Cost-Benefit Analysis in Real Life

When making decisions about personal finances, public policies, or business investments, it’s important to consider the costs and benefits. This process is known as cost-benefit analysis. It helps individuals and organizations weigh potential gains against losses before deciding.

Cost-benefit analysis is used to inform choices that impact our everyday lives. It’s used in infrastructure projects, environmental regulations, and more. This analytical tool plays a vital role in decision-making.

What is Cost-Benefit Analysis Anyway?

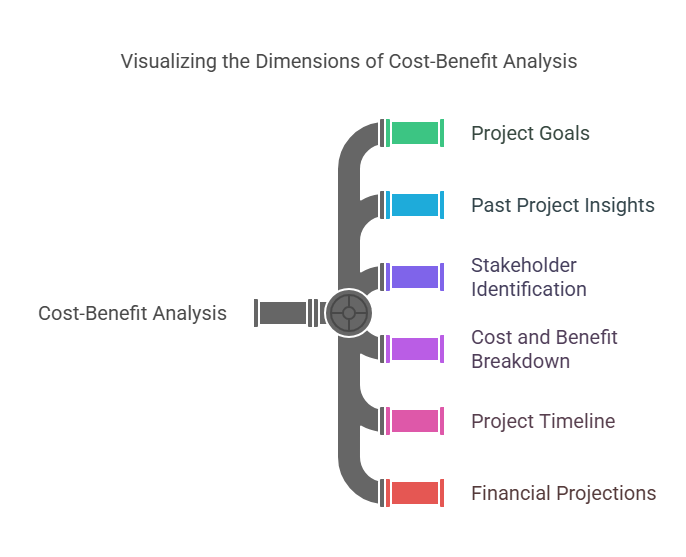

Cost-benefit analysis (CBA) helps estimate the costs and benefits of projects or investments. It’s used in business, project management, and public policy decisions. CBA evaluates costs, benefits, and monetary values for decision-making. It’s applied in feasibility studies, business documents, and government projects. The goal is to systematically evaluate project proposals to achieve goals and save on investment costs.

Conducting CBA involves defining project goals, reviewing historical data, identifying stakeholders, and assessing project costs and benefits. However, CBA isn’t perfect. It can be limited by difficulties in predicting variables and the potential exclusion of the human element in decision-making.

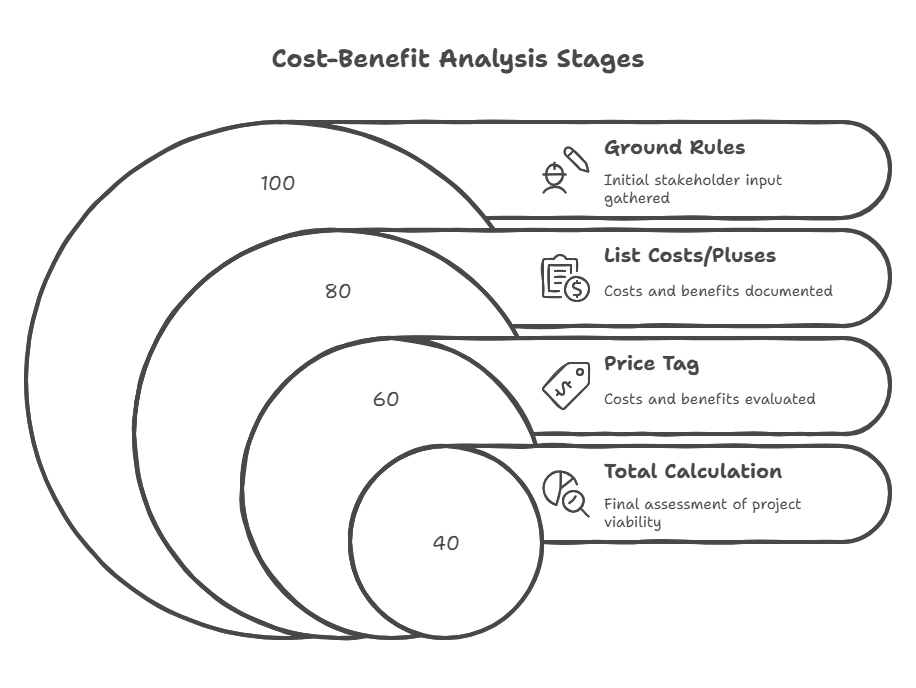

Steps to Do a Good Cost-Benefit Analysis

Step 1: Lay Down the Ground Rules

It is important to set ground rules before starting a cost-benefit analysis. This includes defining project goals, gathering stakeholder input, and reviewing past data. These steps help ensure that the project’s scope and goals are clear, which can affect the cost-benefit analysis.

Project managers can hold regular check-ins or stakeholder meetings to ensure the ground rules are followed. This can help review goals, track progress, and emphasize the importance of adhering to the established framework.

Setting ground rules may involve identifying all relevant stakeholders, getting their input, and ensuring historical data is accurate and complete. Additionally, agreeing on the project’s scope and goals may be tough if stakeholders have different opinions.

Step 2: List All the Costs and Pluses

When conducting a cost-benefit analysis, it’s important to list all project costs. This includes direct costs like materials and labor and indirect costs like overhead and administrative expenses. Non-monetary costs, such as environmental impact and social implications, should also be considered.

On the other hand, list all the project’s benefits. These can be financial returns like revenue and cost savings or intangible benefits such as brand reputation and improved customer satisfaction. Measuring these benefits is essential to make well-informed decisions based on the project’s net value.

Moreover, it’s crucial to identify and assess the potential risks involved. These can include market risks, operational risks, and strategic risks. By outlining these risks, businesses can better understand and prepare for any potential drawbacks or adverse outcomes that may affect the project.

Step 3: Give Each Cost and Plus a Price Tag

Various factors must be considered when assigning a price tag to each project’s cost and benefit when conducting a cost-benefit analysis.

To accurately determine the value of each cost and benefit, project managers should consider direct and indirect costs, opportunity costs, and intangible benefits such as improved brand reputation or employee morale.

Historical data, market research, and expert opinions can also help accurately assess the value of costs and benefits.

Factors that should be considered when assigning a price tag to each cost and benefit include the time value of money, future cash flows, and discount rates for comparing the costs and benefits over time.

Additionally, risks, uncertainties, and non-monetary costs or benefits should be carefully evaluated to accurately represent the project’s financial feasibility.

Businesses can make more informed decisions about project selection and resource allocation by thoroughly analyzing and quantifying all costs and benefits.

Step 4: Add Up the Costs and Pluses

After identifying project scope, determining costs, and computing analysis calculations, the next step in the cost-benefit analysis process is to add up the costs and pluses.

This involves quantifying and comparing the total costs to the total expected rewards. By carefully weighing these factors, businesses can evaluate whether to undertake a project or task.

When assessing the total costs, it’s important to consider direct costs such as materials, labor, and overhead, as well as indirect costs like administrative expenses and potential opportunity costs.

In addition to evaluating monetary benefits, non-financial metrics such as environmental impact or social benefits should be factored into the analysis.

Once the total costs and pluses have been quantified and compared, the project’s overall outcome is determined by whether the benefits outweigh the costs. This step is essential in making informed decisions and aligning project goals with saving on investment costs.

A Peek at the Pros and Cons

The Upsides of Cost-Benefit Analysis

Cost-benefit analysis has many advantages for organizations. It helps make data-driven decisions by measuring the costs and benefits of projects. This method allows businesses to assess the proposed initiatives’ financial feasibility and potential profitability. It also helps uncover hidden costs, evaluate risks, and allocate resources effectively.

The Downsides of Cost-Benefit Analysis

Cost-benefit analysis has limitations. It relies on forecasts, which may not accurately predict project outcomes. The process may be unnecessary for smaller projects, wasting time and resources. It may not be effective in scenarios involving unpredictable factors or intangible human elements, like employee morale or public opinion. This type of analysis can lead to biased or inaccurate results when costs or benefits are underestimated or overlooked.

