Growth or profitability?

Left or right.

Madrid or Barça.

Religion or ethics.

Oasis or Blur.

…

As I get older, I understand that whenever you choose between two options, someone wins in the shadows, who you may never meet. It may be one, one, several, or several coordinated or uncoordinated, but it always comes to mind the exact Latin phrase of Julius Caesar in ancient Rome:

«Divide et vinces«

We are led to believe that the world is binary, that you must choose between zero and one when mathematics shows us the opposite: the distance between zero and one can be infinite. In a world as complex as the one we live in, it is an unacceptable simplicity that you are constantly forced to choose between two options…

My profession and my business require me to understand what is happening in the world; it is not something I can ignore, or at least try to find out how it works and what is true or false to make decisions; it is not a triviality, it is about how to manage risk in an environment of continuous and complex uncertainty.

I realized that I lost the holistic perspective of everything around me if I chose a specific line, ideology, or predetermined direction. Having selected and entered into a pre-existing dynamic, I decided several years ago to take a step back to see the whole play from a better angle, with a broader perspective, allowing me more room for maneuver.

Unicorns vs. Camels.

Years ago, in retrospect, when I got on the roller coaster of entrepreneurship in the startup world, the dilemma that arose was the choice between growth or profitability, appearing two paths to choose, apriori opposite, the growth mentality of the unicorn, choosing the path of venture capital towards unlimited growth, and the profitability mentality of the camel, choosing the path of “at the stroke of a kidney” trying to obtain profitability.

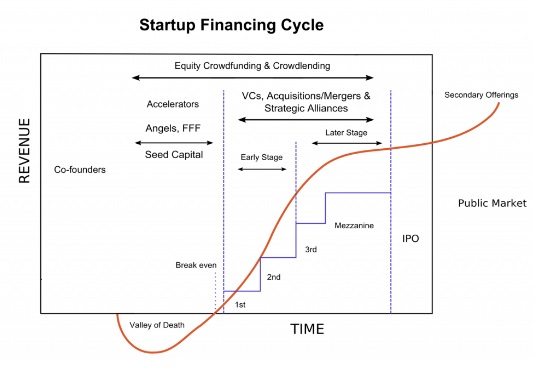

Unicorns do not exist, beyond Greek mythology and within our imagination; they are a statistical rarity characterized by startups obsessed with unlimited growth and disproportionate valuations. The theory says that they are born to quickly create a creative monopoly in the market they target, raising large rounds of funding, in which literally tons of capital is burned to generate high growth in the first years of the startup’s life.

Assuming that the losses are going to be very high, and for a long time, long enough, to overwhelm your competition in the market due to the concentration of capital, and finally by attrition to get the company to the stock exchange, so that new shareholders enter with distorted perspectives of profits and returns.

New investors do not understand that these unicorns are not profitable in practice, nor will they ever be, but are mesmerized by the supposed “success” of the company from a purely competitive perspective… Meanwhile, risk investors walk away with dramatically multiplied profits.

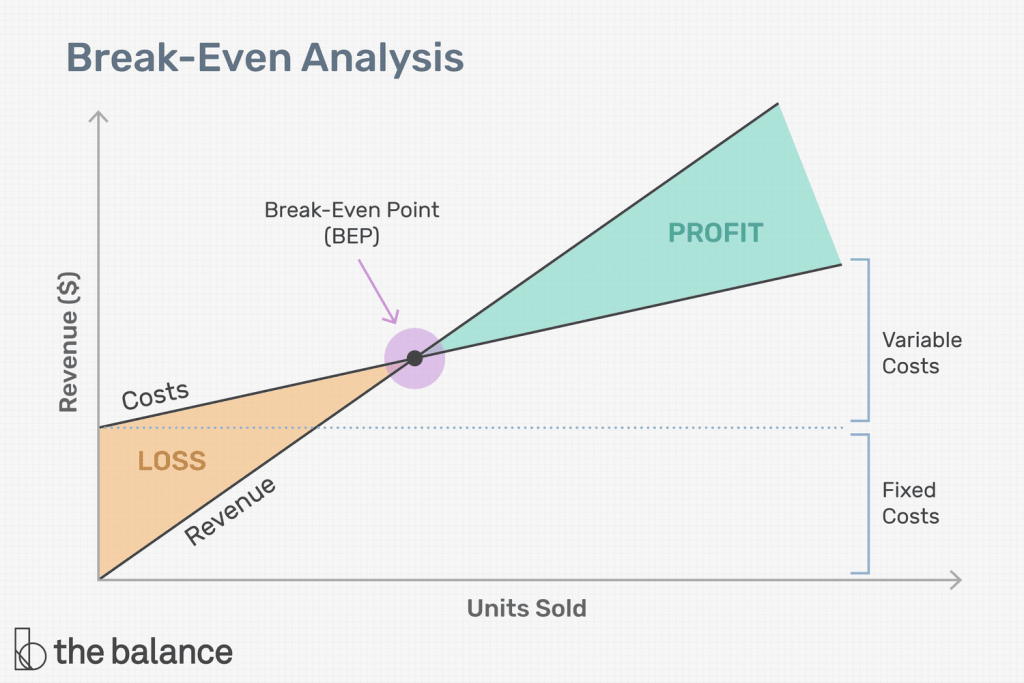

No matter the cost, if not the number of clients, the annual balance sheets will always be harmful for many years, with the expectation of reaching in the eighth, ninth, or tenth year a threshold of profitability in which income equals expenses, from that hypothetical eleventh year, the theory said that began the unlimited profitability and extraordinary returns to investors, in practice, this is not what happens, with few exceptions.

Venture capital in the technology sector is still a relatively young activity within the investment world. In gold, we have been investing since the seventh century BC, in art or land, since the seventeenth century, then looking at a broader timeline, this discipline is relatively new or modern. It has been going on for 30 years and there is still much to do.

The 1990s with the leveraged buyout and the venture capital bubble; the 2000s with the dot-com bubble until the credit crunch, where big tech positioned itself as the largest company in the world, and in which Facebook, Uber, or Airbnb appeared; the 2010s which was the expansion phase and the 2020s which ended with the COVID-19 recession and a new bubble bursting at the end of 2022.

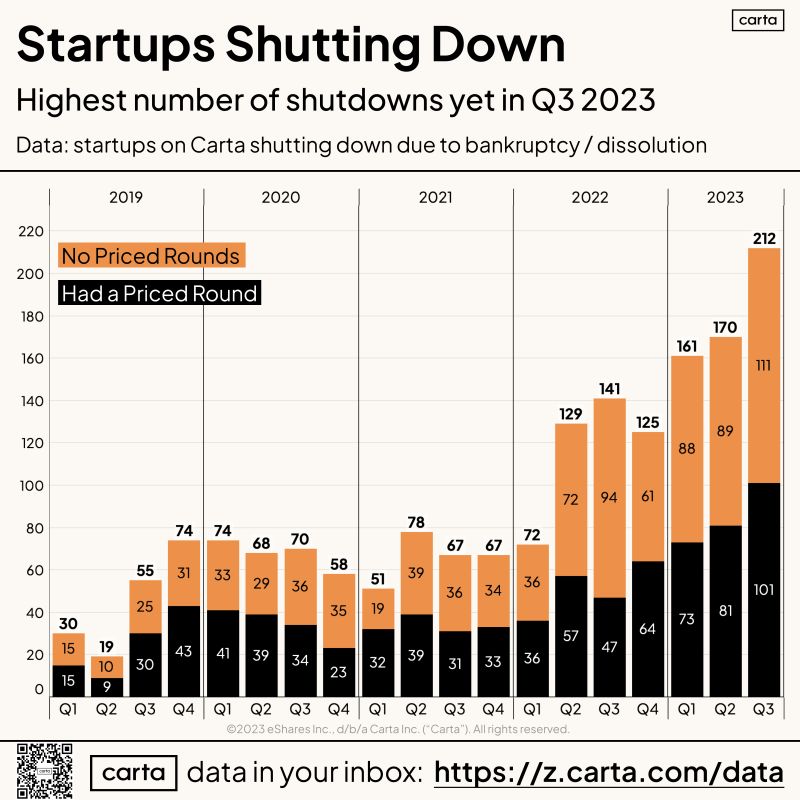

So far this year, more than 543 startups have closed, only in the United States. Many of them were waiting for Series B to arrive, and it has not arrived; and at no time since Series A, they demonstrated that they were profitable, the result, closure, and valuations well below the market price, and they all went to the street.

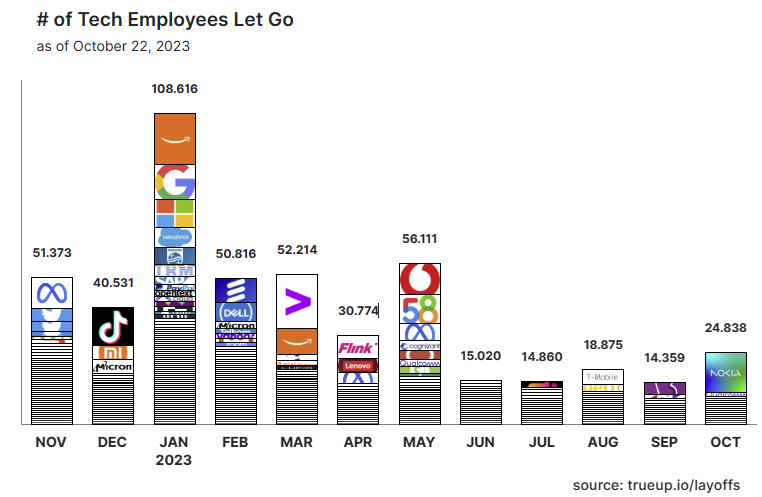

Nearly 400,000 people have lost their jobs in the United States since the tech bubble burst in late 2022. 000 people have lost their jobs in the United States since the bubble burst in the technology sector at the end of 2022. Remember, that in 2020, and 2021, records were broken in venture capital investment, and the pandemic caused the flow of capital to go to the technology market in those years; there is speculation that the emergence of generative AI may have impacted these layoffs, and in a minimum percentage will be accurate, but the reality is that investors need returns. All have had to go to the rebates and reduce staff, which sometimes doubled during the inflow of capital with the Covid bonanza.

Ben Cogan published on LinkedIn a retrospective analysis of the results of the significant American unicorns of the last 15 years that are listed on the stock exchange at the end of 2022; all of these unicorns exceed by far the ten years old since their release on the market, and just Airbnb is being profitable despite having gone through a crisis in the pandemic, a company is saved from the entire portfolio, and as collateral damage is causing price rise in congested rental areas.

The rest accumulate losses which today are impossible to estimate when they will be profitable, if they may one day become; some have not reached their break even after the long ten years, and those who have passed it have not managed to be profitable:

– Doordash (food delivery): –$1.36b

– Uber (ridesharing): -$9.14b

– Snowflake (cloud computing): – $796mm

– Roblox (online gaming): –$924mm

– Palantir (big data analytics): –$373mm

– Coinbase (crypto exchange): –$2.62b

– Rivian (electric vehicles): -$6.75b

– Crowdstrike (cybersecurity): – $183mm

– Draftkings (sports betting): –$1.38b

– Peloton (home fitness): -$2.83b

– Datadog (cloud monitoring): – $50mm

– Robinhood (stock trading): –$1.03b

– Pinterest (social network): –$96mm

– Beyond Meat (plant-based meat): –$396mm

– Snap (social network): –$1.43

If we review the history, some exceptions received venture capital financing and managed to be profitable in a short time. Google, founded in 1998, made profits in 2001. Facebook, born in 2004, did so in 2009. But in no case do the profits, in the exceptions, exceed the losses of the entire portfolios; the technology industry is given exceptionally well to lose money. Indeed, these data do not cease to be macro and should be analyzed by neighborhoods to understand the picture better.

Apart from the instability projected by venture capital from outside, constantly giving bandages, it seems they are moving more by fashion and short-term tactics than by firm strategies developed in the long term. Now it’s cryptography, then NTFs, we’ve got it with the metaverse, and a new bubble in generative AI will burst soon. There’s nothing in the VC world that lasts more than two years.

When my friends ask me which startup I’m investing in, I tell them that in avocados, which buy a hectare of land and plant avocadoes, the yield from the fifth year is extraordinary at the price you sell the avocados unit.

On the contrary, there are startups and companies with a camel mindset, and these animals are characterized by making long journeys through the deserts, drinking very little water, and carrying a lot of weight. They are designed to be sturdy, rugged, and anti-fragile. The startups with a Camel Mindset are ingenious, balanced, resilient, and, more importantly, authentic, designed for the long term, built from the start to be profitable, prioritizing sustainability and balancing growth.

Camel companies do not get caught up in the advertising boom of startups, nor do they buy advertising at airports or on television. They recognize the trials and tribulations of creating world-class companies, have lived experiences, and are hardworking.

They carry out balanced growth, adopt a long-term perspective, and embrace diversification in the business model. Camels are not interested in “blitzscaling” that is, quickly building the company and prioritizing speed over efficiency in search of mass scale. Manages costs throughout your company’s lifecycle to align with a long-term growth curve.

Unicorns are born for the short term; they are binary, or all or nothing, and there is no middle term; they are companies born for explosiveness. When they come wrong, they suffer a lot because, by default, they are over-dimensional for the actual market expectations.

When should a startup be considered if it goes for unicorns? First of all, it targets a huge market, such as, for example, the category of SaaS human resources.

When you have unusual growth since the launch of your startup when you have a native product with network effects, such as a social network, when your hands have an R&D AI project like OpenAI, and you need a lot of capital intensive for years to be able to develop a very cutting edge technology from scratch, where you need to enroll the best engineers in the world in this discipline.

But because of the results obtained after 30 years of venture capital, many have sold ponies disguised as unicorns. Others have entered the trap of this binary dynamic of Silicon Valley, of everything or nothing, of having to be a unicorn at any price or closure. If these startups had been born with the long-term mentality of the camel, today would be good business, sustainable in time, and that offer value to society.

Asana vs. Basecamp.

The category of project management software may be one of the oldest and most prominent in the technological ecosystem; here are companies like Asana, a startup with a unicorn mindset that is still not profitable, received many rounds to get to the stock exchange, and Basecamp, a camel-minded software company that has not chosen the path of the investment round, and have been on the market for more than 24 years since 1999, all a record for a software startup, billing $200 million, with 170 employees, achieving extraordinary profit margins, and being profitable from the third year of life.

Asana has 1,780 employees, according to LinkedIn, and accounts for about $600 million. The number of users is practically equal to one or the other; with the difference in pricing, Basecamp attacks the small business sector and Asana goes by medium, large, and enterprise. Asana went to the stock exchange, and some venture capital investors became millionaires in that punctual transaction. Today, it has accumulated more than 1 billion losses in just the last four years, with no long-term prospect of being profitable.

When you prioritize growth over any other variable in your business, such as efficiency in day-to-day operations or cost control, how your real enemy, with what unicorns meet, is with a terrible operating mermaid from the tenth year, from which it is almost impossible to get out, have become companies that have incorporated many employees in a short space of time, you have to have the processes backbreaking work in your company, so that this does not become a Greek tragedy.

By increasing the bureaucracy without reaction time, they are charged by default the fundamental competitive advantage of being a technological startup, which is to do a lot with very few resources; then it is practically impossible to break the path of the unicorn to profitability, they have over-dimensioned themselves in such a way, that returning to a more agile state of enterprise is utopian, and from this point on, it is almost impossible to get to be profitable.

For solopreneurs with Indie startups, we are obsessed with one metric: the Gross Margin (%) = 1- (COGS/Total Income). It is “easy” to reach 94%, for unicorns should obsess another, the profitability per employee, which in very few cases is fulfilled to become profitable in the long term.

VC is looking for camels.

In this post-COVID crisis and post-bubble scenario, higher interest rates and macroeconomic uncertainty have made venture capital funds appear more cautious and it seems that common sense is being imposed. Funds are now looking for camels, lean unicorns, or AI unicorns with three people on the team, a contradiction anyway. There is no doubt that the era of selling smoke inside a fantastic PowerPoint has already passed…

That is why there has been a more recent rise in “camel” or “indie” startups, profit-centric companies that make more controlled use of their resources to withstand the harsh market conditions.

New AI companies are doing much more with much less. Setting up a startup or software company costs are intrinsically lower than in previous periods. More and more startups outsource vital functions, such as finance or human resources, until they grow enough to want to hire more full-time staff.

We are no longer in an environment of growth at all costs in which sales growth is rewarded. With rising rates, the stock market is punishing firms that remain unprofitable.

In my personal experience managing my startup, I chose profitability from the beginning; it was a simple and natural decision, not for my experience mounting startups; it was the first time if not my experience, in handling my finances and my way of dealing with debt.

The intention was not to give up growth, but I was not obsessed with it; my mantra was engraved on fire; I had absolutely nothing in my hands “if I didn’t get in more than I spent,” whether it was a technological startup, a restaurant, or a hairdresser because it is a technology-based startup, you should not miss this reference, which applies to any business, we are not so unique in the bottom, we’re that must be profitable.

My obsession was to be profitable from the first year, at the expense of my salary, and, fortunately, any change in subsequent years, you can be lucrative and not give up growth. Still, it’s time, temperance, and patience with no shortcuts. It is to create a stable and secure path within a high-risk environment, waiting for the moment when all the stars align to grow to be profitable.

If you have to spend $800 billion to validate a business model, expecting to be profitable from the tenth year, you have absolutely nothing. We can learn this lesson after 30 years of venture capital in technology. Otherwise, we will have known nothing.

In conclusion, if you have a startup in a vast market, with very high chances of being able to get to the IPO (initial public offering) to go to the stock exchange or have a start-up like Figma and you are very likely to buy you Adobe for a dinar, then choose the risk capital path.

If you are not in this league, to which very few come, it will be 0.01% of the entire start-up ecosystem. Don’t complicate your life, do not dilute, and choose the camel’s path.

Vizologi is a revolutionary AI-generated business strategy tool that offers its users access to advanced features to create and refine start-up ideas quickly.

It generates limitless business ideas, gains insights on markets and competitors, and automates business plan creation.