What Is a Joint Venture? Know the Basics

A joint venture is a business strategy where two or more companies work together on a specific project or goal. In this arrangement, each company shares the cost, risk, and rewards. It’s a way for businesses to combine their strengths and resources to achieve something they might not be able to do on their own. If you want to learn more about joint ventures and how they work, keep reading to discover the basics of this business partnership.

Defining a Joint Venture (JV)

Establishing a joint venture has important reasons. These include accessing new markets and resources, enhancing product development, expanding businesses, and benefiting from technological expertise or business practices.

The procedure to create a joint venture involves drafting a clear agreement. This agreement outlines the roles, responsibilities, and goals of each party, as well as the investment and profit proportions, and accounting.

The advantages of joint ventures include sharing financial and operational risks, knowledge, experience, and resources. But there are also challenges, like giving up control, potential cultural and management differences, legal obligations, and planning exit strategies.

Reasons for Establishing a Joint Venture

Resource Sharing and Synergy

Resource sharing and synergy are important for the success of a joint venture. When businesses combine their resources like capital, labor, and expertise, they can work together on specific projects. This leads to shared investments, reduced costs, and lower risks, which can strengthen the financial foundation of the joint venture.

Additionally, a joint venture allows partners to leverage their specialized knowledge. They can tap into each other’s expertise, experience, and know-how. This is especially helpful when entering foreign markets or expanding products and markets. For instance, if two businesses specialize in different areas like manufacturing and technology, joining forces can bring collective innovation and resources. This opens new market opportunities and benefits both parties.

Cost Reduction and Risk Sharing

A joint venture (JV) helps companies save money and spread out risks. They do this by sharing investments, costs, and expertise. When companies work together, they can improve their operations and use their strengths to reach common goals. This reduces expenses and lowers risks for a specific project or business activity.

But before getting into a JV, companies need to think about the financial impact. This includes taxes and how to leave the venture. JVs can bring in money and intellectual property, as well as make it harder for other companies to compete. But they also bring challenges, like liability and potential losses.

Tax rules for JVs are different than for other business setups, so companies have to think carefully about this. They should also think about how to leave the venture and what taxes they might owe. This helps to lower potential financial problems and make sure their interests are safe.

Amalgamation of Specialized Knowledge

Specialized knowledge is important for a joint venture. It helps partners access a wider knowledge base, cut costs, and use resources efficiently. This leads to combined expertise, shared risks, and synergy, creating new opportunities for market expansion, revenue, and intellectual property gains.

However, challenges and risks can be managed with careful planning, a good agreement, shared vision and commitment, and an exit strategy for ending the venture when objectives are met or due to economic policy changes.

Expansion into Global Markets

A joint venture is when two or more businesses work together on specific projects or activities.

Benefits of joint ventures include shared resources and expertise, access to new markets, revenue streams, and improved credibility.

However, there are also risks such as economic changes and challenges.

Joint ventures can provide opportunities to access new markets and governmental documents, tap into domestic partners’ knowledge, and leverage their position in the industry.

Expanding globally through a joint venture requires careful consideration, including developing a strong agreement covering core objectives and responsibilities, and accounting and tax implications.

Potential benefits and risks should be balanced, considering factors like loss of control, cultural differences, and conflict resolution.

Formation Procedures of a Joint Venture

Drafting a Shareholders’ Agreement

When creating a shareholders’ agreement for a joint venture, it’s important to include:

- Objectives, scope, structure, and management of the joint venture

- Ownership interests of the parties involved

- Capital contributions, profit and loss sharing

- Decision-making processes and dispute resolution mechanisms

- Allocation of resources and responsibilities

- Confidentiality and non-compete clauses

Consider the legal framework including laws governing joint ventures, corporate governance, contracts, competition, employment, and intellectual property rights. International tax laws and trade regulations may also be relevant for joint ventures involving foreign entities.

Exit strategies and dissolution in the shareholders’ agreement should cover:

- Circumstances for termination

- Distribution of assets and liabilities

- Procedure for dispute resolution

- Post-termination restrictions

Understanding the Legal Framework

Understanding the legal framework is important for establishing a joint venture. It makes sure that parties follow the laws and regulations that govern business arrangements.

Legal procedures like business licensing, contracts, and asset transfers must be considered when forming a joint venture. This helps prevent legal disputes, protect intellectual property, and assign responsibilities.

Taxation obligations and exit strategies impact the financial aspects of a joint venture. They determine financial liabilities, tax implications, and the financial implications of ending the joint venture.

Knowing these legal nuances, business processes, and tax laws is necessary for the success of the joint venture.

Comparative Analysis: Joint Ventures vs. Other Business Partnerships

Distinct Features of a JV Compared to Partnerships

Joint ventures are different from traditional partnerships. They are created for a single project and are separate from the partners’ other business interests.

Partners use joint ventures to share resources, cut costs, combine expertise, and enter foreign markets.

