Why Friendsurance's Business Model is so successful?

Get all the answers

Friendsurance’s Company Overview

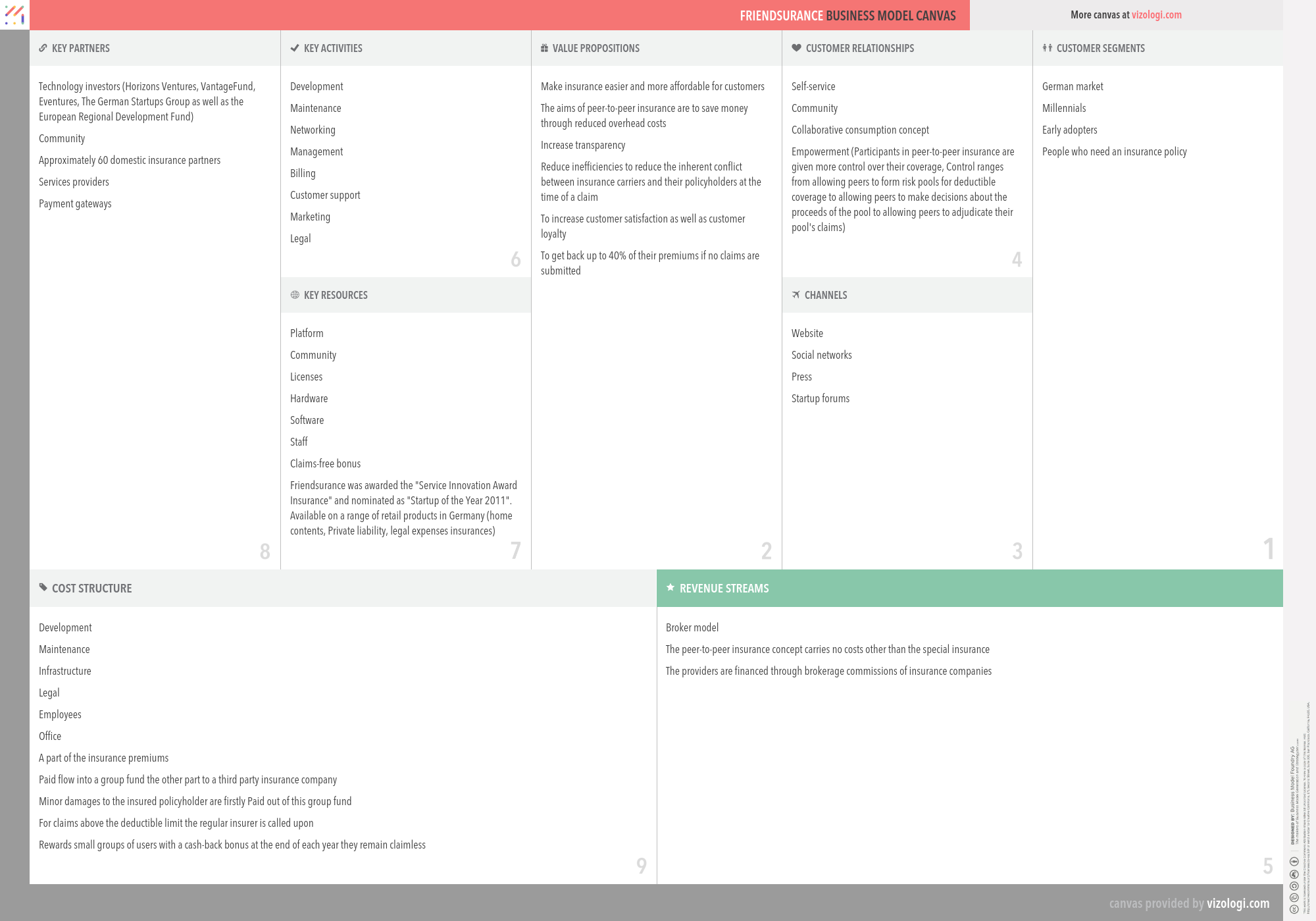

Friendsurance has developed a revolutionary peer-to-peer insurance concept, which rewards small groups of users with a cash-back bonus at the end of each year they remain claimless

http://www.friendsurance.com/Friendsurance’s Customer Needs

Social impact:

Life changing: affiliation/belonging

Emotional: badge value, provides access, rewards me, reduces anxiety

Functional: connects, makes money, reduces costs, organizes, integrates, reduces effort, saves time

Friendsurance’s Related Competitors

Friendsurance’s Business Operations

Blue ocean strategy:

The blue ocean approach is predicated on the premise that market limits and industry structure are not predetermined and may be reconfigured via the actions and attitudes of industry participants. This is referred to as the reconstructionist perspective by the writers. Assuming that structure and market boundaries exist solely in managers' thoughts, practitioners who subscribe to this perspective avoid being constrained by actual market structures. To them, more demand exists, primarily untapped. The core of the issue is determining how to produce it.

Collaborative consumption:

Collaborative Consumption (CC) may be described as a collection of resource circulation systems that allow consumers to both get and supply valued resources or services, either temporarily or permanently, via direct contact with other customers or through the use of a mediator.