This can result in an incomplete and potentially flawed evaluation of a project’s feasibility. Organizations should consider these limitations and use cost-benefit analysis as part of a comprehensive decision-making strategy rather than the sole determining factor.

When to Use Cost-Benefit Analysis

Is It Good for Your Project?

Using cost-benefit analysis can help achieve project goals. It systematically evaluates project proposals, considering costs and benefits. This is important for determining a project’s feasibility. Cost-benefit analysis influences the project plan and timeline by evaluating decision-making factors like costs, benefits, and monetary values.

Putting it All Together for a Project Plan

Cost-benefit analysis helps project managers evaluate the financial feasibility of proposed projects or decisions. It involves identifying project scope, determining costs and benefits, and making recommendations based on analysis. This process helps decide whether to undertake a project or task by comparing total costs versus expected rewards.

Conducting a cost-benefit analysis involves defining project goals, reviewing historical data, identifying stakeholders, computing costs and benefits, and assigning monetary values for decision-making. Project management software and free cost-benefit analysis templates can assist in this process by improving cost and benefits tracking and applying net present value calculations.

In addition, conducting a sensitivity analysis can be useful for decision-making in project plans.

How to Start Your Cost-Benefit Analysis

Figuring Out Your Project’s Goals

The project’s specific goals need to be identified and communicated. This ensures that all decisions made are in line with these objectives.

Stakeholders, like investors, customers, and employees, should be recognized. Their interests in the project, such as financial returns, customer satisfaction, and company growth, must be considered.

It’s important to carefully analyze and quantify potential costs, such as initial investment and ongoing operational expenses. Benefits such as increased revenue, cost savings, and improved brand reputation should also be considered. This helps determine the feasibility and profitability of the project.

Looking Back at Past Projects

In past projects, we mainly focused on estimating costs and benefits to determine whether the projects would be profitable and doable. We wanted to make smart decisions based on carefully assessing the projected costs and benefits.

We did well in measuring non-financial aspects and using cost-benefit analysis to make recommendations. However, we struggled with predicting all factors and sometimes didn’t consider the human side of things.

We also faced challenges like relying too much on forecasts and dealing with limitations in smaller projects. However, these obstacles helped us better grasp the complexities of evaluating project rewards and costs.

Identifying Who Cares About Your Project

Identifying who cares about your project is about recognizing the key stakeholders and their connection to its goals and outcomes. These key stakeholders include internal team members, external partners, and project sponsors. They are motivated by the anticipated benefits of the project. Their motivations and interests are driven by how the project will impact their roles, responsibilities, and objectives.

Effectively engaging and communicating with these key stakeholders requires understanding and addressing their concerns, perspectives, and desired involvement in the project. Regular updates, transparent communication, and appropriate communication channels like meetings, presentations, and progress reports are essential.

Gaining their support and involvement in the project is crucial for its success. Their buy-in can significantly influence the project’s outcome and overall success.

Breaking Down the Project’s Costs and Pluses

Cost-benefit analysis helps businesses determine whether a project makes financial sense. It compares the project’s costs with its potential benefits. To do this, all project costs, such as initial investment, operational expenses, and risks, must be identified. Similarly, potential benefits, such as increased revenue, cost savings, and intangible improvements, should be considered. Quantifying each cost and benefit by assigning monetary values allows for comparison.

Project management software can track these over time for accurate valuation.

Additionally, assessing the net present value provides a better understanding of the project’s overall economic benefits in today’s terms. By evaluating costs and benefits effectively, businesses can make informed investment decisions.

When Will Your Project Happen?

Businesses evaluate a project’s projected benefits and costs to determine feasibility. They also look at the expected timeline for starting and finishing the project. Factors like market conditions, technology, and regulations can affect the project’s timing, directly affecting the cost and benefits.

For example, a longer project may have higher costs due to changes in labor or materials, while a shorter project may bring benefits sooner. So, the project’s timeline is crucial for the cost-benefit analysis and can greatly impact the project’s financial feasibility.

How Much Will Your Project Earn?

