Learning About Risk Evaluation Aversion: Staying Safe!

Life is full of situations with some risk. It could be trying new food or thinking about a job in a new city. Knowing how to handle risk is important. This article will talk about risk evaluation aversion and how it keeps us safe. Understanding it helps us make better choices and stay safe.

What Does It Mean to Be Careful with Risks?

When making decisions, it’s important to consider potential consequences and opt for low-risk options with a high chance of success.

Thorough research and analyzing probabilities can help in this process. Some people avoid risks due to their preference for certainty, prioritizing safeguarding their investment over high returns.

Factors like age, gender, and income level can influence a person’s risk aversion. However, being overly cautious with money can lead to missed opportunities and lower returns.

Balancing risk and reward is crucial for financial success, as being too cautious can hinder wealth accumulation and growth potential.

How to Know if You Are Careful with Risks

Why Some People Don’t Like Taking Risks

Some people avoid risks because they prefer predictable outcomes. They might choose a bank account with guaranteed low interest instead of a stock with higher possible returns but also a chance of loss.

We can determine risk attitude as certainty equivalent, risk neutral, or risk loving. The difference between expected value and certainty equivalent is the risk premium. Being cautious with money can minimize losses but also lower expected returns and cause missed opportunities and erosion of savings due to inflation.

Those averse to risk may favor low-risk investments, like savings accounts, CDs, bonds, and dividend growth stocks, which prioritize stability and liquidity.

Checking If You’re One of Those Who Avoid Risks

Risk evaluation aversion can be determined by a person’s risk attitude classification. This includes certainty equivalent, risk neutral, or risk loving.

The difference between the expected value and the certainty equivalent is called the risk premium.

Measures of risk aversion include Absolute Risk Aversion, which measures the curvature of the utility function, and the Arrow–Pratt measure, which quantifies individuals’ aversion to risk.

Some people avoid taking risks due to their tendency to prefer low uncertainty outcomes. They do this even if the average outcome of the latter is higher in value. This is known as risk aversion.

It can be influenced by the psychophysics of chance, which leads to overweighting of sure things and improbable events. This is relative to events of moderate probability.

Being too careful with money can minimize losses but may also result in lower expected returns, missed opportunities, and erosion of savings due to inflation.

Similarly, the rejection of a sure thing in favor of a gamble of lower or equal expected value, known as risk-seeking behavior, could also result from being overly cautious.

Choices for People Who Avoid Risks When They Invest

Why Saving Accounts are a Safe Choice

Saving accounts are a safe choice. They offer stability and a near-zero chance of losing the original investment. They are a low-risk option for individuals who are cautious with their money. Savings accounts prioritize liquidity and steady growth.

Choosing a saving account over other higher-risk investment options has benefits such as minimized losses, lower expected returns, and reduced erosion of savings due to inflation. Additionally, saving accounts offer a low guaranteed interest rate. This is an attractive feature for risk-averse investors who prefer certainty over potential high returns.

Putting Money in CDs: A Low-Risk Idea

Taking risks with investments can make some people nervous.

But there are options for those who prefer to avoid risks.

These include savings accounts, CDs, bonds, and dividend growth stocks.

Being too cautious with money when investing can lead to minimized losses but also lower expected returns.

It may also mean missing out on opportunities and erosion of savings due to inflation.

How Money Market Funds Work

Money market funds invest in short-term, high-quality securities. These include CDs, Treasury bills, and commercial paper. The goal is to provide investors with a low-risk option and higher returns than traditional savings accounts.

The benefits of money market funds are stability, preservation of capital, and a steady income source. For those preferring low risk, other options include savings accounts, CDs, bonds, and dividend growth stocks.

To determine comfort with investment risk, individuals can evaluate their risk tolerance, investment objectives, and time horizon. Factors like age, income, and financial goals can help identify risk aversion tendencies for informed decisions.

Choosing Bonds for a Safer Investment

Risk-averse individuals prefer low uncertainty outcomes over high uncertainty ones. They prioritize preserving capital over potential high returns, showing risk aversion. Saving accounts are a safe choice for them, offering stability and low chance of losing the original investment. Money market funds also operate as a low-risk option, focusing on stability and liquidity.

They invest in high-quality, short-term securities and prioritize preserving capital, making them attractive for those avoiding high-risk investments.

