Why Venmo's Business Model is so successful?

Get all the answers

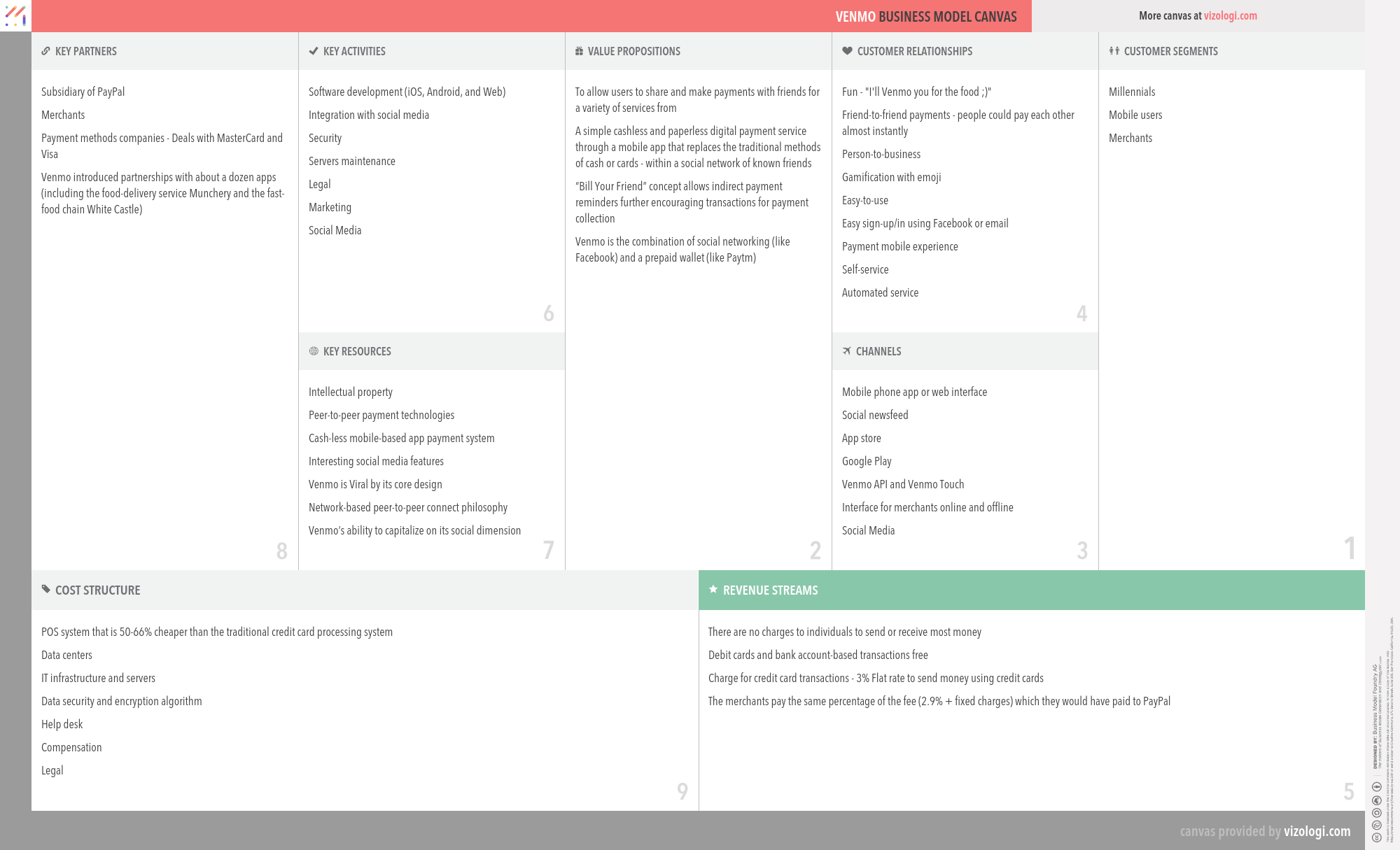

Venmo’s Company Overview

Venmo, LLC provides social payments services. It enables users to connect with people, transfer money, and payouts to any bank overnight. The company was incorporated in 2009 and is based in New York, New York.

https://venmo.comVenmo’s Customer Needs

Social impact:

Life changing: self-actualization, affiliation/belonging

Emotional: reduces anxiety, rewards me, badge value, design/aesthetics, provides access

Functional: saves time, simplifies, quality, saves time, avoids hassles, simplifies, reduces effort, quality, connects

Venmo’s Related Competitors

Venmo’s Business Operations

Aikido:

The aikido business model is often characterized as using a competitor's strength to get an edge over them. This is accomplished through finding weaknesses in a competitor's strategic position. In addition, it adds to marketing sustainability by exposing rivals' flaws, finding internal and external areas for development, and attracting consumers via specific product offers that deviate from the norm.

Brokerage:

A brokerage firm's primary responsibility is to serve as a middleman, connecting buyers and sellers to complete transactions. Accordingly, brokerage firms are compensated through commission once a transaction is completed. For example, when a stock trade order is executed, a transaction fee is paid by an investor to repay the brokerage firm for its efforts in completing the transaction.

