Why Faircent's Business Model is so successful?

Get all the answers

Faircent’s Company Overview

Faircent is one of India’s leading peer-to-peer (P2P) lending marketplaces, connecting borrowers directly with lenders to facilitate faster, more efficient, and cost-effective financial transactions. Established with the mission of empowering individuals and businesses by democratizing access to credit, Faircent leverages technology to create a trustworthy alternative to traditional banking channels. By utilizing a sophisticated, data-driven platform that assesses credit risk in real-time, Faircent ensures that lenders and borrowers find mutually beneficial partnerships. The platform emphasizes user-friendly interfaces, transparency, and robust security measures to maintain a seamless and secure lending experience.

Faircent operates on an innovative business model that centers around an online platform where lenders and borrowers can post their loan requirements or offers, respectively. Borrowers, which can be either individuals or small businesses, apply for loans that range from personal expenses to business expansion needs. Lenders, on the other hand, can choose to fund these loans based on various parameters such as interest rates, loan tenure, borrower profiles, and risk grades. By eliminating intermediaries like banks and financial institutions, Faircent reduces the complexities and costs associated with loan disbursements, thus offering more attractive interest rates for both parties. The platform also provides extensive information and analytical tools to help lenders make informed decisions, whilst offering flexible loan options and customized repayment plans to meet the diverse needs of borrowers.

Faircent’s revenue model is primarily transaction-based, with fees generated from both lenders and borrowers. Borrowers are charged an origination fee, which is a percentage of the loan amount, upon successful disbursement of their loans. This fee varies based on the risk profile and the tenure of the loan. Lenders, on their part, may also be subjected to service fees associated with the returns they earn on their investments. Additionally, Faircent generates revenue through ancillary services such as credit assessment, insurance products, and borrower verification services. By offering these value-added services, Faircent not only diversifies its revenue streams but also enhances the overall user experience, ensuring that both lenders and borrowers have a comprehensive suite of tools to facilitate secure and profitable lending and borrowing activities.

Headquater: Gurgaon, Haryana, India

Foundations date: 2013

Company Type: Private

Sector: Financials

Category: Financial Services

Digital Maturity: Digirati

Faircent’s Related Competitors

KreditBee Business Model

loanDepot Business Model

Paragon Bank Business Model

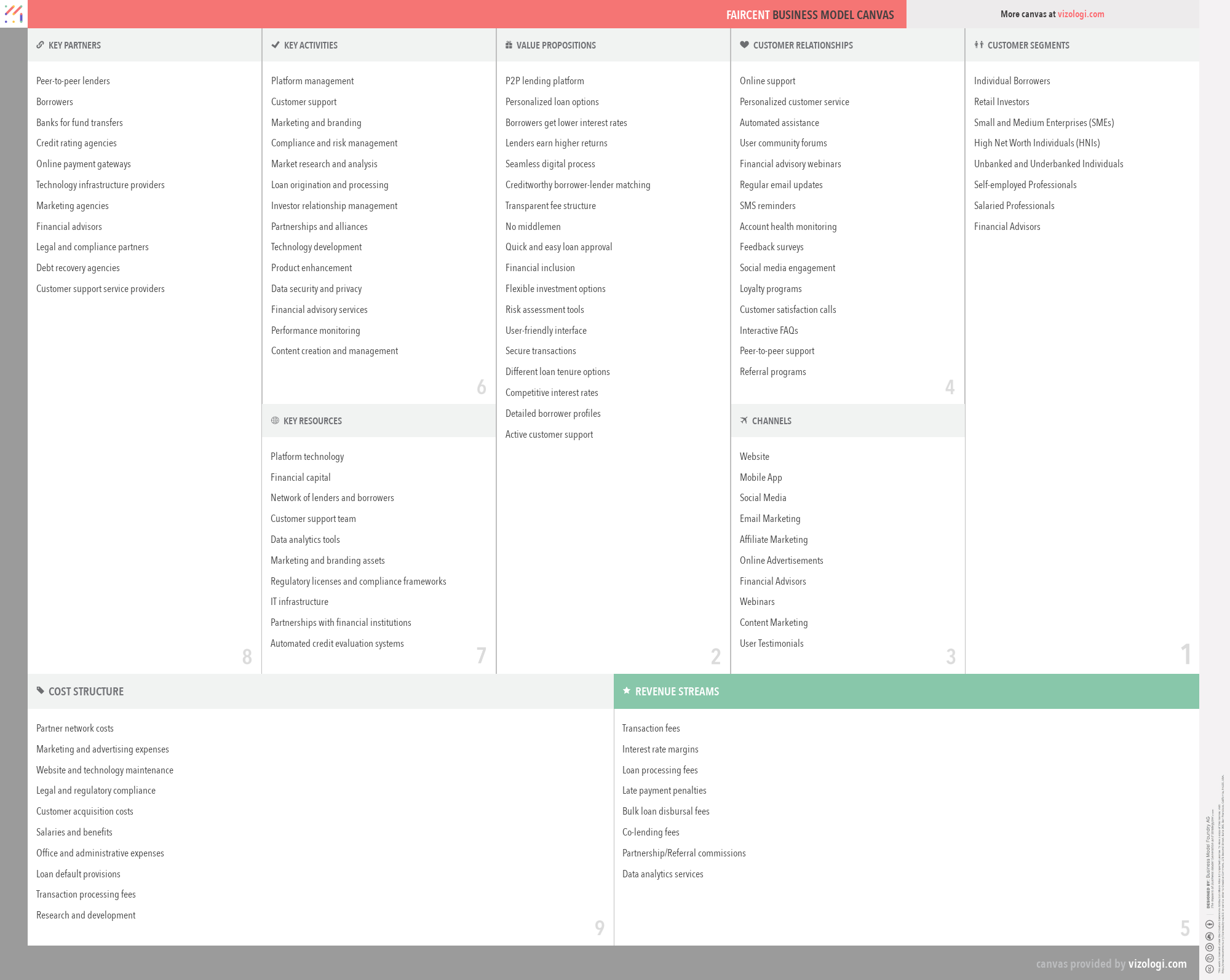

Faircent’s Business Model Canvas

- Peer-to-peer lenders

- Borrowers

- Banks for fund transfers

- Credit rating agencies

- Online payment gateways

- Technology infrastructure providers

- Marketing agencies

- Financial advisors

- Legal and compliance partners

- Debt recovery agencies

- Customer support service providers

- Platform management

- Customer support

- Marketing and branding

- Compliance and risk management

- Market research and analysis

- Loan origination and processing

- Investor relationship management

- Partnerships and alliances

- Technology development

- Product enhancement

- Data security and privacy

- Financial advisory services

- Performance monitoring

- Content creation and management

- Platform technology

- Financial capital

- Network of lenders and borrowers

- Customer support team

- Data analytics tools

- Marketing and branding assets

- Regulatory licenses and compliance frameworks

- IT infrastructure

- Partnerships with financial institutions

- Automated credit evaluation systems

- P2P lending platform

- Personalized loan options

- Borrowers get lower interest rates

- Lenders earn higher returns

- Seamless digital process

- Creditworthy borrower-lender matching

- Transparent fee structure

- No middlemen

- Quick and easy loan approval

- Financial inclusion

- Flexible investment options

- Risk assessment tools

- User-friendly interface

- Secure transactions

- Different loan tenure options

- Competitive interest rates

- Detailed borrower profiles

- Active customer support

- Online support

- Personalized customer service

- Automated assistance

- User community forums

- Financial advisory webinars

- Regular email updates

- SMS reminders

- Account health monitoring

- Feedback surveys

- Social media engagement

- Loyalty programs

- Customer satisfaction calls

- Interactive FAQs

- Peer-to-peer support

- Referral programs

- Individual Borrowers

- Retail Investors

- Small and Medium Enterprises (SMEs)

- High Net Worth Individuals (HNIs)

- Unbanked and Underbanked Individuals

- Self-employed Professionals

- Salaried Professionals

- Financial Advisors

- Website

- Mobile App

- Social Media

- Email Marketing

- Affiliate Marketing

- Online Advertisements

- Financial Advisors

- Webinars

- Content Marketing

- User Testimonials

- Partner network costs

- Marketing and advertising expenses

- Website and technology maintenance

- Legal and regulatory compliance

- Customer acquisition costs

- Salaries and benefits

- Office and administrative expenses

- Loan default provisions

- Transaction processing fees

- Research and development

- Transaction fees

- Interest rate margins

- Loan processing fees

- Late payment penalties

- Bulk loan disbursal fees

- Co-lending fees

- Partnership/Referral commissions

- Data analytics services

Vizologi

A generative AI business strategy tool to create business plans in 1 minute

FREE 7 days trial ‐ Get started in seconds

Try it freeFaircent’s Revenue Model

Faircent makes money by combining different business models. Below, you will find the list of the different monetization strategies identified for this company:

- Transaction facilitator

- Brokerage

- P2P lending

- Power on

- Affiliation

- Blue ocean strategy

- Aikido

- Peer to Peer (P2P)

- Two-sided market

- Sharing economy

- Disruptive trends

- Take the wheel

- Lean Start-up

- Disruptive banking

- Online marketplace

- Community-funded

- Crowd deal

- Equity crowdfunding

- On-demand economy

- Disintermediation

- Reverse engineering

- Tradeable currency

- Dynamic pricing

- Finance get makeover

Faircent’s Case Study

Faircent's CASE STUDY

When we delve into the case study of Faircent, one of India’s premier peer-to-peer (P2P) lending marketplaces, we uncover a compelling narrative of innovation, disruption, and societal impact. Established in 2013 and headquartered in Gurgaon, Haryana, Faircent has revolutionized the financial services sector by offering a direct connection between borrowers and lenders, thereby eliminating the need for traditional banking intermediaries. This approach has not only democratized access to credit but has also empowered individuals and businesses across India.

A Vision for Financial Inclusion

From its inception, Faircent’s mission has been clear: to empower individuals and small businesses by creating a more accessible and efficient credit ecosystem. The company’s founder, Rajat Gandhi, envisioned Faircent as a platform that would lower the barriers to obtaining loans while providing investors with opportunities for higher returns. This dual value proposition has been the cornerstone of Faircent’s success.

By simplifying the lending process through its online platform, Faircent has created a seamless experience characterized by transparency and efficiency. Borrowers can post their loan requirements, such as personal expenses or business expansion needs, and lenders can select from these loan requests based on factors like interest rates, loan tenure, borrower profiles, and risk grades. This disintermediation has led to cost savings and more attractive interest rates for both parties.

Leveraging Technology for Real-Time Credit Assessment

One of Faircent’s unique selling propositions is its sophisticated, data-driven platform that assesses credit risk in real-time. This technology is pivotal in ensuring that lenders and borrowers find mutually beneficial partnerships. According to a report by PwC, advanced credit scoring models and real-time data analytics play a crucial role in reducing default rates and improving loan performance (PwC, 2022).

Faircent uses an automated credit evaluation system that leverages data analytics tools to provide lenders with extensive information and analytical insights. This real-time assessment helps in making informed lending decisions while also minimizing potential risks. With over 1,000,000 registered users and funded loans surpassing INR 200 crore, the efficacy of Faircent’s technology-driven approach is evident (Economic Times, 2023).

A Robust and Flexible Revenue Model

Faircent’s revenue model is primarily transaction-based, deriving fees from both borrowers and lenders. Borrowers are charged an origination fee, a percentage of the loan amount upon successful disbursement. This fee varies based on the risk profile and the tenure of the loan. Lenders, too, are subjected to service fees linked to their investment returns.

Additionally, Faircent has diversified its revenue streams through ancillary services like credit assessment, insurance products, and borrower verification services. By offering these value-added services, Faircent enhances its user experience and ensures a comprehensive suite of tools for secure and profitable lending and borrowing activities.

Addressing Customer Needs and Emotional Drivers

Financial services impact lives profoundly, and Faircent is acutely aware of the social and emotional drivers behind borrowing and lending. For borrowers, Faircent’s platform means accessibility and financial inclusion, motivating individuals and small businesses to pursue growth opportunities they might not have had otherwise. By providing a platform that simplifies access to credit, Faircent fulfills critical functional needs like reducing costs and making money.

For lenders, particularly retail investors or high-net-worth individuals (HNIs), Faircent offers an avenue to earn higher returns with a degree of control over where their funds go. This aspect of affiliation and belonging resonates strongly with investors eager to contribute to the community’s economic well-being while benefiting financially.

Market Patterns and Strategic Positioning

Faircent has positioned itself adeptly within several business patterns: it serves as a transaction facilitator, leveraging a peer-to-peer (P2P) lending model within a two-sided market. The company’s approach aligns with the Blue Ocean strategy, creating new market spaces within the financial services sector that are uncontested and ripe for growth.

Authorities in market innovation, such as W. Chan Kim and Renée Mauborgne, have articulated the power of Blue Ocean strategies in driving growth by minimizing competition and creating new value (Kim & Mauborgne, 2015). Faircent’s focus on disintermediation, dynamic pricing, and the online marketplace paradigm exemplify these principles, offering a fresh, consumer-centric approach to lending.

The Faircent Ecosystem: A Network of Collaborations

A critical component of Faircent’s success is its ecosystem of key partners, including peer-to-peer lenders, borrowers, credit rating agencies, and technology infrastructure providers. These collaborations enable Faircent to maintain a robust platform that integrates cutting-edge technology with reliable financial advisory services.

Compliance and risk management are also at the forefront of Faircent’s operations. The company has partnered with legal and compliance firms to navigate the complex regulatory landscape, ensuring that every transaction adheres to stringent standards. In a sector where trust is paramount, these measures enhance credibility and foster a sense of security among users.

Scaling Up: Market Expansion and Future Prospects

Looking ahead, Faircent is well-poised for expansion, with the potential to significantly impact financial inclusion not just in India but globally. The fintech landscape continuously evolves, and Faircent’s ability to innovate and adapt will be crucial in maintaining its competitive edge.

According to McKinsey, the global fintech industry is projected to grow at a compound annual growth rate (CAGR) of 25 percent over the next decade (McKinsey & Company, 2022). This growth presents an enormous opportunity for Faircent to expand its footprint and further solidify its position as a leader in the P2P lending space.

Conclusion

Faircent’s journey from a startup to a market leader in peer-to-peer lending is a testament to the power of innovation, strategic positioning, and an unwavering commitment to customer needs. By leveraging technology to create a transparent and efficient lending ecosystem, Faircent has transformed the way ordinary individuals and small businesses access credit.

As we continue to observe and study Faircent’s progress, it becomes evident that the company’s unique approach and robust business model offer invaluable insights for anyone looking to disrupt traditional sectors and democratize access to essential services.

By bridging the gap between borrowers and lenders in the most seamless way possible, Faircent is not just facilitating transactions; it is changing lives, one loan at a time.

If you enjoyed this content, you’re in for a treat! Dive into our extensive repository of business model examples, where we’ve dissected and analyzed thousands of business strategies from top tech companies and innovative startups. Don’t miss out!