Key Trends Shaping Modern Equity Management

Introduction

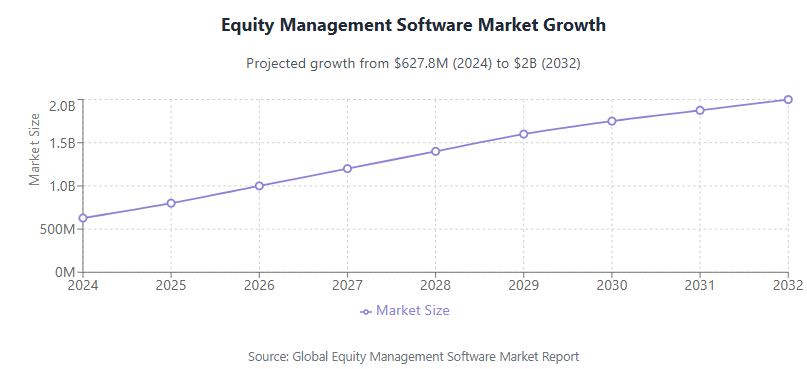

The global equity management software market is expected to grow from $627.8 million in 2024 to $2 billion by 2032. Much of this growth is expected to originate from the US and Canada. These forecasts are a testament to the growing importance of equity management as a critical component of corporate governance in driving success within the US startup ecosystem.

A key growth driver for this market is the rising prominence of stock-based compensation. Such compensation has long been hailed for effectively attracting talent and conserving cash. These benefits became more accessible with the 2018 revision of Rule 701(e). As a result, the limit under which extensive disclosures are not required was raised from $5 million to $10 million in securities sold over 12 months.

In this article, along with the growing importance of stock-based compensation, we will discuss various other trends that are shaping modern equity management.

Key equity management trends

The evolution of the equity management landscape is being driven by the following key trends.

- Importance of managing stock-based compensation

With about 97% of public companies issuing stock-based compensation, such incentives have become increasingly prevalent. This trend can be expected to continue as startups navigate the funding drought.

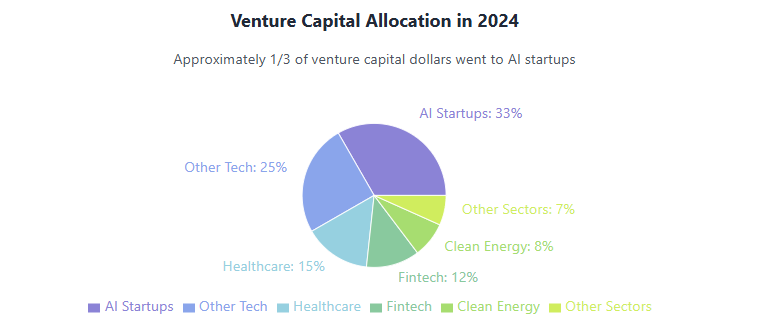

In recent years, while AI startups have secured funding at remarkable valuations, the other sectors have not experienced a comparable level of fundraising success. In 2024, about 1/3rd of venture capital dollars went to AI startups.

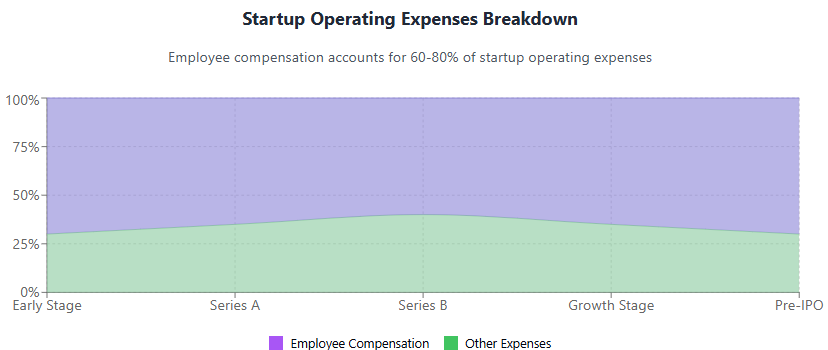

Since employee compensation accounts for 60% to 80% of startup operating expenses, stock-based compensation, which leads to cash conservation, is likely to become more prominent.

However, stock-based compensation is a source of dilution and can hurt investor returns. So, founders must learn about non-dilutive forms of stock-based compensation such as phantom stocks and stock appreciation rights (SARs).

