Why Nubank's Business Model is so successful?

Get all the answers

Nubank’s Company Overview

Nubank is a leading fintech company based in Brazil, known for revolutionizing the financial industry in Latin America. Founded in 2013 by David Vélez, Cristina Junqueira, and Edward Wible, Nubank aims to fight complexity and empower people to regain control over their money. It offers a suite of financial products including a no-fee credit card, a digital savings account, personal loans, and business accounts. Nubank is recognized as the largest digital bank outside Asia, having more than 20 million customers.

Nubank's business model is centered on providing customer-centric, transparent, and efficient financial services that traditional banks fail to deliver. It leverages advanced technology and data analytics to offer a seamless digital banking experience, eliminating the need for physical branches and reducing operational costs. Nubank's primary product, the no-fee credit card, is designed to simplify the credit process and provide users with complete control over their finances through a user-friendly mobile app.

The revenue model of Nubank is multifaceted. It earns interest income from the credit it extends to its customers. It also earns interchange fees from merchants whenever a customer uses Nubank's credit card for transactions. In addition, Nubank generates revenue from its personal loans and business accounts. The company's focus on customer satisfaction and retention, coupled with its innovative and diversified revenue streams, has allowed Nubank to achieve rapid growth and become a dominant player in the Latin American fintech market.

