Understanding the Role of Business Plan Assumptions in Success

Business plans are the strategic blueprints for entrepreneurs and business proprietors, forming the basis for a successful venture. However, the underlying building blocks of these plans—the assumptions—are often neglected. These inferences, drawn based on market trends, consumer behaviour, and financial forecasts, play a pivotal role in determining a business’s feasibility.

Comprehending and analyzing these assumptions becomes a crucial part of strategic planning, equipping entrepreneurs to make informed decisions and boosting their probability of accomplishing their goals.

Grasping Frequent Usage of Business Plan Assumptions

Financial assumptions serve as the foundation for a foolproof business plan. They assist in estimating costs, revenue, return on investment, and expenses. To maintain credibility, it is vital to make accurate and realistic assumptions. It’s advisable to formulate conservative assumptions to exhibit operational stability and reliability. These assumptions should be rooted in real outcomes, industry standards, and personal experience.

It is crucial to include cash flow suppositions in the balance sheet and explain them in the notes to the financial statements. Sensitivity analysis lets us gauge the impact of diverse scenarios.

Illustration of Assumptions Usage

Financial assumptions are a fundamental element of a well-prepared business plan. These assumptions help predict revenue, costs, return on investment, and expenses. It is vital to ensure that the assumptions are precise and align with the evidence provided in the business plan. Formulating prudent assumptions is preferable for maintaining credibility with investors. They need to be based on actual outcomes or industry standards.

It’s essential to include cash flow projections on the balance sheet and clarify the usage of funds. To explain your assumptions, the notes to financial statements should provide detailed analysis. Using spreadsheet programs like Microsoft Excel for data analysis, such as how to categorize data in excel, can prove beneficial. Adequately communicating these financial assumptions is a sign of a well-structured business plan.

Delving into Financial Assumptions in a Business Plan

Value of Financial Assumptions in Plan Development

Financial assumptions form the backbone of business plan development. They guide the calculation of costs, revenue, return on investment, and expenses. Accurate and realistic assumptions help a business plan demonstrate reliability and operational experience to potential investors. The basis for these predictions should be actual outcomes from the company or industry standards, and historical data and personal expertise should corroborate them.

Sensitivity analysis can reveal how different scenarios could affect these assumptions. To maintain transparency, it is recommended that the financial assumptions be enumerated separately or incorporated within the business narrative.

Contrasting Financial Assumptions with Projections

Financial assumptions are a fundamental component in a meticulously composed business plan. They guide in estimating costs, revenue, ROI, and expenses. For credibility, it is crucial to ensure that assumptions align accurately with the data displayed in the plan. Prudent suppositions are recommended to establish trust with financiers. These predictions should be rooted in real experiences of your firm or other industry standards, including all cash flows.

Using spreadsheet software like Microsoft Excel, historical pointers, industry benchmarks, and personal knowledge, you can prepare precise financial assumptions. Performing a sensitivity analysis helps you grasp the effect of different situations, thereby enhancing the plan’s efficiency. Communicating financial assumptions is integral to a triumphant business plan.

Examining Key Assumptions for Various Financial Statements

Income Statement Assumptions

Financial assumptions play a central role in formulating a comprehensive business plan. They help predict costs, revenue, return on investment, and expenses. These assumptions should match the data presented in the plan. To uphold credibility, it’s advisable to take a conservative approach when presenting assumptions. Demonstration of practical assumptions can strengthen the trust of potential investors.

It’s critical to base assumptions on real scenarios from your own company or industry standards. Tools like Microsoft Excel can simplify the calculation and presentation of financial suppositions, and sensitivity analysis can reveal the impact of variable scenarios.

Balance Sheet Assumptions

Financial assumptions are vital to a business plan, offering direction for revenue projections, cost forecasts, and return calculations. These assumptions should parallel the information in the plan to ensure credibility. Adopting conservative suppositions illustrates operational stability and helps foster investor confidence. Inferences should ideally stem from your company’s history or industry standards, supported by past data and individual expertise.

Software like Microsoft Excel efficiently organizes and displays these suppositions. Explicit communication of these assumptions can effectively convey the company’s financial strategy and outlook.

Cash Flow Statement Assumptions

Financial suppositions are an integral part of a well-curated business plan. They aid in predicting costs, revenue, return on investment, and expenses. Ensuring we use conservative assumptions based on factual data from your firm or industry standards is critical in maintaining investor trust. Realistic assumptions about potential operations underpin the financial sections of a business plan.

Considering software tools for preparing your assumptions and sensitivity analysis for examining various situations can be beneficial in achieving a well-rounded business plan.

Notes on Assumptions for Financial Statements

Financial assumptions are pivotal in composing a robust business plan. They are a roadmap for predicting revenue, costs, return on investment, and expenses. The authenticity of assumptions and their alignment with the business plan data can maintain credibility. Prudent assumptions portray operational stability and trustworthiness. These assumptions should be rooted in your company’s experience or those of others in the same sector.

Software programs like Microsoft Excel can simplify the task of preparing financial predictions. Sensitivity analysis lets you explore the impact of varying situations.

Identifying Assumptions Crucial in Developing a Financial Model

Financial assumptions form the cornerstone of a meticulously crafted business plan, offering directions for revenue and cost forecasts, return on investment, and expenses. Assumptions need to mirror the information outlined in the plan accurately. Conservative suppositions are advisable to sustain credibility. Realistic assumptions are central to the financial portion of a firm’s business plan, as scrutiny from investors is common.

Relying on actual results from market analogues or similar organizations is optimal. Assumptions about the flow of money into and out of the organization should feature in balance sheet-related data, while cash flow assumptions should highlight areas of expenditure. Employing spreadsheet applications for accurate assumption management and analysis is advisable. The notes to financial statements should offer insight into the reasoning behind assumptions. Sensitivity analysis can elucidate the influence of diverse circumstances.

Effective assumption communication within the narrative or a dedicated financial section contributes significantly to an accomplished business plan.

Steps to Prepare Your Business Financial Assumptions

Examining Current Financials

Financial assumptions offer the blueprints needed to forecast various facets of a business plan, such as costs, revenue, ROI, and expenses. Ensuring the credibility and accuracy of these suppositions is imperative. They should be derived from empirical data from your organization or industry standards. Customer trust is maintained when balance sheet inclusions cover all aspects of cash flow, and there is a clear outline of fund utilization.

Using applications like Microsoft Excel and offering detailed explanations in the notes to financial statements, you can conveniently communicate the fiscal details of your business plan.

Establishing Financial Assumptions

Financial suppositions provide a roadmap for forecasting the economy of a business plan, like costs, revenue, ROI, and expenses. Accuracy and reflection of the business plan information are integral to building credible suppositions. It’s essential to portray realistically calculated assumptions in the financial section of a business plan to establish investor trust; these should be based on your own company experience or industry benchmarks, including both types of cash flows.

Spreadsheet software can help prepare these assumptions accurately, and sensitivity analysis can elucidate the outcome of diverse scenarios. The key to success is ensuring effective communication of financial assumptions within the narrative or financial section of the plan.

Projecting Cash Flow Statement and Balance Sheet

Financial assumptions lay the groundwork for well-crafted business plans, serving as guides to calculate costs, revenue, ROI, and expenses. Assumptions need to be both precise and credible in their formulation. All cash flows should be featured on the balance sheet, while expenditures must be highlighted in the cash flow statements. Detailed explanations of these suppositions in the notes to financial statements are also necessary.

Leveraging tools like Microsoft Excel for analysis and sensitivity evaluation can boost the reliability of your financial assumptions. Concise communication of these assumptions is essential to a comprehensive business plan.

Visualizing Future Financials

Financial assumptions form an essential part of a detailed business plan. These predictions aid in estimating costs, revenue, ROI, and expenses. By offering conservative assumptions, businesses can uphold investor credibility. Suppositions should ideally stem from your company’s history or industry standards, backed by past data and personal expertise.

Utilizing bullet points or a separate financial section can enhance understanding of these financial assumptions, depict operational maturity, and boost reliability.

Conducting Calculations for Assumptions

Financial suppositions form the bedrock of a well-composed business plan, guiding the forecast of costs, revenue, ROI, and expenses. Ensuring these assumptions align with the information in the plan maintains investor trust. It is recommended to base assumptions on your company’s performance or industry standards. A detailed cash flow model and accurate financial statement notes help demonstrate fund allocation.

Spreadsheet programs and sensitivity analysis can help fine-tune the prediction of these assumptions.

Performing Sensitivity Analysis

Sensitivity analysis is a crucial step in developing a business plan. By observing the effects of different scenarios, businesses can dig deeper into the possible risks and uncertainties tied to their assumptions. Take a tech startup analyzing the effect of varying market penetration levels or customer acquisition costs on their revenue projections. Sensitivity analysis allows ventures to evaluate the feasibility of their business model and make more knowledgeable decisions.

These analyses help businesses spot potential challenges and adjust their blueprints accordingly, guaranteeing more trustworthy and pragmatic business plans.

Highlighting Section Offers

Financial suppositions are crucial to a well-composed business plan. They provide a basis for forecasting costs, revenue, ROI, and expenses. To fortify investor credibility, assumptions should be rooted in personal company experience and industry standards. Detailed cash flow assumptions and prescriptive financial statement notes showcase potential fund utilization. Sensitivity analysis enhances the understanding of diverse scenarios.

To achieve a successful business plan, it’s recommended to use a spreadsheet program for proper financial management and include these assumptions in the narrative or a dedicated financial section.

Summarizing Financial Aspects

In any well-constructed business plan, the role of financial assumptions is pivotal. These suppositions guide cost and revenue estimates, return on investment, and expense forecasts. Accuracy and realism in these predictions are essential to maintain credibility. Investors often scrutinize the financial section of a business plan – hence, it’s advisable to use realistic assumptions. Basing predictions on your own company records or industry standards ensures significant credibility.

Clarity can be achieved by including cash flow predictions and detailed explanations in the financial statements. Software like Microsoft Excel can be used to manage these assumptions.

Finally, ensuring lucid communication of the financial suppositions forms a significant part of a successful business plan.

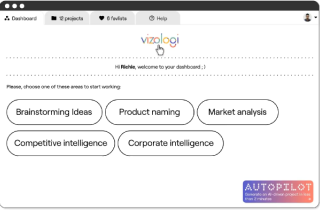

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.