How to Share Costs: Simple Ways

Sharing costs with others is a great way to save money and make the most of your resources. You can split the bill at a restaurant or carpool to work. Simple and effective ways to share costs with friends, family, or colleagues exist. In this article, we will explore some easy strategies for splitting expenses and making the most of shared resources.

We’ll provide practical tips for sharing costs in a way that benefits everyone involved – from groceries to utility bills.

Understanding How to Share Costs

What Sharing Costs Means

Sharing costs can have a big impact on individuals or groups. It helps to distribute financial responsibility fairly. Different types of expenses, like fixed and variable costs, can be divided among parties. This ensures that each party bears a reasonable portion of the financial burden.

Costs can be divided between friends or within a business. This is done by using cost allocation mechanisms. These mechanisms involve identifying cost objects, accumulating costs into a cost pool, and then assigning the costs based on specific criteria. This helps in accurately tracing costs to departments, products, or programs. It also enables informed decision-making.

For businesses, correctly allocating costs is important. This helps in identifying profitable products, implementing cost-reduction strategies, and evaluating staff performance. Proper sharing of costs ensures that unprofitable cost objects are identified. This allows resources to be redirected to more profitable areas. This optimizes overall financial outcomes.

Different Types of Expenses

Different types of expenses can be shared among individuals or businesses. These include direct, fixed, variable, and indirect expenses.

Direct expenses are for specific functions, projects, or departments. Fixed expenses remain constant over time, regardless of production or sales. Variable expenses fluctuate based on production or sales levels. Indirect expenses are not directly associated with a specific function and can include utility bills, office supplies, or janitorial services.

Rent or utilities are fixed expenses, while inventory or staffing costs are variable. One-time expenses among friends or business partners can be divided equally, based on income percentage, taking turns, or by allocating expenses to the person who benefits most.

Regular Bills vs. Changing Bills

Why You Should Share Costs

Sharing costs is important in both personal and professional relationships. Splitting expenses among multiple people or entities helps to track costs accurately for specific activities or products. This leads to better decision-making. For instance, sharing the cost of office supplies in a professional setting helps calculate per-unit costs accurately and identify profitable products or projects. It also encourages efficient allocation of resources, such as staff time and company funds.

Ways to Split Costs

Dividing Up Regular Bills

Regular household bills can be divided in different ways among housemates or family members:

- Based on their usage of utilities like electricity, water, or gas.

- Evenly across all individuals.

Factors like room size, duration of stay, and usage contribution can help determine a fair way to split bills.

The number of people in the household also matters, as more people may mean greater utility consumption.

Those with higher incomes may contribute more towards bills and other expenses.

These methods provide insights into splitting bills effectively based on various factors and circumstances.

Splitting One-Time Expenses

One-time expenses are costs that occur only once. They can be split between multiple parties by carefully identifying and categorizing the different elements of the expense. Factors to consider include the specific usage or benefit derived from each part of the expense, and the financial ability and willingness of each party to contribute.

It’s also important to consider the long-term impact and potential future benefits of the expense. This helps in determining fair allocation.

To ensure equitable sharing of one-time expenses, cost allocation methods like activity-based costing can be used. This accurately assigns costs to the specific benefit or usage derived from the expenses.

Cost drivers such as machine-hours or direct labor hours can help determine the most appropriate way to split the one-time expense based on specific criteria.

By understanding the cost structure and effectively allocating one-time expenses, businesses can make informed decisions and maximize profits.

How to Figure Out Who Pays What

Using a Cost Driver to Decide

Cost allocation involves identifying, accumulating, and assigning costs to cost objects such as departments, products, or programs of a company. It is beneficial for decision-making, as it provides data on cost utilization and helps evaluate and motivate staff.

A cost driver helps determine the change in costs associated with an activity, aiding in the fair sharing of expenses. For instance, companies often use machine-hours or direct labor hours as cost drivers to ensure that shared costs are distributed accurately to different cost objects.

This method ensures that cost allocation is objective and based on specific criteria, resulting in more informed and fair decisions. The benefits of using a cost driver include identifying unprofitable cost objects, making cost-reduction strategies, and allocating resources to more profitable areas.

Cost drivers also assist in evaluating staff performance and motivation, both in business scenarios and when sharing expenses among friends, allowing for an equitable distribution based on accurate data.

Sharing Costs Fairly Between Friends

Cost-sharing among friends is important. It involves talking openly about money and setting clear expectations.

For regular bills like utilities, friends can split the cost equally or based on individual usage.

For one-time expenses like a group vacation, the cost can be divided based on everyone’s budget. Or, the most financially stable friend can pay initially and be reimbursed later.

In a business, it’s important to have guidelines for charging expenses to the company.

Businesses can use methods to divide department budgets fairly. They can also consider employees’ performance and cost-management abilities when allocating expenses.

This helps ensure fair allocation and efficient resource use.

Guidelines for Businesses to Split Expenses

Sharing Expenses by How Much You Use Something

To decide how much each person should pay when sharing expenses, a cost driver can be used to determine the activity that creates a cost. For example, a company may use the number of machine hours or the miles driven to allocate costs to a particular product line or specific consumer.

Guidelines for fairly splitting expenses based on usage typically involve identifying activities like square footage, machine hours, or the amount of time a product is in use. This way, the economic benefit derived from the activity can be measured and allocated accordingly.

When sharing costs based on usage, one-time expenses can be divided up by either charging the beneficiaries of the one-time expense directly, or by spreading the cost equally over a convenient time period such as years. These methods allow for fair and accurate allocation when dividing up costs based on usage.

Sharing Costs Based on Square Footage

Costs can be shared based on square footage. Expenses are allocated according to each department or program’s space within an organization. Factors like building maintenance, utilities, and rental costs affect the allocation, as well as the specific needs of each department.

Square footage can determine how shared expenses are allocated. The space used by each department or program directly influences the costs incurred. Accurately identifying cost objects, accumulating costs into a cost pool, and assigning costs based on square footage ensures a fair and appropriate allocation of expenses.

This method of cost allocation provides valuable data for decision-making, cost utilization, and staff evaluation. It also helps identify unprofitable areas, allowing resources to be redirected to more profitable areas within the organization.

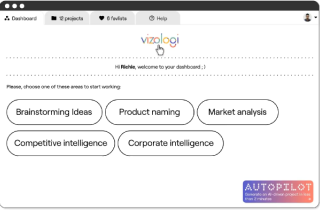

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.