The Three Types of Forecasting: Easy Guide for Beginners

Forecasting is a valuable tool for businesses and individuals, allowing us to predict future trends and outcomes. There are three main types of forecasting – qualitative, time series, and causal – each with its unique approach and uses. Whether you’re a beginner or looking to sharpen your skills, understanding these different types of forecasting can help you make more informed decisions and plan for the future.

In this article, we’ll explain each type of forecasting and how it can be applied in real-world situations.

What’s Forecasting Anyway?

Simple Explanation of Forecasting

Forecasting is an important aspect of decision-making and planning. It involves estimating future demand, sales, or other relevant factors. There are three main types of forecasting: Time Series Forecasting, Causal Forecasting, and Judgmental Forecasting.

Time Series Forecasting uses historical data to predict future patterns using moving averages, exponential smoothing, and trend analysis techniques. Causal Forecasting considers cause-and-effect relationships using regression analysis and econometric models. Judgmental Forecasting relies on experts’ knowledge and insights, using techniques like Delphi and market surveys.

For example, in financial analysis, straight-line or moving average methods are commonly used to predict future revenue growth based on historical figures and trends. In supply chain management, organizations often use causal forecasting to understand the impact of various factors on demand and plan their production accordingly. Meanwhile, in uncertain scenarios, such as during the launch of a new product, judgmental forecasting can provide valuable insights.

The Three Basic Types of Forecasting

Straight-Line Forecasting: What It Means

One key forecasting method financial analysts use is the straight-line method. This technique involves using historical figures and trends to predict future revenue growth. For example, a company might use this method to forecast its sales for the upcoming year based on its past sales data and growth patterns. Companies can make informed predictions about future performance by analyzing the historical revenue growth trend.

The straight-line method is a practical and straightforward approach to forecasting that can be easily understood and applied by financial analysts and managers alike. It provides a general idea of how the company’s revenue may evolve and helps in decision-making and planning.

This forecasting method falls under the category of time series forecasting, which uses historical data to predict future patterns. It is a valuable tool for companies looking to estimate future demand and sales, making it a practical and widely used forecasting technique in the business world.

Moving Averages and How They Work

Moving averages are critical in estimating future trends based on historical data patterns among the various forecasting techniques. This method uses a smoothing technique to establish future value estimates based on underlying data patterns, making it a practical tool for financial analysts and managers.

For instance, in financial analysis, moving averages can help predict future revenue growth by analyzing historical figures and trends. This method allows analysts to gain valuable insights into potential revenue patterns and make informed decisions about future financial planning.

Getting Started with Simple Linear Regression

Simple linear regression is one of the fundamental methods of financial forecasting. It analyzes the relationship between variables for prediction purposes. It involves plotting historical data on a scatter chart to identify trends and using mathematical tools such as trendlines to estimate future values. For instance, in financial analysis, simple linear regression can be used to predict a company’s revenue growth based on its historical performance and other relevant factors.

Financial analysts often use simple linear regression to make informed budget forecasting and revenue projection decisions. Analyzing the historical relationship between variables such as sales and marketing expenditures can generate valuable insights into future trends. For example, a financial analyst may utilize simple linear regression to estimate the impact of marketing investments on future sales figures for a company.

Understanding simple linear regression is essential for enhancing the accuracy of financial forecasting and enabling data-driven decision-making. Incapacity management: method can provide valuable insights into the relationship between production levels and customer demand, aiding in optimizing resources and customer satisfaction.

By mastering the principles of simple linear regression, financial analysts can strengthen their forecasting capabilities and contribute to more effective planning and decision-making within their organizations.

What’s Multiple Linear Regression All About?

One of the forecasting methods financial analysts use is multiple linear regression. This technique is utilized when revenue projection requires the consideration of two or more independent variables.

For example, a retail company might use multiple linear regression to predict future sales based on various factors such as advertising expenditures, pricing strategies, and seasonal trends. The company can make informed decisions about resource allocation and strategic planning by analyzing the relationship between these independent variables and sales.

In another scenario, a manufacturing firm might use multiple linear regression to forecast production levels based on raw material costs, labor expenses, and machinery maintenance schedules. By understanding how these independent variables impact production output, the company can optimize its operations and manage resources effectively.

Multiple linear regression offers a versatile and comprehensive approach to forecasting. It allows businesses to consider the complexities of real-world scenarios when predicting future outcomes. By incorporating multiple factors into the forecasting model, organizations can make more accurate and data-driven decisions.

How to Pick the Right Forecasting Way

Tips to Understand Forecasting Methods

Tips for Understanding Forecasting Methods

When forecasting, it’s essential to understand the different methods available and how they can be used effectively. Here are a few tips to help you grasp the various forecasting techniques:

- Consider the nature of the data: Depending on the data type you are working with, specific forecasting methods may be more suitable than others. For example, time series forecasting is ideal for historical data analysis, while causal forecasting is better for understanding cause-and-effect relationships.

- Evaluate the level of certainty: If the data is uncertain or subjective, qualitative forecasting techniques that rely on expert judgment may be more appropriate. On the other hand, quantitative forecasting methods based on mathematical models and statistical techniques would be beneficial for more objective analysis.

- Understand the demand types: Independent demand, which refers to the market for finished products, and dependent demand, related to the production of another item, are crucial factors in forecasting.