Headquater: São Paulo, Brazil, LatAm

Foundations date: 2013

Company Type: Private

Sector: Financials

Category: Financial Services

Digital Maturity: Digirati

Nubank’s Related Competitors

Starling Bank Business Model

Alipay Business Model

PayPal Business Model

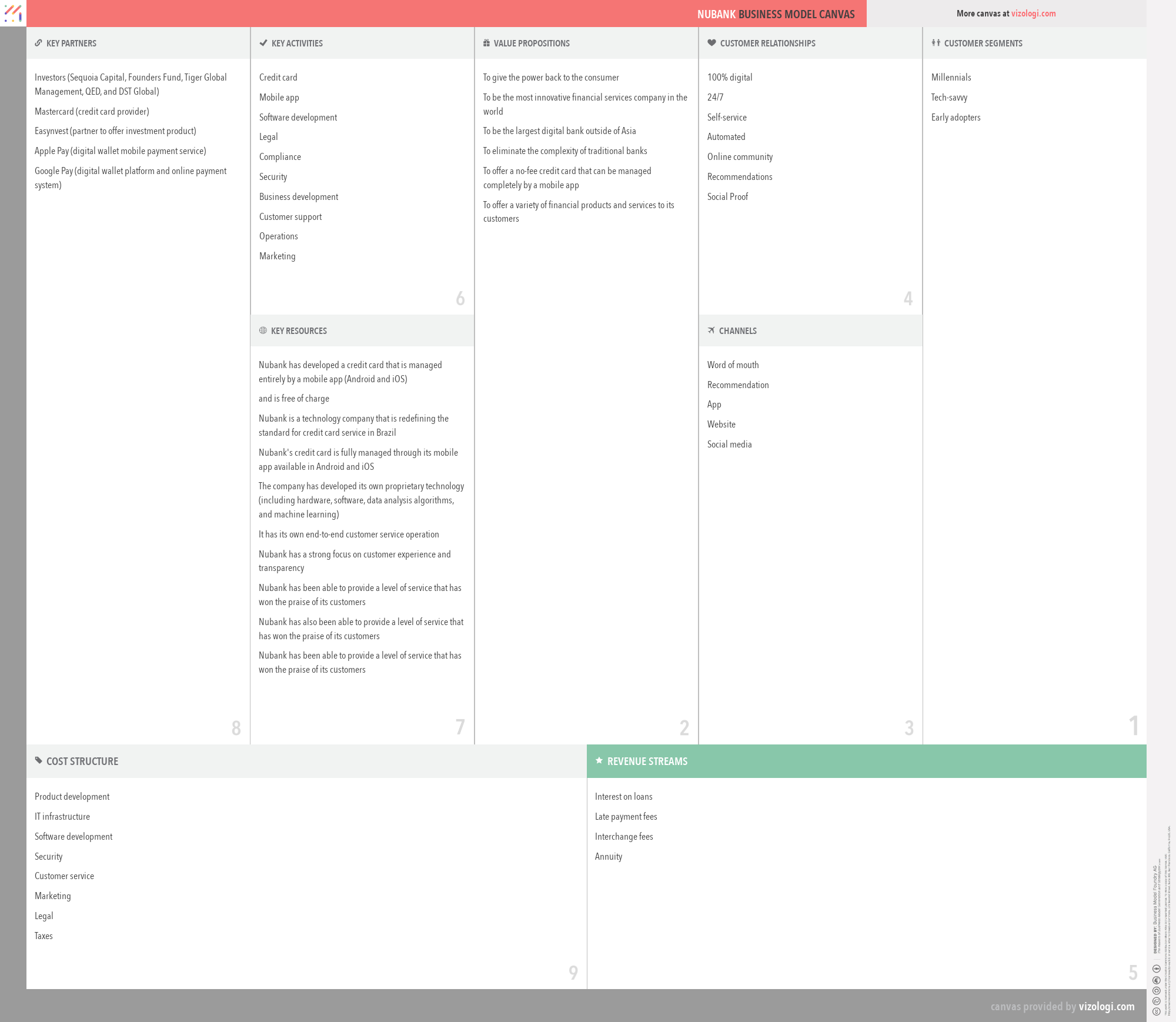

Nubank’s Business Model Canvas

- Investors (Sequoia Capital, Founders Fund, Tiger Global Management, QED, and DST Global)

- Mastercard (credit card provider)

- Easynvest (partner to offer investment product)

- Apple Pay (digital wallet mobile payment service)

- Google Pay (digital wallet platform and online payment system)

- Credit card

- Mobile app

- Software development

- Legal

- Compliance

- Security

- Business development

- Customer support

- Operations

- Marketing

- Nubank has developed a credit card that is managed entirely by a mobile app (Android and iOS)

- and is free of charge

- Nubank is a technology company that is redefining the standard for credit card service in Brazil

- Nubank's credit card is fully managed through its mobile app available in Android and iOS

- The company has developed its own proprietary technology (including hardware, software, data analysis algorithms, and machine learning)

- It has its own end-to-end customer service operation

- Nubank has a strong focus on customer experience and transparency

- Nubank has been able to provide a level of service that has won the praise of its customers

- Nubank has also been able to provide a level of service that has won the praise of its customers

- Nubank has been able to provide a level of service that has won the praise of its customers

- To give the power back to the consumer

- To be the most innovative financial services company in the world

- To be the largest digital bank outside of Asia

- To eliminate the complexity of traditional banks

- To offer a no-fee credit card that can be managed completely by a mobile app

- To offer a variety of financial products and services to its customers

- 100% digital

- 24/7

- Self-service

- Automated

- Online community

- Recommendations

- Social Proof

- Millennials

- Tech-savvy

- Early adopters

- Word of mouth

- Recommendation

- App

- Website

- Social media

- Product development

- IT infrastructure

- Software development

- Security

- Customer service

- Marketing

- Legal

- Taxes

- Interest on loans

- Late payment fees

- Interchange fees

- Annuity

Vizologi

A generative AI business strategy tool to create business plans in 1 minute

FREE 7 days trial ‐ Get started in seconds

Try it freeNubank’s Revenue Model

Nubank makes money by combining different business models. Below, you will find the list of the different monetization strategies identified for this company:

- Transaction facilitator

- Brokerage

- Digital

- Disruptive banking

- Innovative retail banking model

- Customer relationship

- Customer loyalty

- Easy and low-cost money transfer and payment

- Digital transformation

- Mobile first behavior

- Crowdfunding

- Data as a Service (DaaS)

- Technology trends

- Disruptive trends

- Cross-selling

- Alternative currencies and banking

Nubank’s Case Study

Nubank's CASE STUDY

If there is one name that embodies the disruption of the traditional banking landscape in Latin America, it’s Nubank. Launched in 2013, Nubank emerged out of São Paulo, Brazil, with a distinct mission: to simplify the complex world of financial services and empower consumers by providing them with transparent, efficient, and customer-centric financial solutions. With an astounding customer base of over 20 million, Nubank has rapidly become not just the largest digital bank in Latin America but also a globally recognized fintech innovator.

The Genesis of Nubank

Nubank was conceived by three visionary leaders: David Vélez, Cristina Junqueira, and Edward Wible. Vélez, frustrated by the inefficiencies and complexities of Brazil's traditional banking system, saw an immense opportunity to disrupt the market. Joined by Junqueira, with her profound understanding of the local financial market, and Wible, the tech genius, the trio set out to reimagine banking. In nine short years, their brainchild has grown into a fintech powerhouse.

One might ask, what makes Nubank so special? To answer that, we need to dive deep into its unique value propositions, business patterns, and technological advancements.

A New Model of Banking

Nubank’s unique business model centers around leveraging advanced technology and data analytics to offer a streamlined, 100% digital banking experience. This eliminates the need for physical branches, significantly reducing operational costs. The primary product—a no-fee credit card managed entirely through an intuitive mobile app—is a testament to Nubank’s commitment to user-centric design and functionality.

When we first launched the no-fee credit card, our aim was clear: eliminate the cost and complexity that plagued traditional banking products. The response was overwhelmingly positive. Focused on enhancing customer satisfaction and fostering loyalty, the card swiftly became a gateway to additional services including digital savings accounts, personal loans, and business accounts.

A Multi-faceted Revenue Model

Nubank's revenue model is both diversified and innovative. Revenue streams include interest income from extended credit, interchange fees from merchants on credit card transactions, and various fees associated with our business accounts. Additionally, our personal loans business has shown substantial growth, contributing significantly to the overall revenue. According to recent reports, Nubank's net revenues reached approximately $963 million in 2021, reflecting a year-on-year growth of 70% (source: Business Insider, 2022).

Technological Prowess

At its core, Nubank is a technology company. Proprietary algorithms, machine learning, and a robust IT infrastructure enable us to deliver unparalleled services. Our mobile app, available on both Android and iOS, epitomizes our technology-driven approach. Built entirely in-house, the app's seamless interface allows customers to manage their finances effortlessly.

The emphasis on data analytics has been a cornerstone of our strategy. Real-time data processing capabilities give us insights into customer behavior, enabling us to offer personalized services and proactive customer support. This approach has significantly simplified the user experience and ensured disruptive trends like digital transformation and mobile-first behavior are at the forefront of our strategy.

Customer-Centric Culture

What truly sets Nubank apart is our unwavering focus on customer experience. We believe in empowering users by providing them with tools that not only simplify financial management but also offer rewards, emotional connection, and social impact. By eliminating traditional banking hassles, we’ve created a model that saves time, reduces effort, and lowers costs.

Our 24/7 digital customer support and robust online community foster an environment of trust and loyalty. This customer-first approach has resulted in a Net Promoter Score (NPS) of 88—a remarkable feat in the financial services industry where the average NPS hovers around 34 (source: KPMG, 2022).

Strategic Partnerships

Strategic partnerships play a crucial role in our growth. Collaborations with investors like Sequoia Capital and Tiger Global Management have provided both capital and valuable insights. Our partnership with Mastercard, which facilitates our credit card services, and collaborations with digital wallets like Apple Pay and Google Pay, exemplify our forward-thinking approach.

Impact and Expansion

Nubank’s social impact goes beyond financial services. Our mission to simplify banking has resonated deeply in a region plagued by economic instability and financial exclusion. By offering services tailored to the tech-savvy, early adopters, and millennials, we’ve played a significant role in fostering financial inclusion.

Our success in Brazil has acted as a springboard for expansion into other Latin American markets. As we look toward the future, our focus remains on sustaining growth, spearheading digital transformation, and maintaining our commitment to customer-centric innovation.

Learning from the Nubank Case Study

The Nubank case study offers critical insights into how traditional industries can be disrupted by technology-driven, customer-centric models. Organizations looking to innovate should note Nubank's strategic use of technology, diversified revenue models, and unyielding focus on customer satisfaction. As technology and consumer expectations continue to evolve, the Nubank model offers a blueprint for the future of financial services.

In the end, Nubank's story is a remarkable journey of innovation, resilience, and the relentless pursuit of excellence. As we continue to revolutionize banking in Latin America and beyond, one thing remains certain: the future of finance is digital, and Nubank is at the forefront of this transformation.

If you enjoyed this content, you’re in for a treat! Dive into our extensive repository of business model examples, where we’ve dissected and analyzed thousands of business strategies from top tech companies and innovative startups. Don’t miss out!