, China.

www.poly.com.cnCountry: Beijing

Foundations date: 1999

Type: State-owned

Sector: Industrials

Categories: Conglomerate

China Poly Group’s Customer Needs

Social impact:

Life changing: heirloom

Emotional: provides access, attractiveness, badge value, fun/entertainment

Functional: simplifies, organizes, integrates, connects, avoids hassles, variety, saves time, quality, reduces risk, reduces effort

China Poly Group’s Related Competitors

China Poly Group’s Business Operations

Corporate innovation:

Innovation is the outcome of collaborative creativity in turning an idea into a feasible concept, accompanied by a collaborative effort to bring that concept to life as a product, service, or process improvement. The digital era has created an environment conducive to business model innovation since technology has transformed how businesses operate and provide services to consumers.

Direct selling:

Direct selling refers to a situation in which a company's goods are immediately accessible from the manufacturer or service provider rather than via intermediate channels. The business avoids the retail margin and any extra expenses connected with the intermediaries in this manner. These savings may be passed on to the client, establishing a consistent sales experience. Furthermore, such intimate touch may help to strengthen client connections. Finally, direct selling benefits consumers by providing convenience and service, such as personal demonstrations and explanations of goods, home delivery, and substantial satisfaction guarantees.

Energy:

Energy development is an area of study concerned with adequate primary and secondary energy sources to satisfy society's requirements. These activities include those that promote the development of conventional, alternative, and renewable energy sources and the recovery and recycling of energy that otherwise would have been squandered.

Lock-in:

The lock-in strategy?in which a business locks in consumers by imposing a high barrier to transferring to a competitor?has acquired new traction with New Economy firms during the last decade.

Skunkworks project:

A skunkworks project is one that is created by a small, loosely organized group of individuals who study and develop a project with the primary goal of radical innovation. The terminology arose during World War II with Lockheed's Skunk Works project. However, since its inception with Skunk Works, the phrase has been used to refer to comparable high-priority research and development initiatives at other big companies that include a small team operating outside of their regular working environment and free of managerial restrictions. Typically, the phrase alludes to semi-secretive technological initiatives, such as Google X Lab.

Solution provider:

A solution provider consolidates all goods and services in a particular domain into a single point of contact. As a result, the client is supplied with a unique know-how to improve efficiency and performance. As a Solution Provider, a business may avoid revenue loss by broadening the scope of the service it offers, which adds value to the product. Additionally, close client interaction enables a better understanding of the customer's habits and requirements, enhancing goods and services.

State-owned:

As rivals or subjects of study, Chinese businesses' emergence on the world stage necessitates or creates a new category of business models: state-owned enterprises. These enterprises typically do not exist for profit but rather to offer critical goods and services to society that cannot be supplied economically by established firms. This model is characterized by fixed pricing, monopoly access to consumers, an advantage in exploiting resources, minimal or no tax obligations, and recurring financial losses.

Technology trends:

New technologies that are now being created or produced in the next five to ten years will significantly change the economic and social landscape. These include but are not limited to information technology, wireless data transmission, human-machine connection, on-demand printing, biotechnology, and sophisticated robotics.

Recommended companies based on your search: