Understanding ESG Models

ESG considerations are important in finance. They affect investment strategies. Financial firms must understand ESG factors. This helps them manage risks and find opportunities. Accurate ESG modeling includes data and analytical techniques. It helps firms make better investment decisions and meet regulations.

Overview of ESG Models

What is ESG Models?

ESG Models are strategies used in sustainable investment. They consider environmental, social, and governance factors in decision-making.

The goal is to align investment goals with values. This includes considering the impact on nature, waste reduction, energy efficiency, and emissions reduction.

ESG Models focus on improving interactions with the workforce and communities. This involves initiatives like occupational health, employee welfare, community engagement, and diversity and inclusion.

Additionally, these models emphasize ethical behavior, transparency, risk management, and stakeholder engagement.

By integrating ESG factors, firms can identify and mitigate risks effectively while finding value creation opportunities.

ESG Models are important for assessing financial performance, addressing risks, and promoting sustainable development in the financial industry.

To be effective, these models need various data sources, analytical techniques, and stakeholder engagement to align with organizational values.

Importance of ESG Models

ESG models are important in finance. They help investors match their values with their investments and reduce risks. These models consider environmental, social, and governance factors, guiding businesses to make sustainable choices. ESG factors help in identifying and managing risks related to climate change, social impact, and governance, creating stronger and responsible investment portfolios.

Businesses and investors benefit from ESG models by gaining insights into areas like waste reduction, energy efficiency, and climate risk mitigation. These models also focus on occupational health, employee welfare, and community engagement, improving overall performance and reputation.

Incorporating ESG factors promotes ethical behavior, better risk management, and stakeholder engagement. ESG models offer a framework for strategic decisions that prioritize sustainability and long-term value creation in today’s financial world.

Key Components of ESG Models

Environmental Factors

Environmental factors are important in ESG modeling. They include waste reduction, energy efficiency, water conservation, emissions reduction, green building design, climate risk mitigation, and biodiversity protection.

Financial services firms use these factors to align their investment strategies with sustainable values and manage risks effectively.

These factors have a significant impact on investment strategies and financial performance. Modeling them accurately helps firms identify and mitigate risks, such as divesting from high-risk assets and investing in resilient ones.

Considering environmental factors in operations helps businesses address challenges like climate change, reduce their carbon footprint, and ensure sustainable practices that align with investor values and regulatory requirements.

ESG models can help mitigate risks by integrating environmental considerations into decision-making processes. Firms can evaluate the potential impact of policies, climate change, and other environmental risks on their portfolios.

This approach helps firms manage risks effectively and identify opportunities for value creation in areas like renewable energy and sustainable practices.

Through comprehensive ESG modeling, financial services firms can make informed investment decisions that support long-term sustainability and financial performance.

Social Factors

Social factors are important in ESG models. They affect investment strategies, risk management, and sustainability.

When including ESG criteria in investments, social factors like health and safety, employee well-being, community involvement, and diversity matter.

These factors not only match investments with social beliefs but also help with long-term financial success. They build better relationships and enhance a company’s reputation.

By focusing on social factors, businesses can identify risks, improve efficiency, and grow sustainably.

Following the seven steps for integrating ESG into facility management processes can help firms create a strong ESG strategy and match their values.

Sustainable investing and highlighting social factors help firms deal with challenges like financial crises and industry changes better.

Governance Factors

Governance factors influence how companies make decisions, report on activities, and ensure ethical behavior in ESG models.

These factors are critical for aligning investment strategies with values and reducing risks in sustainable investment.

Incorporating governance factors into ESG modeling faces challenges due to the complexity and interrelated nature of ESG factors.

Challenges include the need to consider decision-making processes, ethics, risk management, and stakeholder engagement.

Integrating governance factors allows financial firms to understand ESG risks and opportunities, identify value creation, and meet regulatory requirements.

The seven steps for integrating ESG into facility management underline the importance of governance aspects such as transparency, accountability, and ethical conduct.

By promoting sustainable development and responsible stewardship, this approach supports resilient portfolios in the financial industry.

Collaboration among asset owners in sustainable finance can enhance its impact, mitigate financial risks, and address global crises like the COVID-19 pandemic and climate change.

Stewardship activities, data-driven decision-making, and monitoring portfolio impacts on the UN Sustainable Development Goals show a commitment to a sustainable future driven by ESG considerations.

Integration of ESG in Investment Strategies

Incorporating ESG Criteria

Incorporating ESG criteria into investment strategies can be broken down into seven steps.

-

Raise awareness among facility managers about the importance of ESG considerations.

-

Provide training on ESG principles and align them with organizational operations.

-

Deepen facility managers’ knowledge of the organization’s ESG goals.

-

Develop a strategy for implementation, identify key stakeholders, and set ESG-related goals.

-

Create an implementation plan with clear communication channels.

-

Access internal or external resources to successfully integrate ESG into operational processes.

-

Establish systems for data collection, analysis, and reporting as a key aspect of data management.

After developing a strategy, implement it by:

-

Applying new technologies.

-

Providing staff training.

-

Making operational changes.

Regular monitoring and evaluation are essential to ensure the ESG strategy meets its goals.

Accurate ESG modeling offers widespread benefits:

-

Identify and mitigate risks effectively.

-

Climate change impact modeling can prompt asset divestment and investment in resilient options.

-

Improve ESG performance by addressing reputational risks associated with poor labor practices.

-

Meet regulatory requirements and provide transparency to investors.

In today’s financial industry, integrating ESG considerations into modeling is increasingly important for sustainable investment and risk management. Financial firms must integrate ESG factors to enhance financial performance, align with sustainable development goals, and foster responsible asset management practices.

By following the seven steps outlined, companies can develop an effective ESG strategy prioritizing sustainability, risk mitigation, and stakeholder engagement. Expert guidance from individuals like Jeffrey Saunders, Dean Stanberry, and Colette Temmink is crucial for advancing sustainable investment practices and promoting stewardship activities across industries.

Impact on Financial Performance

Integrating ESG criteria into investment strategies positively impacts financial performance. Businesses that consider ESG factors can minimize their impact on nature, improve relationships with their workforce and the community, and prioritize ethical decision-making.

This approach helps in reducing risks and spotting value creation opportunities. ESG models assist firms in better identifying and managing risks related to waste, energy, emissions, and biodiversity. These factors are intertwined with financial risks like credit and market risks, underlining the importance of including ESG criteria in investments.

By focusing on ethical behavior, decision-making, and engaging stakeholders, ESG models improve portfolio evaluations. They are a critical part of sustainable investing in the finance industry today.

Risk Mitigation through ESG Models

ESG models play a crucial role in mitigating risks within investment strategies by incorporating environmental, social, and governance considerations. By integrating ESG criteria, financial firms can better understand and manage risks, reducing the potential impact of financial crises. This integration helps firms identify and address risks related to climate change, social issues, and governance practices, ultimately enhancing the resilience of investments during times of crisis.

Implementing ESG models involves a comprehensive process that includes waste reduction, energy efficiency, water conservation, emissions reduction, green building design, climate risk mitigation, and biodiversity protection.

Additionally, firms focus on areas such as occupant health, employee welfare, community engagement, diversity, and inclusion to ensure ethical behavior and stakeholder engagement. By following the seven steps recommended for integrating ESG considerations into operations and processes, organizations across industries can develop an effective ESG strategy that aligns with their values and priorities. This approach not only helps in identifying and mitigating risks but also uncovers opportunities for value creation, meeting regulatory requirements, and addressing sustainability challenges in today’s financial industry.

The collaboration between experts like Jeffrey Saunders, Dean Stanberry, and Colette Temmink highlights the importance of external assurance and the commitment tosustainable investing and stewardship activities in the sustainable finance market, combating green washing and promoting responsible financial practices.

ESG Models in Potential Financial Crisis

Resilience of ESG Investments

ESG investments are a good bet in uncertain times. They mix environmental, social, and governance factors in investment plans.

This approach focuses on things like cutting waste, using energy better, and connecting with communities. It helps in creating lasting value and lowering risks in investments.

Considering ESG factors doesn’t just limit the effects of climate change and boost sustainable practices. It also improves decision-making, ethical standards, and engaging stakeholders.

Experts like Jeffrey Saunders, Dean Stanberry, and Colette Temmink back this holistic investment method. They stress on weaving ESG considerations in every operation and step.

In today’s fast-changing finance world, companies see the upsides of blending ESG factors in their plans. It helps in dealing with issues like financial ups and downs, the COVID-19 hit, and shifting regulations.

By matching with sustainable goals, these firms promote openness and responsibility in managing assets. This paves the way for a bigger sustainable finance market.

Role of ESG in Sustainable Finance

ESG models are very important in sustainable finance. They align investment strategies with values and lessen risks by looking at environmental, social, and governance factors. These models help companies spot and lessen risks effectively for long-term value creation.

Financial firms can enhance their portfolios by divesting from high-risk assets and investing in stronger ones through accurate ESG modeling. Introducing ESG criteria in investment strategies not only helps in risk reduction but also in finding chances for value creation. This involves suggesting investments in growing sectors like renewable energy and identifying companies ready for a sustainable future.

Considering ESG factors is key for positive outcomes for both investors and the environment. This shows how sustainable finance practices matter and how ESG drives responsible investment decisions and sustainable development.

Role of Corporate Governance in ESG Models

Corporate governance has a big impact on ESG models in organizations.

Good governance helps companies set clear accountability, transparent reporting, and ethical decision-making.

This guides how ESG factors are integrated into operations, promoting sustainable investment and responsible business behavior.

Strong governance also boosts the reliability of ESG data and reporting, promoting trust with investors and the public.

Companies can align governance with ESG goals by:

-

Increasing awareness of ESG among managers.

-

Improving knowledge of ESG goals.

-

Allocating resources to ESG.

-

Creating a solid ESG strategy.

-

Effectively managing ESG data.

-

Implementing ESG initiatives widely.

-

Regularly monitoring ESG performance.

These steps help companies support their ESG objectives and drive sustainable development.

Challenges in ESG Modelling

Data Availability and Quality

Data availability plays a crucial role in shaping the quality of ESG models within the financial industry. Without access to reliable and comprehensive data, the accuracy and effectiveness of these models can be compromised. To ensure the quality of data used in ESG modeling, financial services firms must take proactive measures.

This includes incorporating a range of data sources and analytical techniques, such as using social media sentiment analysis to gauge public perception of sustainability efforts or scenario analysis to assess the impact of policy changes on company valuations.

Additionally, ongoing monitoring and analysis are essential to ensure that the data used is accurate and up-to-date. By addressing challenges related to data availability and quality in ESG modeling, firms can develop effective strategies, mitigate risks, identify opportunities for value creation, and meet regulatory requirements. The seven steps outlined by Jeffrey Saunders, Dean Stanberry, and Colette Temmink provide a structured approach for integrating ESG considerations into facility management operations and processes, emphasizing the importance of waste reduction, energy efficiency, water conservation, emissions reduction, green building design, climate risk mitigation, biodiversity protection, employee welfare, community engagement, diversity and inclusion, ethical behavior, risk management, and stakeholder engagement.

Portfolio Construction Considerations

When constructing a portfolio with ESG considerations in mind, it’s important to think about:

-

Waste reduction

-

Energy efficiency

-

Water conservation

-

Emissions reduction

-

Green building design

-

Climate risk mitigation

-

Biodiversity protection

These factors align investment strategies with sustainable goals and show a commitment to environmental and social responsibility.

Incorporating ESG criteria effectively means focusing on:

-

Occupational health

-

Employee welfare

-

Community engagement

-

Diversity and inclusion

By prioritizing these, investors can build portfolios that not only give financial returns but also benefit society and the environment.

Risk mitigation is crucial in ESG portfolio construction. Accurately modeling climate change impacts and other ESG risks helps to identify and handle risks effectively. Using various data sources and analysis techniques, financial firms can understand how ESG factors affect their portfolios, identifying risks and seizing value creation opportunities.

As ESG becomes more vital to investors, accurate modeling and risk mitigation strategies are essential for successful portfolio construction.

Future of ESG Models

Technological Advancements in ESG Analysis

Technological advancements in ESG analysis have changed how financial portfolios are evaluated. Businesses are integrating ESG considerations to tackle issues like waste reduction, energy efficiency, emissions reduction, and climate risk. These advancements also improve interactions with the workforce and community by focusing on occupational health, employee welfare, and diversity.

Technology helps organizations make ethical decisions, report transparently, and ensure ethical behavior through risk management. By following seven steps to integrate ESG into facility management, organizations can create an effective strategy aligned with their values. This contributes to sustainable development goals and the financial industry’s move towards universal ownership and sustainability.

Through responsible investing, asset owners track portfolios’ impacts on UN Sustainable Development Goals, promoting a transparent and sustainable finance market. The COVID-19 pandemic and climate change emphasize the significance of ESG factors in financial decisions, shaping portfolios and investment strategies for a more sustainable future.

Impact on Portfolio Evaluations

Incorporating ESG criteria is important for portfolios. It helps manage risks and improve financial performance.

ESG models are useful for identifying and minimizing risks. They also highlight opportunities for value creation.

By using ESG factors, firms can align their investment strategies with sustainable goals. This helps create stronger portfolios.

There are seven steps for integrating ESG into operations. These include awareness, knowledge, resources, and data management.

Following these steps helps organizations monitor and improve their ESG performance.

By incorporating ESG considerations, organizations can enhance financial performance. They also contribute to sustainable portfolios.

Jeffrey Saunders, Dean Stanberry, and Colette Temmink stress the benefits of accurate ESG modeling. This ensures strong stewardship in finance and promotes sustainable development.

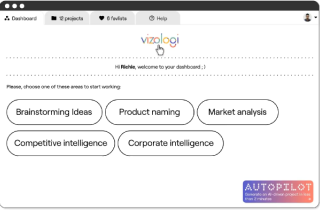

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.