Why Capital One Financial's Business Model is so successful?

Get all the answers

Capital One Financial’s Company Overview

Capital One Financial Corporation, founded in 1994, is a pioneering force in the financial services industry, specializing in offering a diverse range of products and services to consumers, small businesses, and commercial clients. Through its extensive network of branches and a robust online presence at www.capitalone.com, the company strives to simplify banking, making it more accessible and user-friendly. Capital One’s mission is to help customers succeed by bringing humanity, ingenuity, and simplicity to banking. Their product line is divided into three primary segments: Credit Card, Consumer Banking, and Commercial Banking. The Credit Card segment caters to both domestic and international markets, offering innovative credit solutions for consumers and small businesses in the United States, Canada, and the United Kingdom. Consumer Banking provides a full suite of deposit and loan products, including auto loans and mortgage services. Meanwhile, the Commercial Banking segment delivers tailored lending, deposit, and treasury management services to commercial real estate, middle-market companies, and industrial clients.

Capital One stands out in the financial sector with its data-driven, technology-first approach, revolutionizing the traditional banking model. By leveraging advanced analytics and machine learning, Capital One delivers personalized experiences to its customers, ensuring tailored financial solutions that meet individual and business needs. The company’s commitment to security and innovation is evident in its robust digital banking platform, which offers users the convenience of managing their finances online or via mobile applications. This model not only enhances customer satisfaction and engagement but also allows for streamlined operations and cost-effective service delivery. Capital One's comprehensive approach to banking integrates cutting-edge technology with customer-focused service, distinguishing it as a leader in the financial services industry.

Capital One’s revenue model is multifaceted, ensuring a diverse and stable income stream. The company primarily earns through interest and fees on credit cards, which remains a significant revenue generator. In addition, it accrues income from its extensive array of consumer banking products, such as deposits, auto loans, and mortgage services, where interest and service fees play essential roles. The Commercial Banking segment contributes through various lending programs, deposit gathering, and treasury management services, further diversifying the company's revenue streams. Capital One's strategic blend of interest income, service fees, and innovative financial solutions enables it to maintain a strong financial foothold while continuing to invest in technology and customer service enhancements.

Headquater: Richmond, Virginia, US

Foundations date: 1988

Company Type: Public

Sector: Financials

Category: Financial Services

Digital Maturity: Beginner

Capital One Financial’s Related Competitors

Intesa Sanpaolo Business Model

Banco Bilbao Vizcaya Argentaria Business Model

Banco do Brasil Business Model

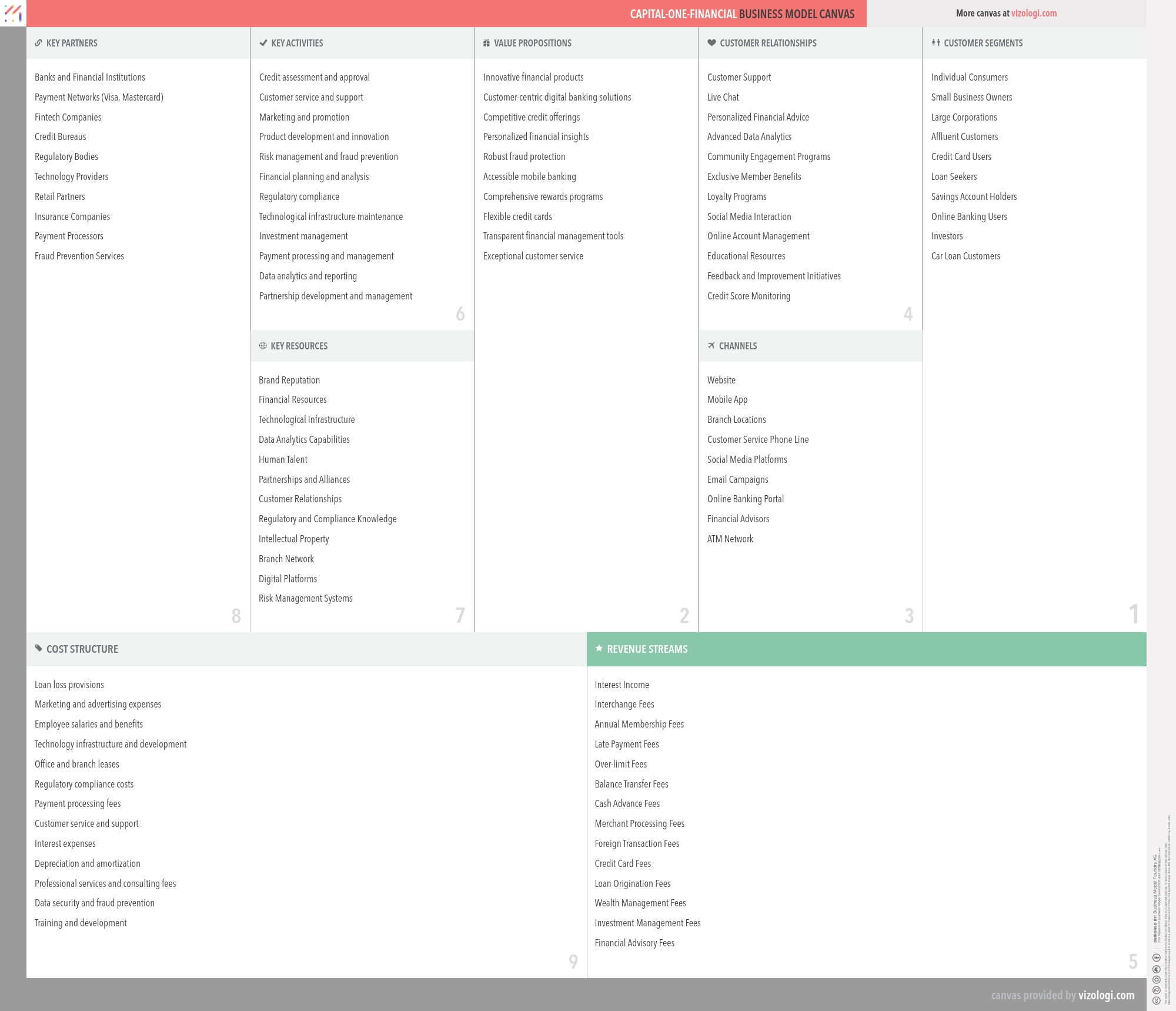

Capital One Financial’s Business Model Canvas

- Banks and Financial Institutions

- Payment Networks (Visa, Mastercard)

- Fintech Companies

- Credit Bureaus

- Regulatory Bodies

- Technology Providers

- Retail Partners

- Insurance Companies

- Payment Processors

- Fraud Prevention Services

- Credit assessment and approval

- Customer service and support

- Marketing and promotion

- Product development and innovation

- Risk management and fraud prevention

- Financial planning and analysis

- Regulatory compliance

- Technological infrastructure maintenance

- Investment management

- Payment processing and management

- Data analytics and reporting

- Partnership development and management

- Brand Reputation

- Financial Resources

- Technological Infrastructure

- Data Analytics Capabilities

- Human Talent

- Partnerships and Alliances

- Customer Relationships

- Regulatory and Compliance Knowledge

- Intellectual Property

- Branch Network

- Digital Platforms

- Risk Management Systems

- Innovative financial products

- Customer-centric digital banking solutions

- Competitive credit offerings

- Personalized financial insights

- Robust fraud protection

- Accessible mobile banking

- Comprehensive rewards programs

- Flexible credit cards

- Transparent financial management tools

- Exceptional customer service

- Customer Support

- Live Chat

- Personalized Financial Advice

- Advanced Data Analytics

- Community Engagement Programs

- Exclusive Member Benefits

- Loyalty Programs

- Social Media Interaction

- Online Account Management

- Educational Resources

- Feedback and Improvement Initiatives

- Credit Score Monitoring

- Individual Consumers

- Small Business Owners

- Large Corporations

- Affluent Customers

- Credit Card Users

- Loan Seekers

- Savings Account Holders

- Online Banking Users

- Investors

- Car Loan Customers

- Website

- Mobile App

- Branch Locations

- Customer Service Phone Line

- Social Media Platforms

- Email Campaigns

- Online Banking Portal

- Financial Advisors

- ATM Network

- Loan loss provisions

- Marketing and advertising expenses

- Employee salaries and benefits

- Technology infrastructure and development

- Office and branch leases

- Regulatory compliance costs

- Payment processing fees

- Customer service and support

- Interest expenses

- Depreciation and amortization

- Professional services and consulting fees

- Data security and fraud prevention

- Training and development

- Interest Income

- Interchange Fees

- Annual Membership Fees

- Late Payment Fees

- Over-limit Fees

- Balance Transfer Fees

- Cash Advance Fees

- Merchant Processing Fees

- Foreign Transaction Fees

- Credit Card Fees

- Loan Origination Fees

- Wealth Management Fees

- Investment Management Fees

- Financial Advisory Fees

Vizologi

A generative AI business strategy tool to create business plans in 1 minute

FREE 7 days trial ‐ Get started in seconds

Try it freeCapital One Financial’s Revenue Model

Capital One Financial makes money by combining different business models. Below, you will find the list of the different monetization strategies identified for this company:

- Cash machine

- Cross-selling

- Customer loyalty

- Best in class services

- Customer relationship

- Private level banking

- Credits

- Discount club

- Brokerage

- Self-service

- Lock-in

Capital One Financial’s Case Study

Capital One Financial's CASE STUDY

As we delve into the intricate mechanisms behind Capital One Financial's operation, it’s crucial to recognize what sets this company apart in the financial services industry. Founded in 1994, Capital One Financial Corporation has defied traditional banking paradigms, reinventing service delivery by leveraging data analytics and technology. Our exploration into Capital One’s unique strategies and their implementations will illuminate the elements that make the company a beacon of innovation and customer-centricity.

Foundations and Beginnings

When we think of Capital One, several attributes come to mind: innovation, customer service excellence, and robust risk management. These qualities are not incidental but are the results of deliberate strategic decisions made since its inception. Established with a mission to simplify banking and enhance customer success, Capital One began as a monoline credit card company. This focus on a single product segment initially allowed Capital One to fine-tune its expertise and develop sophisticated risk assessment models.

The company’s roots in credit card issuance set the tone for its future endeavors. By 1996, just two years post-foundation, Capital One had already bagged a $5 billion IPO. This early achievement marked the beginning of what would be decades of innovative growth and expansion into various financial segments, including consumer banking and commercial banking.

Data-Driven Innovation

Arguably, the most significant factor differentiating Capital One from its competitors is its dedication to a data-driven approach. Capital One was among the first in the industry to embrace data analytics and machine learning, transforming how it interacted with customers and managed risks. According to a 2022 report from McKinsey, businesses leveraging data and analytics in decision-making processes are 19 times more likely to achieve above-average profitability and 23 times more likely to outperform competitors in customer acquisition.

By using advanced analytics, Capital One can offer personalized credit solutions that align perfectly with customer credit behavior. One illustrative example is the company's "Information-Based Strategy" (IBS), initiated by Co-Founder Rich Fairbank. By segmenting the customer base into detailed profiles, Capital One could tailor its marketing and pricing of credit cards, making offers highly relevant to individual customers. This personalization significantly improves customer satisfaction and drives higher uptake and loyalty.

Building Technological Infrastructure

Another cornerstone of Capital One's success is its robust technological infrastructure. The company’s commitment to technological excellence is evident not only in its digital banking platforms but also in its internal operations. For instance, in 2016, Capital One announced a groundbreaking strategy to reduce reliance on physical data centers and embrace cloud computing. Partnering with Amazon Web Services (AWS), Capital One aimed to migrate over 90 percent of its data center footprint to the cloud. According to Forrester, this migration helped Capital One achieve improved operational efficiency, with a 50 percent reduction in application downtime (Forrester, 2020).

By pioneering this shift towards cloud infrastructure, Capital One not only set itself apart from more traditional banks but also reaped significant cost savings and operational agility. This flexibility is critical as it allows the company to rapidly adapt to changing market conditions and customer needs.

Diversified Revenue Streams

Capital One’s revenue model is as multifaceted as its product offerings. The company primarily earns through interest and fees on credit cards, which remain a significant revenue generator. In 2022, the credit card segment accounted for approximately 65 percent of total revenue, underscoring its importance (Annual Report, 2022). This is coupled with income from its extensive array of consumer banking products, such as deposits and auto loans, which provide stability and diversification to the revenue streams.

One particular case that stands out is Capital One’s approach to commercial banking, contributing around 20 percent of their revenue. With tailored lending and treasury management services for middle-market companies, Capital One has integrated itself into the backbone of American commerce. Notably, their adaptive credit solutions have nurtured growth in sectors such as commercial real estate and industrial clients.

Customer-Centric Approach

Guided by a mission to humanize and simplify banking, Capital One places significant emphasis on customer experience. The company's use of advanced customer relationship management tools and personalized financial insights has earned it a loyal customer base. For instance, the introduction of the Capital One Café concept reflects the company's shift towards more engaging and approachable banking. These cafés serve as both financial advice hubs and community spaces, embodying the company's commitment to establishing stronger customer connections.

Moreover, Capital One's mobile banking app, as noted by JD Power, ranks consistently high in customer satisfaction with a score of 877 out of 1,000, outpacing many competitors (JD Power, 2023). The app’s seamless interface, comprehensive features, and robust security measures are key factors driving this success. Statistics show that 80 percent of Capital One’s customers actively use digital services, underscoring the importance of digital maturity in enhancing customer engagement and satisfaction.

Security and Risk Management

In an era where data breaches and cyber threats are paramount concerns, Capital One has demonstrated extraordinary commitment to security and risk management. Despite facing a significant data breach in 2019, the company’s swift response and subsequent security enhancements have been noteworthy. By investing heavily in advanced fraud prevention systems and partnering with top tech firms, Capital One fortifies its defenses while maintaining customer trust.

A public statement by Timika Oyola, VP of Cyber Operations at Capital One, highlighted their adoption of real-time AI threat detection systems. "Our investment in AI and real-time analytics has bolstered our ability to preemptively identify and mitigate threats before they impact our customers," she noted in a 2022 interview with Bloomberg.

Strategic Partnerships and Ecosystem

Capital One’s success is also attributed to its strategic partnerships with key players in the financial and technology sectors. These alliances range from collaboration with payment networks like Visa and Mastercard to fintech companies, all contributing to an enriched service palette. Furthermore, partnerships with credit bureaus and insurance companies enable Capital One to offer comprehensive customer solutions, tapping into a broader spectrum of financial needs.

The company has also earned accolades for its partnership model. In 2021, Forbes named Capital One amongst the top 50 most admired companies, largely due to its collaborative ecosystem that drives innovation and agility (Forbes, 2021).

Scaling New Heights

In conclusion, what sets Capital One Financial apart is its daring approach to embrace technology, unwavering focus on customer-centric solutions, and strategic revenue diversification. From its data-driven origins and technological audacity to its personalized customer engagements and robust security measures, Capital One demonstrates that banking can be both innovative and deeply human.

As we move forward, Capital One’s vision continues to challenge the status quo, proving that a bank with the right blend of technology and human touch can indeed create ripples across the financial services landscape. Through inspired leadership, continuous innovation, and an unrelenting focus on customer success, Capital One is not just a bank—it’s a pioneer shaping the future of finance.

If you enjoyed this content, you’re in for a treat! Dive into our extensive repository of business model examples, where we’ve dissected and analyzed thousands of business strategies from top tech companies and innovative startups. Don’t miss out!