In various global jurisdictions, joint ventures are commonly used to enter foreign markets. Foreign entities form joint ventures with domestic ones, leveraging business relationships and required government documents.

Joint Ventures in Different Global Jurisdictions

Joint ventures (JVs) need to follow legal and regulatory rules in different parts of the world. This includes figuring out the JV’s structure, power distribution, profit sharing, and liability to meet local laws.

Cultural differences and business practices also matter in JVs in different places. These can affect decision-making, communication, and problem-solving, so everyone involved should understand them well.

Also, tax and financial factors are important in operating a JV globally. Differences in tax laws, reporting, and currency changes can really affect how well the JV does, so it needs smart financial planning.

China

China has a big market and a growing economy, making it an appealing location for joint ventures. The country’s strategic geographic location also provides access to other Asian markets, which is great for expanding business. Government policies and incentives for foreign investment in China make it a favorable environment for joint ventures.

Laws in China play a big role in how joint ventures are formed and operated. Understanding the legal requirements, like licensing, protecting intellectual property, and labor laws, is important for a successful joint venture in China.

There are cultural and business challenges when starting a joint venture in China. Language barriers, different business practices, and management styles can be obstacles. To overcome these challenges, cultural sensitivity and understanding the local business environment are crucial for the joint venture to succeed in China.

India

Setting up a joint venture in India has many advantages. It allows for shared investment, new market access, and synergies. There’s also the benefit of local expertise, barriers to competition, economies of scale, and improved credibility.

However, it also comes with challenges and risks. These include cultural differences, management conflicts, and potential difficulties in dissolving the venture. Additionally, regulatory compliance, intellectual property protection, resource sharing, and misaligned business objectives can be significant obstacles.

Ukraine

A joint venture in Ukraine has many benefits, like shared investment and expertise, new market opportunities, and synergy. There are also tax obligations, including corporate income tax, personal income tax, value-added tax (VAT), and excise duty.

Businesses should consider the risks of giving up control, cultural differences, and the need for a well-drafted agreement and tax implications when establishing a JV.

Dissolving a JV can be challenging and may require a thorough exit strategy.

Analyzing the Advantages and Challenges of a Joint Venture

Benefits: Top Advantages of Initiating a JV

Joint ventures have many advantages for businesses:

- Shared investment, expertise, and resources

- Increased credibility and potential barriers to competition

- Opportunities to enter new markets, create additional revenue streams, and gain intellectual property benefits

- Resource sharing and cost reduction

- Combining expertise and resources to reduce expenses and risks

- Access to specialized knowledge and experience

- Expansion into global markets through collaboration, synergy, and leveraging strengths and networks

- Improved economies of scale, making companies less vulnerable to economic swings and other external factors

Challenges: Risks and Considerations of a JV

Forming a joint venture comes with potential risks. These include giving up control, managing cultural and management differences, tax implications, and potential liability.

Before starting a joint venture, companies should carefully assess their reasons for doing so and how well they align with the other party. They should also consider market conditions and how it will impact their existing operations.

When weighing the pros and cons of a joint venture, companies need to consider risk sharing, gaining a broader knowledge base, tax implications, cultural and management differences, liability, and restrictions on outside activities.

It’s crucial to have a well-crafted agreement and an exit strategy. The decision to form a joint venture should thoroughly consider both strategic and operational factors.

The Financial Aspects of a Joint Venture

Taxation Obligations for a JV

Tax obligations for a joint venture can be complex because a JV isn’t a separate legal entity, it’s created for a specific purpose or project. Each party is responsible for their share of the JV’s tax burden and must report the JV’s income, expenses, and other taxes on their individual tax returns. The tax implications for JV participants depend on the JV’s nature, activities, business structure, operations, and geographical locations.

Unlike partnerships and corporations, JVs have different tax obligations because they are used for limited-term projects with profit sharing and risk allocation without forming a separate business entity. This means the tax considerations for JVs may differ from other business partnerships as there are no distinct entity-level tax obligations.

Exit Strategies and Dissolution of a JV

Joint ventures typically have common exit strategies. These may include acquisition, initial public offering, and liquidation. Factors such as market conditions, partner objectives, and applicable laws can influence the choice of strategy.

When planning to dissolve a joint venture, it’s important to consider legal and financial implications. This includes tax obligations, intellectual property rights, debt liabilities, and employee redundancies.

To ensure a smooth and amicable dissolution process, the involved parties should have a well-defined exit clause in the joint venture agreement. They should also conduct an overall business assessment, agree on post-termination obligations, and seek legal and financial advice for disentangling assets and liabilities.

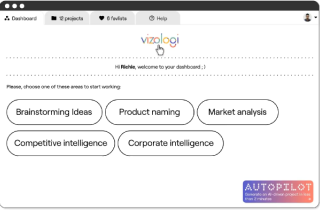

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.