Evaluating a project’s financial feasibility is important. It involves determining how much money the project can make. To do this, we need to do a cost-benefit analysis. This means examining all the costs, like initial investment and running expenses, and understanding how they affect potential earnings. Many things, like market trends and rules, can make it hard to predict how much a project might make.

So, we need to calculate and compare all the costs and expected rewards carefully. Tools like net present value calculations can help us forecast future cash flow accurately.

Examples of Cost-Benefit Analysis in Action

Cost-benefit analysis is used in real-world projects and initiatives.

It evaluates the financial feasibility of infrastructure developments and public policy decisions in government projects.

Companies use it to assess the profitability of investment projects, expansion strategies, and operational decisions in business administration.

Non-profit organizations apply it to assess the impact of social programs and fundraising initiatives.

In the construction industry, companies use cost-benefit analysis to evaluate the financial viability of building new facilities, infrastructure developments, and real estate projects.

The environmental sector assesses the economic impacts of environmental regulations and sustainability initiatives.

Research shows its impact in case studies of healthcare programs, educational initiatives, and public health interventions.

These studies demonstrate how cost-benefit analysis effectively quantifies such projects’ financial and non-financial impacts, supporting data-driven decision-making processes.

Is Cost-Benefit Analysis a Sure Thing?

Cost-benefit analysis is a valuable tool for evaluating project feasibility. However, it can be challenging to accurately consider all costs and benefits. For example, uncertain or intangible factors like environmental impact or employee morale may be hard to quantify.

CBA uses a systematic approach but has limitations. It heavily relies on forecasting and may not capture all potential outcomes. It also tends to exclude the human element and qualitative aspects.

Therefore, it’s important not to rely solely on CBA for decision-making. Considering alternative economic analyses can provide a more comprehensive assessment of project profitability.

Why Cost-Benefit Analysis Isn’t Always Perfect

Cost-benefit analysis has limitations and drawbacks. It relies on forecasts and may be inaccurate for smaller projects. It may struggle to provide a complete assessment in situations involving intangible costs or benefits, like those affecting human experience, environmental quality, or social well-being.

External factors, such as unexpected economic conditions or shifting market demands, can significantly impact its effectiveness. Businesses should be cautious when solely relying on cost-benefit analysis and consider supplementing it with other economic analyses for a well-rounded decision-making strategy.

Templates to Help You Ace Cost-Benefit Analysis

Plan Who Does What with a RACI Chart

A RACI chart, also called a responsibility assignment matrix, helps define and track the roles and responsibilities of team members in a project.

The chart clarifies who is responsible, accountable, consulted, and informed for each task or deliverable.

For instance, cost-benefit analysis outlines responsibilities for data gathering, calculations, signing off, informing others, and consulting on parameters.

This ensures no activities or decisions slip through the cracks and helps everyone stay aligned.

Without a RACI chart, there’s a risk of confusion, overlapping responsibilities, lack of clarity, and a breakdown in project direction and accountability.

Using a RACI chart in project planning can streamline operations, clarify responsibilities, and improve project outcomes.

Keep Track of Your Budget

It’s important to keep track of your budget when making business decisions. One way to do this is to use cost-benefit analysis to estimate the costs and benefits of projects or investments. Comparing costs to expected rewards helps businesses make informed financial decisions. However, there are potential risks, like difficulty predicting variables and overlooking the human element in decision-making.

Tools like project management software and CBA templates can help manage the budget effectively, improve the CBA process, and provide historical data. They aid in assessing project costs and benefits, assisting businesses to achieve goals while saving on costs. Sensitivity analysis and project management software can also help in effective cost and benefit tracking, ensuring sound financial decisions.

What Could Go Wrong? List Risks Here

An organization’s cost-benefit analysis can face risks and pitfalls that affect its outcome. Reliance on future forecasts and projections can be challenging if the data isn’t accurate. External factors like economic changes or shifts in consumer behavior may impact the analysis results. Uncertainties in identifying and evaluating risks and quantifying non-financial metrics are specific business challenges.

It’s essential to address these challenges when conducting a cost-benefit analysis for accurate assessments and robust decision-making.

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.