Knowing how to manage these types of demand effectively is essential for accurate forecasting and capacity management.

Considering these tips, you can better grasp the various forecasting methods and make more informed decisions for your organization’s planning and resource management.

Forecasting with Time Series Analysis

Types of Forecasting

Forecasting with Time Series Analysis involves using historical data to predict future patterns. The three main types of forecasting are Time Series Forecasting, Causal Forecasting, and Judgmental Forecasting.

Time Series Forecasting utilizes historical data to predict future patterns, using techniques such as moving averages, exponential smoothing, and trend analysis. Causal Forecasting considers cause-and-effect relationships using regression analysis and econometric models. Judgmental Forecasting relies on experts’ knowledge and insights, using techniques like Delphi and market surveys.

For example, a retail company might use Time Series Forecasting to predict seasonal sales patterns. At the same time, a manufacturing firm may employ Causal Forecasting to determine the impact of raw material costs on product pricing. Judgmental Forecasting may be utilized in a startup setting, where historical data is limited, and expert opinions carry significant weight.

Understanding the different types of forecasting methods is essential for making informed decisions in business planning and management. By using the appropriate method that aligns with the nature of the data and the business context, organizations can optimize their operations, reduce costs, and enhance customer satisfaction through accurate forecasting.

Using Econometric Models for Predictions

Econometric models play a vital role in forecasting future trends and behaviors. There are three main types of forecasting: time series forecasting, causal forecasting, and judgmental forecasting.

Time series forecasting involves using historical data to predict future patterns, such as moving averages, exponential smoothing, and trend analysis. For example, a retailer may use this method to anticipate sales trends for particular products based on past sales data.

Causal forecasting focuses on cause-and-effect relationships and utilizes regression analysis and econometric models. A transportation company that analyzes the relationship between fuel prices and shipping costs to forecast future expenses is an example.

Judgmental forecasting relies on experts’ knowledge and insights, using techniques like Delphi and market surveys. For instance, a marketing team might gather expert opinions to forecast consumer preferences for a new product launch.

Putting Forecasting to Work In Business

Types of Forecasting in Business

Three main forecasting methods play a crucial role in business forecasting. These methods include time series forecasting, causal forecasting, and judgmental forecasting.

- Time Series Forecasting: This method utilizes historical data to predict future patterns, such as moving averages, exponential smoothing, and trend analysis. For example, a retail business may use time series forecasting to predict sales during specific seasons based on previous years’ sales data.

- Causal Forecasting: This type considers cause-and-effect relationships, utilizing regression analysis and econometric models. A manufacturing company might use causal forecasting to predict the impact of raw material price changes on production costs.

- Judgmental Forecasting relies on experts’ knowledge and insights, using techniques like the Delphi method and market surveys. For instance, an advertising agency may use judgmental forecasting to predict the success of a new marketing campaign based on feedback from industry experts.

Each forecasting method has its practical applications, and understanding their differences is essential for effective business decision-making and planning.

Why Might Forecasting Not Always Work?

Challenges You Might Face with Predictions

When it comes to forecasting, there are several challenges that you might face regardless of the method you use. Firstly, the accuracy of predictions is a common challenge. Forecasting methods often rely on historical data, but unforeseen events or changes in consumer behavior can significantly impact the accuracy of predictions. For example, a sudden shift in market trends or a new competitor entering the market can make previous data obsolete.

Secondly, another challenge is the complexity of managerial forecasting problems. As businesses expand and diversify, the forecasting process becomes increasingly intricate. Managers may struggle to choose the correct technique for a specific application. For instance, different forecasting methods are needed for predicting demand for products with seasonal fluctuations versus those with consistent year-round demand.

Finally, data limitations can also pose a challenge. Forecasting relies heavily on data, and incomplete or inaccurate data can lead to unreliable predictions. For instance, if historical data is not available for a specific product due to its recent introduction to the market, forecasting becomes more challenging.

Helpful Hints and Extra Tools for Forecasting

Cool Tricks and Tools for Forecasting Newbies

New Titles:

- Forecasting Basics.

- Forecasting Methods.

- Forecasting for Success

Forecasting is a crucial aspect of decision-making and planning. It provides estimates of future demand, sales, and other relevant factors.

There are three main types of forecasting: time series forecasting, causal forecasting, and judgmental forecasting.

Time series forecasting involves using historical data to predict future patterns, such as moving averages, exponential smoothing, and trend analysis. Companies can use moving averages to estimate future values based on past data trends.

Causal forecasting considers cause-and-effect relationships, utilizing regression analysis and econometric models. For instance, businesses can analyze the relationship between variables for revenue projection using simple linear regression.

Judgmental forecasting relies on subjective assessments and expert judgment, using techniques like Delphi and market surveys. This approach is useful in uncertain scenarios, allowing experts to provide valuable insights on future trends and demand.

Understanding these types of forecasting is essential for effective decision-making and planning. Accurate forecasting allows organizations to optimize their operations, reduce costs, and enhance customer satisfaction.

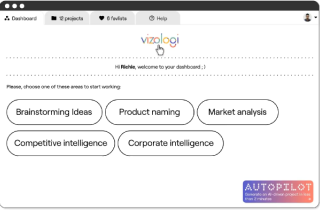

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.