Starting a Microenterprise: A Simple Guide

Have you ever considered starting your own small business? Maybe you love baking, crafting, or offering a specific service. Whatever your talents, starting a microenterprise – a very small business with fewer than five employees – could be a great way to turn your skills into a successful venture. In this simple guide, we will give you the basic steps to get your microenterprise started, including planning, funding, and marketing.

By following these steps, you can turn your passion into a profitable business.

Defining a Microenterprise: The Basics

A microenterprise is a small business. It usually has fewer than 10 employees and is started with a small amount of capital.

Microbusinesses have less than $250,000 in annual revenue and focus on specific niches.

They are popular because of low startup costs and flexibility. Microcredit provides small loans to people with no collateral, credit history, savings, or employment history.

Microfinance institutions, nonprofit organizations, and government grants are common financing options for these businesses.

Microenterprises are regulated differently around the world. The standards and definitions vary in the United States, European Union, Australia, Philippines, and India.

Despite challenges in scaling, microenterprises play a vital role in improving the quality of life and economy in developing countries. They create jobs and boost purchasing power.

Comparing Microenterprises to Small Businesses

Microenterprises are smaller than small businesses. They have fewer employees and make less money. Microbusinesses often focus on specific areas because they are small. The definitions of microenterprises vary by region. In the European Union, they have fewer than 10 employees and make less than €2 million a year. In the United States, a microenterprise has fewer than 10 employees. In Australia, it depends on the turnover.

Micropreneurs have lower startup costs and more flexibility, while entrepreneurs focus on larger businesses. This affects things like marketing, IT, customer service, and business regulations. Microbusiness owners must deal with these differences to succeed.

Global Context: Microenterprise Definitions and Standards

United States

Microenterprises in the United States are small businesses with less than 10 employees and annual revenue of less than $250,000. They start with minimal capital, have low startup costs, and focus on specific niches, differentiating them from larger small businesses. Despite their size, microenterprises boost the economy by creating jobs and providing essential goods and services to communities, impacting purchasing power and overall quality of life.

European Union

The European Union is responsible for overseeing and supporting the growth of microenterprises in its member countries. It is crucial for the EU to create an environment that fosters the development of small businesses by providing resources and financial support. One way the EU supports and promotes the growth of microenterprises is by implementing policies and regulations that facilitate their success.

For instance, the EU has established initiatives aimed at improving access to financing formicrobusinesses, such as providing microcredit to entrepreneurs with limited credit history or collateral. Furthermore, the European Union actively advocates for the reduction of regulatory burdens on small businesses and facilitates trade and commerce across its member countries. Through these measures, the EU aims to create an environment that enables microenterprises to thrive and contribute to the overall economy, thus benefitting both the entrepreneurs and their communities.

Australia

Microbusinesses in Australia are small businesses with less than 10 employees and less than $2 million in annual revenue. This is similar to the definition in other countries, like the United States, where small businesses have fewer than 500 employees.

Microenterprises in Australia have access to financing options, including microcredit, which provides small loans to entrepreneurs who may not have access to traditional financing.

These businesses have a significant impact on the broader economy by creating jobs, stimulating local economic activity, and contributing to innovation and competition.

Philippines

In the Philippines, microenterprises are small businesses with fewer than 10 employees and annual revenue of less than $250,000. They often focus on specific niches and differ from larger small businesses because of their size and scope.

Microenterprises in the Philippines are typically financed through microcredit, offering small loans to entrepreneurs without collateral, credit history, savings, or employment history. This helps individuals start businesses despite financial constraints.

These businesses have a significant impact on the broader economy, creating job opportunities, increasing purchasing power, contributing to local economic growth, and helping in poverty alleviation and economic development. Ultimately, they improve the quality of life for many Filipinos.

India

Microenterprises in India face challenges with accessing financial expertise and resources. This makes it hard for them to grow. Owners also struggle with marketing, IT, customer service, tax compliance, and business regulations.

Despite these challenges, microenterprises are vital for the Indian economy. They create jobs, increase purchasing power, and lead to improved living standards and economic growth. Women-led microbusinesses also have a positive impact on local communities and help reduce poverty.

Fortunately, in India, microenterprises have access to various financing options. This includes microcredit, support from microfinance institutions, and nonprofit organizations. These resources empower entrepreneurs to start and expand their businesses, driving economic development at the grassroots level.

Microenterprise Categories and Models

Microenterprises are small businesses that are categorized based on the number of employees and annual revenue. There are various models for operating these businesses.

Micropreneurship is a type of entrepreneurship that focuses on smaller scale businesses. It differs from traditional entrepreneurship in its smaller size and limited industry focus.

Micropreneurs often operate businesses with less than 10 employees and revenue under $250,000 annually. They also leverage microcredit to fund the business. These small-scale businesses can have a significant impact on the broader economy by creating jobs, boosting purchasing power, and improving the quality of life, especially in developing countries.

However, microenterprises face common hurdles such as limited access to resources, financial expertise, and high-interest rates on microloans.

Nevertheless, they can be successful in various fields. For example, individuals have used microcredit to start tailoring businesses and increase income within their communities.

Successful microbusinesses usually require a thorough business plan, choosing an appropriate business structure, and navigating challenges in marketing, IT, billing, customer service, and business regulations.

Micropreneurship versus Entrepreneurship: Distinguishing Traits

Micropreneurship is different from traditional entrepreneurship in terms of business size and scope. Micropreneurs usually have fewer than 10 employees and limited revenue, setting them apart from traditional entrepreneurs. They have low startup costs and can focus on specific niches, unlike traditional entrepreneurs who often need more capital. The global context also influences this distinction.