Community-funded:

The critical resource in this business strategy is a community's intellect. Three distinct consumer groups comprise this multifaceted business model: believers, suppliers, and purchasers. First, believers join the online community platform and contribute to the production of goods by vendors. Second, buyers purchase these goods, which may be visual, aural, or literary in nature. Finally, believers may be purchasers or providers, and vice versa.

Crowdsourcing:

Crowdsourcing is a kind of sourcing in which people or organizations solicit donations from Internet users to acquire required services or ideas. Crowdsourcing differs from outsourcing because work may originate from an undefined public (rather than being commissioned from a particular, identified organization). In addition, those crowdsourcing procedures are a combination of bottom-up and top-down. The benefits of crowdsourcing may include reduced prices, increased speed, better quality, increased flexibility, scalability, and variety. An anonymous crowd adopts a solution to a task or issue, usually through the internet. Contributors are compensated or have the opportunity to win a prize if their answer is selected for manufacturing or sale. Customer engagement and inclusion may help build a good rapport with them, resulting in increased sales and income.

Customer loyalty:

Customer loyalty is a very successful business strategy. It entails giving consumers value that extends beyond the product or service itself. It is often provided through incentive-based programs such as member discounts, coupons, birthday discounts, and points. Today, most businesses have some kind of incentive-based programs, such as American Airlines, which rewards customers with points for each trip they take with them.

Digital:

A digital strategy is a strategic management and a business reaction or solution to a digital issue, which is often best handled as part of a broader company plan. A digital strategy is frequently defined by the application of new technologies to existing business activities and a focus on enabling new digital skills for their company (such as those formed by the Information Age and frequently as a result of advances in digital technologies such as computers, data, telecommunication services, and the World wide web, to name a few).

Disintermediation:

Keeping the purchase price low by avoiding mediators and maximizing supply margins is a win-win situation. In finance, disintermediation refers to how money is removed from intermediate financial organizations such as banks and savings and loan associations and invested directly. Disintermediation, in general, refers to the process of eliminating the middleman or intermediary from future transactions. Disintermediation is often used to invest in higher-yielding securities.

Disruptive trends:

A disruptive technology supplants an existing technology and fundamentally alters an industry or a game-changing innovation that establishes an altogether new industry. Disruptive innovation is defined as an invention that shows a new market and value network and ultimately disrupts an established market and value network, replacing incumbent market-leading companies, products, and alliances.

Knowledge and time:

It performs qualitative and quantitative analysis to determine the effectiveness of management choices in the public and private sectors. Widely regarded as the world's most renowned management consulting firm. Descriptive knowledge, also called declarative knowledge or propositional knowledge, is a subset of information represented in declarative sentences or indicative propositions by definition. This differentiates specific knowledge from what is usually referred to as know-how or procedural knowledge, as well as knowledge of or acquaintance knowledge.

Lean Start-up:

The Lean Start-up methodology is a scientific approach to developing and managing businesses that focuses on getting the desired product into consumers' hands as quickly as possible. The Lean Startup method coaches you on how to guide a startup?when to turn, when to persevere?and how to build a company with maximum acceleration. It is a guiding philosophy for new product development.

Peer to Peer (P2P):

A peer-to-peer, or P2P, service is a decentralized platform that enables two people to communicate directly, without the need for a third-party intermediary or the usage of a corporation providing a product or service. For example, the buyer and seller do business now via the P2P service. Certain peer-to-peer (P2P) services do not include economic transactions such as buying and selling but instead connect people to collaborate on projects, exchange information, and communicate without the need for an intermediary. The organizing business provides a point of contact for these people, often an online database and communication service. The renting of personal goods, the supply of particular products or services, or the exchange of knowledge and experiences are all examples of transactions.

Power on:

This method allows the modification of current structures via the use of cutting-edge technology, as shown by growing political unrest, a crisis in representation and governance, and upstart companies upending established sectors. Nevertheless, the nature of this transition is often exaggerated or severely underestimated. As a result, some cling to delirious fantasies of a new techno-utopia in which greater connection results in direct democracy and wealth.

Sharing economy:

The sharing economy eliminates the necessity for individual asset ownership. The phrase sharing economy is an umbrella word that encompasses various definitions and is often used to refer to economic and social activity that involves online transactions. Originally coined by the open-source community to refer to peer-to-peer sharing of access to goods and services, the term is now occasionally used more broadly to refer to any sales transaction conducted via online marketplaces, including those that are business to consumer (B2C) than peer-to-peer.

Technology trends:

New technologies that are now being created or produced in the next five to ten years will significantly change the economic and social landscape. These include but are not limited to information technology, wireless data transmission, human-machine connection, on-demand printing, biotechnology, and sophisticated robotics.

Two-sided market:

Two-sided marketplaces, also called two-sided networks, are commercial platforms featuring two different user groups that mutually profit from the web. A multi-sided platform is an organization that generates value mainly via the facilitation of direct contacts between two (or more) distinct kinds of connected consumers (MSP). A two-sided market enables interactions between many interdependent consumer groups. The platform's value grows as more groups or individual members of each group use it. For example, eBay is a marketplace that links buyers and sellers. Google connects advertising and searchers. Social media platforms such as Twitter and Facebook are also bidirectional, linking consumers and marketers.

Recommended companies based on your search: