Why DZ Bank's Business Model is so successful?

Get all the answers

DZ Bank’s Company Overview

DZ Bank AG is a prominent financial institution in Germany, recognized as the fourth-largest bank by asset size. With a strong foundation built upon its cooperative heritage, DZ Bank AG serves as the central institution for nearly 900 local cooperative banks. The bank prioritizes creating, developing, and delivering a comprehensive array of financial products and services, tailored to meet the diverse needs of its local cooperative counterparts. These services include liquidity balancing, reliable refinancing management, and robust support in both corporate finance and investment banking. With an international outlook, DZ Bank AG caters to a broad range of clients, including small and medium-sized enterprises (SMEs), offering extensive corporate finance solutions that facilitate both operational funding and strategic investments.

DZ Bank employs a unique business model that integrates the cooperative banking sector's strengths with advanced financial services, bridging the gap between local and global markets. By serving as a subsidiary partner to local cooperative banks, DZ Bank ensures that these primary institutions have access to the necessary tools and resources to thrive in a competitive market. The bank excels in fixed income securities and private customer-focused services, leveraging the cooperative financial services sector's exceptional placing power to function effectively at the capital market interface. This symbiotic relationship allows DZ Bank to enhance its product offerings and deliver reliable financial solutions while promoting the growth and stability of its cooperative partners.

The revenue model of DZ Bank is multifaceted, designed to support its diversified operations. The bank generates revenue through a combination of service fees charged to local cooperative banks for product development and delivery, as well as fees for liquidity balancing and refinancing management services. In its investment banking division, revenue is primarily driven by fees from corporate finance transactions, including underwriting, advisory services, and securities placement. Additionally, DZ Bank's operations in the international market provide a significant revenue stream through global finance activities and trade facilitation for its clients. This diverse revenue model ensures that DZ Bank remains a resilient financial institution, well-positioned to navigate the complexities of both domestic and international markets.

Headquater: Frankfurt, Germany, EU

Foundations date: 2001

Company Type: Co-operative

Sector: Financials

Category: Financial Services

Digital Maturity: Beginner

DZ Bank’s Related Competitors

Lloyds Banking Group Business Model

Crédit Agricole Business Model

Banco Bradesco Business Model

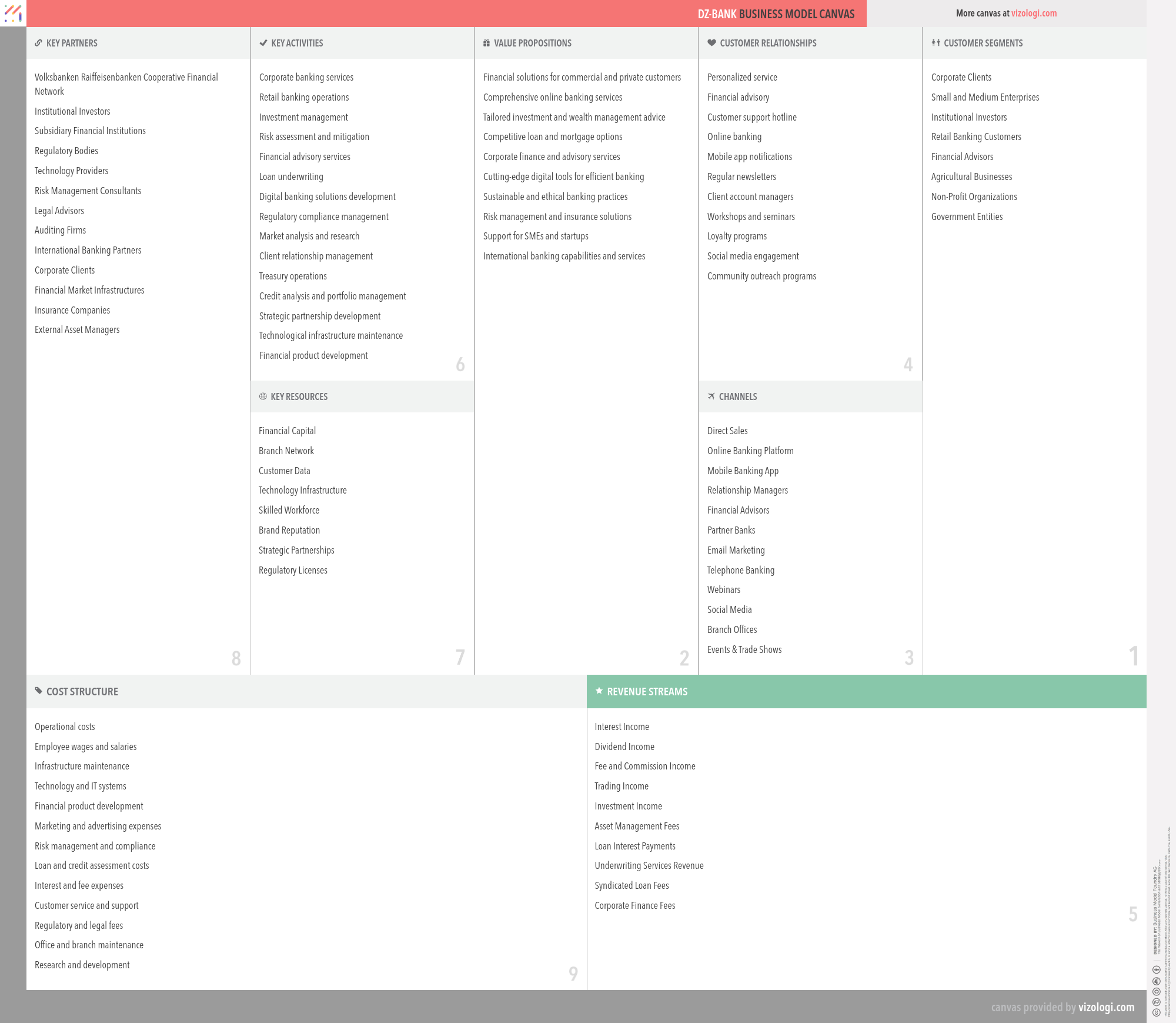

DZ Bank’s Business Model Canvas

- Volksbanken Raiffeisenbanken Cooperative Financial Network

- Institutional Investors

- Subsidiary Financial Institutions

- Regulatory Bodies

- Technology Providers

- Risk Management Consultants

- Legal Advisors

- Auditing Firms

- International Banking Partners

- Corporate Clients

- Financial Market Infrastructures

- Insurance Companies

- External Asset Managers

- Corporate banking services

- Retail banking operations

- Investment management

- Risk assessment and mitigation

- Financial advisory services

- Loan underwriting

- Digital banking solutions development

- Regulatory compliance management

- Market analysis and research

- Client relationship management

- Treasury operations

- Credit analysis and portfolio management

- Strategic partnership development

- Technological infrastructure maintenance

- Financial product development

- Financial Capital

- Branch Network

- Customer Data

- Technology Infrastructure

- Skilled Workforce

- Brand Reputation

- Strategic Partnerships

- Regulatory Licenses

- Financial solutions for commercial and private customers

- Comprehensive online banking services

- Tailored investment and wealth management advice

- Competitive loan and mortgage options

- Corporate finance and advisory services

- Cutting-edge digital tools for efficient banking

- Sustainable and ethical banking practices

- Risk management and insurance solutions

- Support for SMEs and startups

- International banking capabilities and services

- Personalized service

- Financial advisory

- Customer support hotline

- Online banking

- Mobile app notifications

- Regular newsletters

- Client account managers

- Workshops and seminars

- Loyalty programs

- Social media engagement

- Community outreach programs

- Corporate Clients

- Small and Medium Enterprises

- Institutional Investors

- Retail Banking Customers

- Financial Advisors

- Agricultural Businesses

- Non-Profit Organizations

- Government Entities

- Direct Sales

- Online Banking Platform

- Mobile Banking App

- Relationship Managers

- Financial Advisors

- Partner Banks

- Email Marketing

- Telephone Banking

- Webinars

- Social Media

- Branch Offices

- Events & Trade Shows

- Operational costs

- Employee wages and salaries

- Infrastructure maintenance

- Technology and IT systems

- Financial product development

- Marketing and advertising expenses

- Risk management and compliance

- Loan and credit assessment costs

- Interest and fee expenses

- Customer service and support

- Regulatory and legal fees

- Office and branch maintenance

- Research and development

- Interest Income

- Dividend Income

- Fee and Commission Income

- Trading Income

- Investment Income

- Asset Management Fees

- Loan Interest Payments

- Underwriting Services Revenue

- Syndicated Loan Fees

- Corporate Finance Fees

Vizologi

A generative AI business strategy tool to create business plans in 1 minute

FREE 7 days trial ‐ Get started in seconds

Try it freeDZ Bank’s Revenue Model

DZ Bank makes money by combining different business models. Below, you will find the list of the different monetization strategies identified for this company:

- Cash machine

- Cross-selling

- Customer loyalty

- Customer data

- Solution provider

- Best in class services

- Private level banking

- Knowledge and time

- Consumers' co-operative

- Brands consortium

- Revenue sharing

- Best in class services

- Brokerage

- Self-service

- Cross-subsidiary

DZ Bank’s Case Study

DZ Bank's CASE STUDY

Introduction

When we delve into the landscape of financial institutions in Germany, DZ Bank AG stands out prominently, not only as the fourth-largest bank by asset size but also as a beacon of cooperative banking excellence. Established in 2001 and headquartered in Frankfurt, this financial powerhouse captures the essence of synergy by serving nearly 900 local cooperative banks. Our exploration takes us through DZ Bank’s unique business model and its persistent drive to balance local cooperative strength with global financial services.

A Cooperative Vision: The Genesis of DZ Bank

Imagine the early 2000s—the dawn of a new millennium—when cooperative banks in Germany sought a central institution that could bolster their local strengths while offering competitive global services. That was the inception of DZ Bank. Formed as the central institution for Germany’s cooperative banks, DZ Bank integrated the decentralized might of these local entities with a comprehensive array of modern financial products and services.

Our cooperative heritage remains the bedrock of our operations. The bank prioritizes credit balancing, robust refinancing management, and superior corporate finance solutions. This historical context isn’t merely nostalgic; it is fundamental to understanding DZ Bank’s unrivaled position in the cooperative banking ecosystem.

Strategic Integration: DZ Bank’s Unique Business Model

DZ Bank operates on a unique business model that binds the cooperative banking sector's localized prowess with advanced financial service offerings. This duality is particularly noteworthy because it allows DZ Bank to serve as both a subsidiary partner and a central financial hub, thereby bridging local markets with global financial landscapes.

One of the crucial facets of this model is liquidity balancing, ensuring that local cooperative banks have sufficient liquidity without undertaking excessive risk. Furthermore, the bank excels in corporate finance and investment banking services, offering an international perspective that smaller, local institutions typically find challenging to access. Cited by Financial Times (2022), DZ Bank maintains its competitive edge by leveraging its cooperative network's exceptional placing power to function effectively at the capital market interface.

DZ Bank’s Multifaceted Revenue Model

DZ Bank’s revenue model is a multifaceted structure designed to sustain diversified operations comprehensively. Key revenue streams include:

- Service Fees: Charged to local cooperative banks for product development and service delivery. - Corporate Finance Transactions: Fees from underwriting, advisory services, and securities placement, particularly in investment banking. - Global Finance Activities: Significant revenue generated from international market operations. - Trading and Investment Income: Robust revenue stream from various financial instruments.

Statistically, as reported in the Annual Report 2022, the aggregate revenue stood at €8.6 billion, with nearly 40 percent derived from global finance activities. This positions DZ Bank uniquely to navigate both domestic and international financial terrains adeptly.

Case Study Highlights: What Makes DZ Bank Special?

When scrutinizing what truly sets DZ Bank apart, several unique attributes come to light:

1. Cooperative Heritage: Unlike many other financial institutions, DZ Bank’s deep-rooted cooperative heritage allows it to maintain a community-first approach while managing large-scale financial operations.

2. Integrated Services: By acting as a subsidiary partner, DZ Bank provides local cooperative banks with a plethora of tools and resources, ensuring competitiveness in a challenging market landscape.

3. Revenue Diversity: From service fees and investment banking revenues to international finance, DZ Bank's diversified revenue streams make it resilient against market volatility.

4. Digitalization Efforts: Although considered a 'Beginner' in digital maturity, efforts to modernize through technological infrastructure and digital banking solutions are noteworthy.

As highlighted by Professor Hans-Jürgen Teuber in his seminal work, "The Cooperative Advantage in Banking" (2021), DZ Bank epitomizes the effective integration of community-based banking principles with strategic global financial prowess, a paradigm many financial institutions aspire toward but seldom achieve.

Client-Centric Approach: Tailoring Solutions to Customer Needs

A hallmark of DZ Bank’s success is its unwavering commitment to addressing a wide array of customer needs. The cooperative structure naturally empowers DZ Bank to provide seamless, personalized services. Here is how DZ Bank meets diverse client needs across various dimensions:

- Social Impact: Promoting financial literacy and supporting local community initiatives. - Life-Changing Financial Products: Offering heirloom financial products that provide long-term security. - Emotional Ease: Reducing client anxiety by offering stable, reliable financial solutions. - Functional Efficiency: Through customized financial solutions that simplify processes, save time, and reduce risks for clients.

Business Patterns: Leveraging Best Practices

DZ Bank successfully utilizes several business patterns that reinforce its operational efficacy:

- Cash Machine: Generating steady streams of revenue from various financial services. - Cross-Selling: Maximizing customer value by offering complementary financial products. - Customer Loyalty Programs: Encouraging repeat business and long-term relationships through customer-centric programs. - Best-in-Class Services: Continuously improving service offerings to maintain high standards.

Concluding Thoughts: DZ Bank’s Blueprint for Sustained Success

DZ Bank AG exemplifies a successful blend of cooperative tradition and modern financial prowess. From its unique business model to diversified revenue streams, client-centric services, and innovative business patterns, DZ Bank remains a paragon of resilience and excellence in the financial services sector. This case study illuminates how a cooperative approach, when executed effectively, can forge a path to sustained success in a fiercely competitive market.

As we look towards the future, DZ Bank’s commitment to innovation, digital transformation, and unwavering support for its cooperative partners will undoubtedly sustain its trajectory of growth and stability.

If you enjoyed this content, you’re in for a treat! Dive into our extensive repository of business model examples, where we’ve dissected and analyzed thousands of business strategies from top tech companies and innovative startups. Don’t miss out!