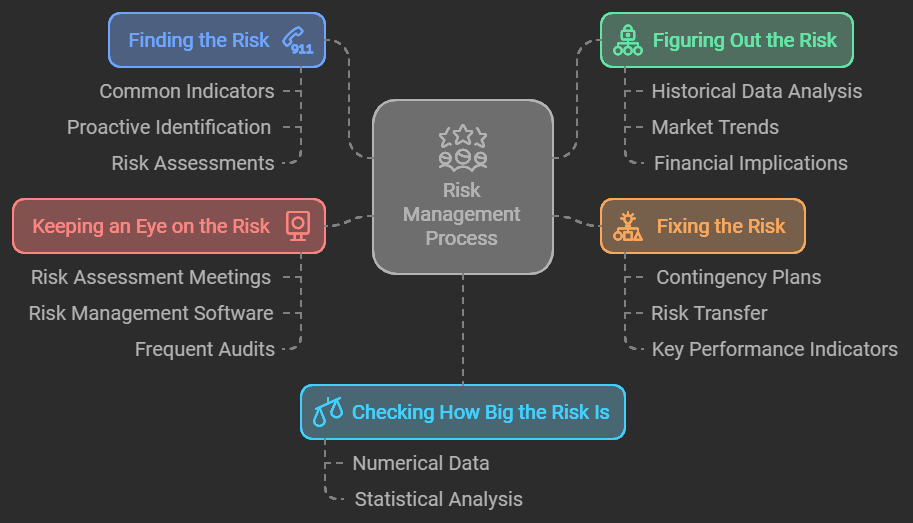

The 5 Components of Risk Identification

Identifying and managing risks is a crucial part of any project or business. To handle potential challenges effectively, it’s important to first identify areas where risks may arise. This involves recognizing and analyzing potential uncertainties that could impact the project or business venture’s success. Understanding the five key components of risk identification helps individuals and organizations prepare for potential obstacles.

Discovering What Risk Means

Various methods can be used to effectively spot and identify different types of risks. These methods include SWOT analysis, brainstorming sessions, and scenario planning. These approaches help businesses identify internal and external risks that may impact their operations and objectives.

Organizations can use both numerical and qualitative methods to assess the magnitude of a risk. Numerical methods assign a numerical value to the likelihood and impact of a risk. Qualitative methods use descriptive scales such as low, medium, and high.

Businesses can rely on risk management tools and techniques to determine and address potential risks. These include risk heat maps, risk registers, and risk matrices. These tools help accurately determine the probability and impact of risks and then develop appropriate response plans to manage these risks effectively.

The Main Pieces of Risk Discovery

Risk discovery involves identifying potential risks in a business. This includes using methods like data analysis, brainstorming, and scenario planning. It’s important to use numbers and words to understand the size of a risk.

For example, financial figures can show the potential impact, while descriptions can give a better understanding of the risk. Once risks are found, businesses can make plans to deal with them. This might involve avoiding the risk, reducing it with controls, transferring it with insurance, or accepting it if the impact is small. By using these strategies, businesses can manage and lessen the impact of risks on their operations.

First Part: Finding the Risk

How to Spot Different Risks

Individuals and organizations can look for common indicators or signs to spot different risks. These include unexpected market changes, technological disruptions, or regulatory shifts. Staying proactive is important in identifying potential risks before they become major issues.

Regular risk assessments, staying informed about industry trends, and fostering a culture of risk awareness within the organization can help achieve this.

Various methods or tools can be used to assess the severity or magnitude of a particular risk. These include risk matrices, probability-impact assessments, scenario analysis, or historical data analysis.

Businesses can use these approaches to identify and prepare for potential threats effectively. This helps minimize their impact and adapt to changing market conditions.

Second Part: Checking How Big the Risk Is

Looking at Risk with Numbers

Numerical data helps identify and assess risks in an organization. Businesses can prioritize risks, allocate resources efficiently, and develop effective risk mitigation strategies by quantifying risk factors and using statistical analysis.

This approach allows organizations to measure the magnitude of a risk, which is essential for making informed decisions about risk management. For example, a company can use numerical data to analyze the probability of a cyber-attack and its potential financial impact.

Using numerical data to assess risks enables organizations better to understand the likelihood and potential consequences of various risks. This empowers them to address potential threats and adapt to changing market conditions proactively.

Looking at Risk with Words

Language and words are important in identifying and describing risks. By using specific and descriptive language, companies can understand and communicate different types of risks, such as financial, operational, compliance, strategic, and reputational risks. Descriptive words also help assess the severity of a risk, enabling organizations to prioritize and address the most critical risks. Verbal communication is important for understanding and managing potential risks.

It promotes collaboration and information sharing among different departments and individuals within an organization. Effective verbal communication ensures that all stakeholders know potential risks and can work together to develop response plans and mitigation strategies. Companies can use language and words effectively to enhance their risk management processes and improve overall business resilience.

Third Part: Figuring Out the Risk

Regarding risk identification, businesses have five key components to consider.

First, they can use methods like historical data analysis or risk assessment questionnaires to accurately assess and measure the level of risk in a given situation.

Secondly, they can determine the potential impact and likelihood of different risks by looking at market trends, customer preferences, and emerging technologies.

Third, businesses must consider factors like financial implications, legal requirements, and the potential damage to their reputation when determining the overall level of risk and the appropriate response to mitigate it.

By weighing these components, companies can better prepare for potential threats and adapt to changing market landscapes.

Fourth Part: Fixing the Risk

The risk management framework has a fourth part. This part focuses on fixing identified risks by implementing specific strategies, such as risk response planning and mitigation.

Organizations can develop contingency plans, transfer risks through insurance, or avoid certain activities altogether.

Key performance indicators (KPIs) can measure the effectiveness of risk mitigation efforts. These may include reducing potential losses, increasing risk tolerance, or improving overall business resilience.

Communication and collaboration play a crucial role in addressing and fixing risks. They ensure that all relevant stakeholders are involved in the risk management process.

Regular meetings, clear communication channels, and cross-functional teams can help identify, assess, and address risks effectively.

This collaborative approach ensures that all perspectives and expertise are considered, leading to a more comprehensive risk management strategy.

Fifth Part: Keeping an Eye on the Risk

The fifth part of the risk management process involves monitoring potential risks. Various strategies can help, including setting up regular risk assessment meetings, using risk management software to track and monitor identified risks, and conducting frequent risk audits.

By utilizing these strategies, one can continuously monitor and evaluate identified risks. This ensures that any new risks are promptly identified and assessed. It also helps thoroughly evaluate any changes to existing risks. Based on the ongoing monitoring and evaluation, risk mitigation measures can be adjusted and refined to address new or evolving risks.

This ensures that the risk management process remains practical and up-to-date. For example, a company may regularly update its risk mitigation strategies based on industry trends and market conditions. This helps the company to stay ahead of potential risks and maintain a competitive edge in the market.

Why It’s Important to Find Risks

Finding and identifying risks is essential for business success. Failing to do so can lead to financial losses, project delays, damaged reputation, and missed opportunities.

Actively finding risks helps organizations better prepare for and reduce potential threats. This leads to better decision-making, strategic planning, and resource allocation.

A thorough risk assessment gives valuable insights into potential challenges. It allows businesses to make informed decisions and develop effective strategies to address and manage risks.

This can result in improved operational efficiency, optimized resource allocation, and enhanced overall performance. Therefore, finding and identifying risks is vital for organizations and individuals to navigate uncertainties and achieve their objectives in today’s dynamic business environment.

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.