Since this kind of non-dilutive stock-based compensation might not be appropriate across the board, founders should also create and manage an acceptable stock option pool. Investors must be informed about the dilution to be expected, and founders should aim to adhere to their projections as much as possible.

You must also note that stock-based compensation is taxed quite differently from cash compensation. It attracts long-term or short-term capital gains tax depending on the holding period. So, to ensure that employees actually find such compensation enticing, you must educate them on capital gains tax and the benefits of early exercising to initiate their holding periods sooner.

In addition to employee education, you must also invest in 409A valuations. These valuations are meant to establish the fair market value (FMV) of your company. They are required every 12 months or after a material event. If your stock options have an exercise price lower than the FMV, they might be treated as non-qualified deferred compensation (NQDC). Since this would result in higher scrutiny from the IRS, accuracy in 409A valuations is extremely important.

- Complex ownership structures

Many corporations have an extremely convoluted ownership structure on account of stock-based compensation, complex securities, and multi-class share structures. These instruments enable companies to raise funds at favorable terms and meet investor requirements. However, they also complicate dilution analysis.

A company’s ownership structure may change gradually as convertible debt and Simple Agreement for Future Equity (SAFE) notes are converted and stock options are exercised. These marginal changes can potentially have a significant impact on which faction holds the most influence over the company. Hence, founders, particularly CFOs, must carefully design funding agreements and employee compensation plans, as anticipating changes and reacting to them can lead to sub-optimal outcomes.

These challenges are exacerbated when a company adopts a complex, multi-entity holding structure, whether for tax benefits or strategic reasons.

An example of this would be OpenAI. The leading AI startup is set up in a manner that OpenAI Nonprofit owns and controls a holding company that controls OpenAI Global, a capped-profit company. Recently, OpenAI secured $40 billion in funding from SoftBank and other investors. However, if OpenAI fails to transition to a for-profit entity, the funding could drop to $30 billion.[4]

Companies that are involved in such transitions must carefully execute transactions to ensure that all stakeholder rights are respected while also minimizing tax implications.

- Need for integrated solutions

As equity structures become more complex, equity management solutions must branch out. To start with, visualizing the dilution impact of different equity compensation plan alternatives and funding round outcomes requires specialized tools. Simple spreadsheets offer high customizability, but they simply are not agile or accessible enough.

Secondly, since equity compensation has become a key part of employee compensation, the importance of 409A valuations has only amplified. Consequences of non-compliance with this requirement include a 20% penalty tax, immediate taxation of vested income, and a higher-than-normal interest rate on unpaid taxes.

Additionally, fully leveraging the tax benefits of stock-based compensation requires the timely filing of key forms such as Form 3921 and 83(b) elections. These forms are meant to inform the IRS about incentive stock options (ISO) exercise and early exercise of stock options, respectively.

Furthermore, heading into funding rounds, startups must fully understand their options. To do so, they must visualize the impact of issuing different volumes of equity to incoming investors. Existing investors would also benefit from such analysis, as it helps anticipate dilution and exercise any anti-dilution rights if necessary.

Finally, equity management often comes under the purview of the board of directors. Hence, to truly streamline equity management, software must evolve to allow the board of directors to receive proposals, send votes, and reach conclusions to approve or reject equity changes.

- Global compliance and regulatory hurdles

In this globalized economy, to stay competitive, corporations must establish global supply chains. This involves setting up subsidiaries all over the world and employing people from different nations. At the same time, investors too are expanding their search for opportunities beyond national borders.

As a result, complying with the securities and income tax laws of more than one jurisdiction has become necessary for companies.

For instance, if a company employs foreigners, it must ensure that these employees do not qualify for US tax residency through the Substantial Presence Test (SPT). Otherwise, the employees may be subject to taxation from the US as well as their home country. In this scenario, not only will your compensation package be less competitive, but you must also ensure compliance with US and foreign stock-based compensation laws.

Ironically, most companies would prefer dealing with the compliance hurdles of stock-based compensation since it allows them to conserve cash reserves.

Streamlining equity management!

Equity management is becoming increasingly integral to corporate governance and overall success. Executing this function effectively requires diligence, substantial financial acumen, and comprehensive knowledge of income tax regulations.

As the complexities increase, relying solely on individual expertise will become increasingly unsustainable. You must invest in a reliable equity management solution that offers comprehensive support. This would help you save valuable leadership time while also ensuring stakeholder consensus.

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.