Understanding a Risk Analysis Audit: Making It Simple

There’s a way to minimize risks in your business, protect your data, and safeguard your reputation. It’s called a Risk Analysis Audit.

This process helps you identify potential threats, assess their impact, and find effective solutions, simplifying a complex process.

This article aims to break down the complexities of a Risk Analysis Audit in simple terms, providing a clear understanding of its importance and how it can benefit your business.

What is a Risk Analysis Audit?

The Basics of Looking at Risk

A risk analysis audit involves evaluating potential hazards. It also includes assessing the likelihood and potential impact of those risks, identifying vulnerabilities, and determining the effectiveness of existing risk controls.

One way to make sense of the results is to use a risk matrix. This categorizes risks based on their likelihood and severity, helping prioritize which risks need to be addressed first and allocate resources effectively.

To identify dangers and figure out what might go wrong, it’s important to conduct a thorough brainstorming session with key stakeholders. Additionally, conducting a SWOT analysis can help in identifying potential dangers and areas of concern.

Important Reasons for Risk Analysis Audits

A risk analysis audit is important. It helps identify potential risks and hazards in various areas like workplace safety, cybersecurity, financial investments, and healthcare services. Organizations conduct these audits to assess potential dangers, prevent incidents, minimize losses, and ensure safety and security.

For instance, in healthcare, a risk analysis audit can identify potential medical errors, security breaches, and patient safety concerns. In cybersecurity, it helps uncover vulnerabilities in digital systems and data protection. In financial services, it identifies potential fraud, market risks, and compliance issues.

Key Steps in a Risk Analysis Audit

Identify the Dangers

Potential dangers or risks that could be identified in a risk analysis audit are:

- Cybersecurity threats

- Workplace accidents

- Supply chain disruptions

- Financial vulnerabilities

Organizations can effectively identify and assess these potential hazards through a risk analysis audit. This can be done by:

- Conducting thorough surveys

- Analyzing historical data

- Consulting with subject matter experts

The key steps in determining what actions to take in response to the dangers identified include:

- Prioritizing the identified risks based on their potential impact

- Developing mitigation strategies

- Implementing preventive measures

Figure Out What Might Go Wrong

Potential dangers or risks in a risk analysis audit include financial losses, data breaches, project delays, and regulatory non-compliance. To figure out what might go wrong, interviews with stakeholders, reviewing historical data, and using risk management tools are important.

Once potential risks are identified, steps should be taken to decide what to do. This includes prioritizing risks based on their impact and likelihood, developing risk response plans, and regularly monitoring and reviewing the effectiveness of risk management strategies.

For example, in the financial industry, potential risks may involve market volatility and regulatory changes. This leads to the need for scenario planning and stress testing to prepare for potential adverse outcomes.

Decide What to Do About It

After identifying potential risks through a risk analysis audit, an organization can decide on the best course of action. This is done by carefully evaluating the likelihood and impact of each risk. Then, they prioritize them based on their severity and develop a comprehensive plan to address and mitigate them.

Effective strategies for addressing and mitigating the dangers and potential issues include:

- Implementing contingency plans

- Investing in risk management tools and technologies

- Training employees on risk awareness and management

- Regularly monitoring and reassessing risks

Businesses and organizations can benefit from the results of a risk analysis audit. This can help in terms of safety and cost savings by proactively preventing potential incidents that could harm employees, customers, or finances. By identifying and addressing risks early on, they can avoid costly damages, lawsuits, and disruptions to their operations. This ultimately leads to improved safety and financial stability.

Tools for Risk Analysis Audits

Charts and Software That Help

Charts and software help with risk analysis audits. They include statistical process control (SPC) charts, control charts, and Monte Carlo simulations.

Experts can provide training and guidance on interpreting and analyzing the data in these tools. Risk analysis audits are used in financial planning, project management, and quality control.

In financial planning, these tools can help identify risks in investment portfolios. In project management, they aid in forecasting potential schedule delays or budget overruns.

For quality control, they monitor and analyze product or service defects.

By using these charts and software, experts can identify potential risks and develop strategies to mitigate them.

Ask the Experts for Help

Risk analysis audits are used in finance, healthcare, and information technology industries. The results help identify potential threats, vulnerabilities, and their impact on the business. Tools like risk assessment software, data analytics, and business impact analysis are available for these audits.

It’s good to seek expert advice when dealing with complex business processes, new technology adoption, or changes in regulatory requirements. Expert assistance is also recommended when the organization lacks experienced personnel in risk management or when incorporating advanced risk analysis methodologies.

Common Areas Where Risk Analysis Audits are Used

Banks and Money Stuff

A Risk Analysis Audit evaluates a company’s financial situation to find potential risks. It looks at financial statements, business operations, and market conditions to predict future financial loss.

Companies analyze the results using statistical methods to prioritize and address the most significant threats to their financial stability. They also compare their performance against industry standards to find areas for improvement.

Risk Analysis Audits are commonly used in banking, insurance, investment firms, and healthcare. They are crucial for assessing financial health and identifying potential risks that could impact their operations.

Building Stuff and Safety

A Risk Analysis Audit is a systematic process for evaluating potential risks, identifying hazards, and implementing control measures to prevent accidents and injuries.

It helps organizations identify and assess potential risks, prioritize safety measures, and comply with safety regulations.

The key steps include identifying hazards, assessing the risks associated with each hazard, implementing control measures to mitigate the risks, and evaluating the effectiveness of the control measures.

The results can enhance safety measures by providing valuable insights into potential risks, informing the development of safety procedures, and guiding the allocation of resources for safety improvements.

For example, a manufacturing facility may use the results to implement machine guarding, develop lockout/tagout procedures, and provide training for employees on hazard recognition and control.

Computers and Keeping Information Safe

A Risk Analysis Audit is an assessment to find potential risks and vulnerabilities in computer systems and information security. It helps to understand threats to sensitive information and implement preventive measures.

The key steps include identifying assets and information to protect, assessing threats and vulnerabilities, quantifying potential impact, and prioritizing measures to address risks.

Results can be used to create a plan for keeping information safe, identifying areas for improvement, outlining necessary security measures, and allocating resources. This plan can enhance the overall security posture of the organization.

How to Make Sense of the Results from a Risk Analysis Audit

Reading the Report Right

A Risk Analysis Audit is important because it helps a company identify and evaluate potential risks. These risks could impact their operations, financial health, or reputation. It also allows for the development of strategies to mitigate these risks.

Key steps involved in conducting a Risk Analysis Audit include:

- Identifying potential risks

- Assessing the impact of these risks

- Developing a risk management plan

Tools and resources that can be used to perform a Risk Analysis Audit effectively include:

- Risk assessment software

- Financial data analysis tools

- Industry reports

- Expert consultations

Using these tools and resources is important to gather relevant data and information for a comprehensive risk analysis.

Making a Plan to Keep Safe

Identifying potential dangers and risks is important. This can be achieved by conducting a risk analysis audit. The audit involves identifying, assessing, and prioritizing potential risks. Various techniques such as brainstorming, interviews, and checklists can be used to identify potential dangers. After the audit, creating action plans to mitigate or eliminate risks, setting deadlines, and allocating resources is crucial.

Risk analysis audits can be used in industries like healthcare, finance, and manufacturing. For instance, in healthcare, audits can identify patient safety risks, and in manufacturing, they can identify hazards in the workplace.

Real-Life Success Stories of Risk Analysis Audits

Businesses That Stayed Safe

A Risk Analysis Audit assesses potential risks and vulnerabilities within a business. It helps to identify and prioritize potential threats and provides a roadmap to mitigate those risks.

Businesses need to understand where their weaknesses lie and take proactive steps to address them in order to minimize potential damage. Once the results are in, businesses can use this information to implement necessary controls and safeguards to protect their assets, both digital and physical.

This may involve updating security protocols, training employees on best practices, or implementing new technology solutions. Several businesses have successfully prevented major security breaches by conducting regular Risk Analysis Audits.

For example, a large financial institution avoided a potential data leak by identifying and fixing a vulnerability in their digital infrastructure. Likewise, a small retail business prevented a cyber-attack by strengthening their network security following an audit.

These real-life examples demonstrate the effectiveness of Risk Analysis Audits in keeping businesses safe from potential threats.

How Risk Analysis Saved Money

Risk analysis helps businesses save money. It identifies potential risks and finds cost-effective solutions. For example, a company did a risk analysis and found a supply chain issue. They then set up backup suppliers, avoiding costly delays.

Key steps in risk analysis include identifying potential risks, evaluating them, and developing strategies to deal with them. This is used in areas like cybersecurity, financial planning, and project management.

By carefully analyzing risks, businesses can save money by addressing issues before they become costly problems.

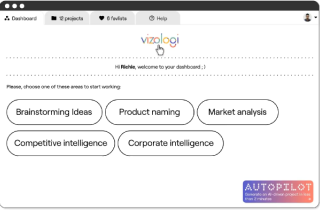

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.