Shares that Pay You: Dividend Growth Stocks

Investing carefully means prioritizing the protection of capital rather than aiming for high returns. It involves choosing low-risk investments that offer stability and minimal chance of losing the original investment.

To assess someone’s approach to risks, they can be classified as certainty equivalent, risk-neutral, or risk-loving based on their risk attitude. Some people avoid risks because of risk aversion, preferring low-uncertainty outcomes over higher value but more uncertain outcomes.

Factors like age, income, and gender often influence how risk-averse individuals are.

Permanent Life Insurance as an Investment

Being careful with investments means preferring to keep your money safe instead of aiming for big profits. This is for people who like low-risk options like savings accounts, CDs, bonds, and steady stocks that rarely lose money. They focus on having access to their money and slow, steady growth rather than big wins or losses. When deciding how much risk to take, consider personal factors like age, income, and gender.

Research shows that older people, those with lower income, and women usually prefer lower risks. Knowing your own comfort with risk is important for picking the best investment that fits your financial goals.

Good and Bad Sides of Avoiding Risk

The Ups and Downs of Being Cautious with Money

Being careful with risks means prioritizing stability and minimizing the chance of loss. Knowing if you are careful with risks involves evaluating whether you prefer low-uncertainty outcomes over high-uncertainty outcomes.

Some people dislike taking risks due to a preference for a sure outcome over a gamble, even if the gamble has higher or equal expected value. To check if you are someone who avoids risks, assessing your attitude towards risky choices is crucial.

Figuring out your risk comfort zone in investments entails understanding your preference for low-risk or high-risk investments, such as savings accounts versus stocks.

Money thoughts and feelings regarding the psychology of risk often involve the psychophysics of chance, including overweighting of sure things and improbable events.

Being careful with money can be too much when it leads to missed opportunities, lower expected returns, and potential erosion of savings due to inflation.

Figuring Out Your Risk Comfort Zone in Investments

A person’s comfort level with investment risk is influenced by factors like age, income, and gender.

Older individuals, lower-income people, and women are usually more cautious about risk than younger individuals, higher-income earners, and men.

Risk tolerance significantly affects investment choices.

People who prefer lower-risk options, like savings accounts, CDs, bonds, and dividend growth stocks, prioritize steady growth and liquidity.

However, risk-seeking investors may lean towards high-risk investments with potential for substantial gains or losses.

Being cautious can prevent big losses, but being overly careful may also mean missing out on opportunities and lower than expected returns.

Avoiding moderate and high probabilities in favor of sure things can reduce the appeal of positive gambles.

Money Thoughts and Feelings: Psychology of Risk

How We Feel Affects What Risk We Take

Risk aversion comes from worries about keeping money safe and a preference for knowing what will happen. People who prefer to know what will happen might prioritize a certain result over taking a chance with a higher or equal expected value. How people feel about possible outcomes affects their risk preference. Those who want stability and almost no chance of losing their initial investment often choose low-risk investments.

Those who want the chance for big gains may choose high-risk investments. Studies have shown that older people, those with lower incomes, and women are usually more risk averse. Being careful with money can limit losses but might also mean missing out on opportunities and losing savings because of inflation.

What’s Inside Our Heads When We Decide to Take Risks?

Our brains have many preferences and things we dislike. These influence how we take risks. People often try to avoid losing things, which is called loss aversion. This leads many to make safe choices with money. Emotions also have a big impact on our actions.

For example, the fear of missing out might drive someone to take a big risk and invest. On the other hand, feelings of worry and uncertainty can make others stick to safe investments. These examples show how our emotions and personalities affect the risks we take with money. So, it’s clear that our thoughts and feelings are important when we make risky choices.

Being Careful With Money: Is It Ever Too Much?

Someone can check if they are being too cautious with their money by looking at their risk aversion. Choosing low-risk investments like savings accounts or bonds over potentially higher returns indicates excessive caution. While this approach may minimize losses, it can also lead to lower expected returns, missed opportunities, and erosion of savings due to inflation. Overcaution is a problem when it causes someone to pass up higher value opportunities due to fear of risk.

This can limit financial growth and harm long-term financial security.

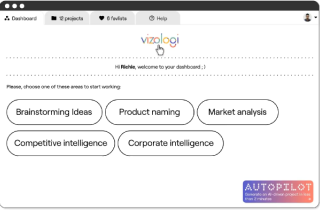

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.