Cash machine:

The cash machine business model allows companies to obtain money from sales since consumers pay ahead for the goods they purchase, but the costs required to generate the revenue are not yet paid. This increases companies' liquidity, which they may use to pay off debt or make additional investments. Among several others, the online store Amazon often employs this business model.

Cashier-as-a-service:

Cashier-as-a-Service (CaaS) describes the practice of paying using a third-party service. When consumers purchase goods online, they often pay the seller indirectly via a third party - the cashier. Both the consumer and the merchant place their confidence in the cashier, who is supposed to facilitate the trustworthy and safe transfer of money. By paying a business through a cashier, consumers may purchase goods without providing merchants with their financial data.

Codifying a distinctive service capability:

Since their inception, information technology systems have aided in automating corporate operations, increasing productivity, and maximizing efficiency. Now, businesses can take their perfected processes, standardize them, and sell them to other parties. In today's corporate environment, innovation is critical for survival.

Corporate innovation:

Innovation is the outcome of collaborative creativity in turning an idea into a feasible concept, accompanied by a collaborative effort to bring that concept to life as a product, service, or process improvement. The digital era has created an environment conducive to business model innovation since technology has transformed how businesses operate and provide services to consumers.

Culture is brand:

It requires workers to live brand values to solve issues, make internal choices, and provide a branded consumer. Developing a distinctive and enduring cultural brand is the advertising industry's holy grail. Utilizing the hazy combination of time, attitude, and emotion to identify and replicate an ideology is near to marketing magic.

Digital:

A digital strategy is a strategic management and a business reaction or solution to a digital issue, which is often best handled as part of a broader company plan. A digital strategy is frequently defined by the application of new technologies to existing business activities and a focus on enabling new digital skills for their company (such as those formed by the Information Age and frequently as a result of advances in digital technologies such as computers, data, telecommunication services, and the World wide web, to name a few).

Digital transformation:

Digitalization is the systematic and accelerated transformation of company operations, processes, skills, and models to fully exploit the changes and possibilities brought about by digital technology and its effect on society. Digital transformation is a journey with many interconnected intermediate objectives, with the ultimate aim of continuous enhancement of processes, divisions, and the business ecosystem in a hyperconnected age. Therefore, establishing the appropriate bridges for the trip is critical to success.

Digitization:

This pattern is based on the capacity to convert current goods or services into digital versions, which have several benefits over intangible products, including increased accessibility and speed of distribution. In an ideal world, the digitalization of a product or service would occur without compromising the consumer value proposition. In other words, efficiency and multiplication achieved via digitalization do not detract from the consumer's perceived value. Being digitally sustainable encompasses all aspects of sustaining the institutional framework for developing and maintaining digital objects and resources and ensuring their long-term survival.

Disintermediation:

Keeping the purchase price low by avoiding mediators and maximizing supply margins is a win-win situation. In finance, disintermediation refers to how money is removed from intermediate financial organizations such as banks and savings and loan associations and invested directly. Disintermediation, in general, refers to the process of eliminating the middleman or intermediary from future transactions. Disintermediation is often used to invest in higher-yielding securities.

Disruptive banking:

The banking industry's disruptors are changing the norms that have been in place for decades. These new regulations, however, will only be effective until the next round of disruption occurs. Banks and credit unions must thus be nimble and responsive. We need audacious tactics. 'Disruptive Innovation' is a term that refers to the process whereby a product or service establishes a foothold at the bottom of a market and then persistently climbs up the value chain, ultimately replacing existing rivals.

Disruptive trends:

A disruptive technology supplants an existing technology and fundamentally alters an industry or a game-changing innovation that establishes an altogether new industry. Disruptive innovation is defined as an invention that shows a new market and value network and ultimately disrupts an established market and value network, replacing incumbent market-leading companies, products, and alliances.

Easy and low cost money transfer and payment:

This business model makes cheaper and more accessible for users to transfer money and make and collect payments. Sending or receiving money for either payment of salaries, settlement of business transactions, payment of school fees, or for family support is common both for businesses and individuals. It requires efficient, reliable and affordable money transfer services whereby money can be deposited in one location and withdrawn in another in both urban and rural areas.

Ecosystem:

A business ecosystem is a collection of related entities ? suppliers, distributors, customers, rivals, and government agencies ? collaborating and providing a particular product or service. The concept is that each entity in the ecosystem influences and is impacted by the others, resulting in an ever-changing connection. Therefore, each entity must be adaptive and flexible to live, much like a biological ecosystem. These connections are often backed by a shared technical platform and are based on the flow of information, resources, and artifacts in the software ecosystem.

Experience:

Disrupts by offering a better understanding that customers are willing to pay for. Experience companies that have progressed may begin charging for the value of the transformation that an experience provides. An experienced company charges for the feelings consumers get as a result of their interaction with it.