In developing countries, microenterprises are often funded through microcredit, providing small loans to individuals with no collateral or credit history. In wealthier nations, traditional entrepreneurship may be more common due to better access to resources and funding. Therefore, the global context plays a significant role in shaping the characteristics of micropreneurship and entrepreneurship.

The Roadmap to Launching a Microenterprise

Step by Step: Establishing Your Microenterprise

Establishing a microenterprise involves several important steps:

- Creating a business plan

- Choosing an appropriate business structure

- Registering the business with local authorities

To succeed, it’s important to evaluate the market and identify niche opportunities. This involves:

- Conducting market research

- Identifying the target demographic

- Analyzing the competition to determine where the product or service fits within the market

Microenterprises have various financing options, including microloans and grants. Microcredit can be used to access capital without collateral, credit history, or employment history. Government grants, microfinance institutions, and nonprofit organizations also provide financial support to these businesses.

Evaluating the Market and Identifying Niche Opportunities

To evaluate the market for a potential niche opportunity in the microenterprise sector, entrepreneurs can conduct market research. They can analyze industry trends, consumer behavior, and competitive landscape. Gathering data on market size, growth potential, and customer demographics is also important. This helps to identify untapped or underserved niches. Seeking feedback from potential customers or conducting surveys can pinpoint specific needs or preferences that lead to niche opportunities.

Microentrepreneurs can identify gaps in the market and leverage those opportunities. Focusing on specialized products or services that address unmet consumer needs is crucial. Understanding the target market and its pain points helps microbusiness owners tailor their offerings to meet specific demands. This approach can lead to increased customer loyalty and differentiation from competitors.

When assessing the potential demand and profitability of a niche opportunity, entrepreneurs should consider key factors. These include the target market size, purchasing power, and willingness to pay for the product or service. Analyzing the cost structure, pricing strategy, and distribution channels helps gauge the feasibility of the niche opportunity. Researching the regulatory environment, industry trends, and technological advancements provides insights into potential challenges and opportunities for growth.

Financing Options for Microenterprises

Applying for Loans and Government Grants

Microenterprises can apply for government grants. To qualify, they must meet specific criteria related to their business nature, location, and project type. When seeking loans, microbusinesses need a detailed business plan, financial statements, and projections to show they can repay the loan. Loan applications should also demonstrate a strong business concept and clear payment plan.

Microenterprises typically access microfinance through small-scale loans from microfinance institutions or nonprofits. While these loans require less documentation, they often have higher interest rates. On the other hand, government grants provide free financial assistance that doesn’t need to be repaid, making them an attractive option for microenterprises.

Microfinance and Bootstrapping Techniques

Microfinance and bootstrapping provide vital financial support for small businesses and microenterprises. This support helps them access the funding necessary to grow and succeed.

For instance, microfinance institutions and nonprofit organizations offer microcredit, which are small loans without collateral or credit history requirements. These are available to entrepreneurs in developing countries.

Additionally, bootstrapping techniques, like personal savings, credit cards, or retained earnings, enable microenterprise owners to fund their businesses without external help.

Common techniques for microfinance and bootstrapping include establishing a business plan, selecting an appropriate business structure, and seeking financial assistance from microfinance institutions, NGOs, or community lending groups. These strategies help entrepreneurs secure the funds they need to start or expand their microbusinesses.

On a global scale, microfinance and bootstrapping techniques play an important role in the overall success and sustainability of microenterprises. In developing countries, these financial tools empower individuals to start businesses, create jobs, and stimulate economic growth in their communities. The impact can be seen in various industries, for example, a woman using microcredit to set up a tailoring business, which boosts her income and benefits her community.

Therefore, microfinance and bootstrapping techniques are indispensable for the success and long-term viability of microenterprises worldwide.

The Impact of Microenterprises on the Broader Economy

Microenterprises create jobs and boost the economy. They are essential for growth in developing countries. These small businesses provide employment and increase purchasing power. By focusing on niche markets, they also help revitalize communities.

Microenterprises help reduce poverty and improve income distribution. For example, a woman starting a tailoring business using microcredit can increase her income and reduce poverty. This increased income also boosts purchasing power, leading to further economic growth.

Despite their benefits, microenterprises face obstacles. Limited resources, financial expertise, and high-interest rates on loans can make scaling difficult. Critics worry that these challenges could lead to cycles of debt. However, with a solid business plan and the right structure, microenterprise owners can overcome these obstacles and find success.

Common Hurdles in Running a Microenterprise

Microenterprise owners commonly face challenges like limited resources and lack of financial expertise when setting up and running their businesses. Unlike small businesses, microenterprises typically have fewer than 10 employees and minimal revenue, making their obstacles unique. To overcome these challenges, owners can create a solid business plan and carefully select a business structure such as sole proprietorship, LLC, corporation, or partnership.

It’s also crucial to navigate key areas like marketing, IT, billing, customer service, taxes, and business regulations. For instance, microcredit can empower a woman to start a tailoring business, boost her income, and benefit her community. These examples show how microenterprises play a crucial role in improving the quality of life and the economy in developing countries, despite the obstacles they face.

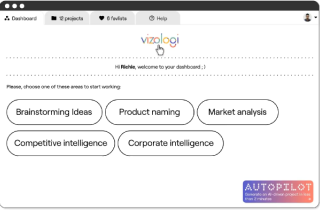

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.