Innovative retail banking model:

The design has no resemblance to a bank but more to a coffee shop. There is free wifi and a large number of iPads accessible for internet use. Automated teller machines (ATMs) are located around the perimeter of the coffee shop, allowing customers to conduct financial transactions. The workforce consists of a mix of coffee shop patrons and banking personnel who circulate and make themselves accessible. If you need services not available through an ATM, fully trained bank personnel can offer all services typically available at a conventional bank branch.

Lean Start-up:

The Lean Start-up methodology is a scientific approach to developing and managing businesses that focuses on getting the desired product into consumers' hands as quickly as possible. The Lean Startup method coaches you on how to guide a startup?when to turn, when to persevere?and how to build a company with maximum acceleration. It is a guiding philosophy for new product development.

Micropayment:

Micropayments are financial transactions involving a tiny amount of money that is frequently conducted online. While micropayments were initially intended to apply minimal amounts of money, practical systems allowing less than one dollar transactions have met with little success. One impediment to the development of micropayment systems has been the need to keep transaction costs low, which is impracticable when transferring such tiny amounts, even if the transaction charge is just a few cents.

Mobile first behavior:

It is intended to mean that as a company thinks about its website or its other digital means of communications, it should be thinking critically about the mobile experience and how customers and employees will interact with it from their many devices. The term is “mobile first,” and it is intended to mean that as a company thinks about its website or its other digital means of communications, it should be thinking critically about the mobile experience and how customers and employees will interact with it from their many devices.

Network builders:

This pattern is used to connecting individuals. It offers essential services for free but charges for extra services. The network effect is a paradox that occurs when more people utilize a product or service, the more valuable it becomes.

On-demand economy:

The on-demand economy is described as economic activity generated by digital marketplaces that meet customer demand for products and services via quick access and accessible supply. The supply chain is managed via a highly efficient, intuitive digital mesh built on top of current infrastructure networks. The on-demand economy is transforming commercial behavior in cities worldwide. The number of businesses, the categories covered, and the industry's growth rate are all increasing. Businesses in this new economy are the culmination of years of technological progress and customer behavior change.

Open business:

Businesses use the open business approach to incorporate goods and services ecosystems from third parties that operate inside the same market framework. Collaboration between companies has the potential to increase the value delivered to the end customer or user. Software developers and platform integrators often use this business model.

Orchestrator:

Orchestrators are businesses that outsource a substantial portion of their operations and processes to third-party service providers or third-party vendors. The fundamental objective of this business strategy is to concentrate internal resources on core and essential functions while contracting out the remainder of the work to other businesses, thus reducing costs.

Private level banking:

Private label banks allow any business with a sizable client base, brand, or unique technological solution to operating as a private label bank. Private banking refers to the customized financial and banking services to its affluent high net worth individual (HNWI) customers. HNWIs generally have more money than ordinary individuals, enabling them to access a broader range of conventional and alternative assets. Private banks' goal is to connect such people with the most suitable alternatives.

Product innovation:

Product innovation is the process of developing and introducing a new or better version of an existing product or service. This is a broader definition of innovation than the generally recognized definition, which includes creating new goods that are considered innovative in this context. For example, Apple launched a succession of successful new products and services in 2001?the iPod, the iTunes online music service, and the iPhone?which catapulted the firm to the top of its industry.

Radical transparency:

The concept of radical transparency, or everyone knowing everything, has the potential to be a significant driver of improved organizational performance. This is especially true for new, fast-growing businesses that are under pressure to achieve aggressive sales targets and keep their investors pleased. In governance, politics, software design, and business, radical transparency refers to activities and methods that significantly enhance organizational processes and data openness.

Self-service:

A retail business model in which consumers self-serve the goods they want to buy. Self-service business concepts include self-service food buffets, self-service petrol stations, and self-service markets. Self-service is available through phone, online, and email to automate customer support interactions. Self-service Software and self-service applications (for example, online banking apps, shopping portals, and self-service check-in at airports) are becoming more prevalent.

Solution provider:

A solution provider consolidates all goods and services in a particular domain into a single point of contact. As a result, the client is supplied with a unique know-how to improve efficiency and performance. As a Solution Provider, a business may avoid revenue loss by broadening the scope of the service it offers, which adds value to the product. Additionally, close client interaction enables a better understanding of the customer's habits and requirements, enhancing goods and services.

Technology trends:

New technologies that are now being created or produced in the next five to ten years will significantly change the economic and social landscape. These include but are not limited to information technology, wireless data transmission, human-machine connection, on-demand printing, biotechnology, and sophisticated robotics.

Tradeable currency:

This pattern involves the creation of a digital asset and the establishment of a payment mechanism. Through this, the user earns points that may be used for other services.

Transaction facilitator:

The business acts as an acquirer, processing payments on behalf of online merchants, auction sites, and other commercial users for a fee. This encompasses all elements of purchasing, selling, and exchanging currencies at current or predetermined exchange rates. By far the biggest market in the world in terms of trade volume. The largest multinational banks are the leading players in this industry. Around the globe, financial hubs serve as anchors for trade between a diverse range of various kinds of buyers and sellers 24 hours a day, save on weekends.

Recommended companies based on your search: