Why Shaanxi Coal & chemical Industry's Business Model is so successful?

Get all the answers

Shaanxi Coal & chemical Industry’s Company Overview

Shaanxi Coal and Chemical Industry Group Co., Ltd. (SHCCIG) is a leading conglomerate in the energy and chemical sectors, headquartered in Shaanxi Province. The company is dedicated to advancing the Western Development Strategy and maximizing the extensive coal resources available in the region. With a portfolio that includes over 90 wholly-owned, holding, and joint-stock companies, SHCCIG is engaged in a diverse array of industries. Its ten primary business sectors encompass coal mining, the coal chemical industry, electric power, iron and steel, heavy industrial equipment, construction, railway investment, technology, finance, and modern services, all aimed at fostering sustainable development and economic growth in Shaanxi and beyond.

SHCCIG's business model is built on a comprehensive integration of the entire value chain from resource extraction to end-product manufacturing and services. By owning and operating diverse subsidiaries across key industrial sectors, the company ensures a synergistic approach to production and distribution. This vertical and horizontal integration allows SHCCIG to optimize resource utilization, enhance operational efficiencies, and maintain stringent control over the quality of its products and services. Additionally, the company invests heavily in technological innovation and infrastructure development, positioning itself as a key player in both traditional and emerging markets.

The revenue model of SHCCIG is multifaceted, reflecting its broad spectrum of operations. Primarily, the company generates income through the extraction and sale of coal, which serves as a foundational revenue stream. Furthermore, significant revenues are derived from the coal chemical industry, electric power generation, and the production of iron and steel. SHCCIG also benefits from investment returns in construction and railway sectors, along with its technological innovations and financial services. Through its diversified revenue streams, SHCCIG ensures financial stability and the continuous growth of its comprehensive industrial ecosystem, reinforcing its position as a cornerstone of China's energy and chemical industries.

Headquater: Xi'an, Shaanxi, China

Foundations date: 2004

Company Type: State-owned

Sector: Industrials

Category: Mining

Digital Maturity: Conservative

Shaanxi Coal & chemical Industry’s Related Competitors

BHP Billiton Business Model

China Minmetals Business Model

Datong Coal Mine Group Business Model

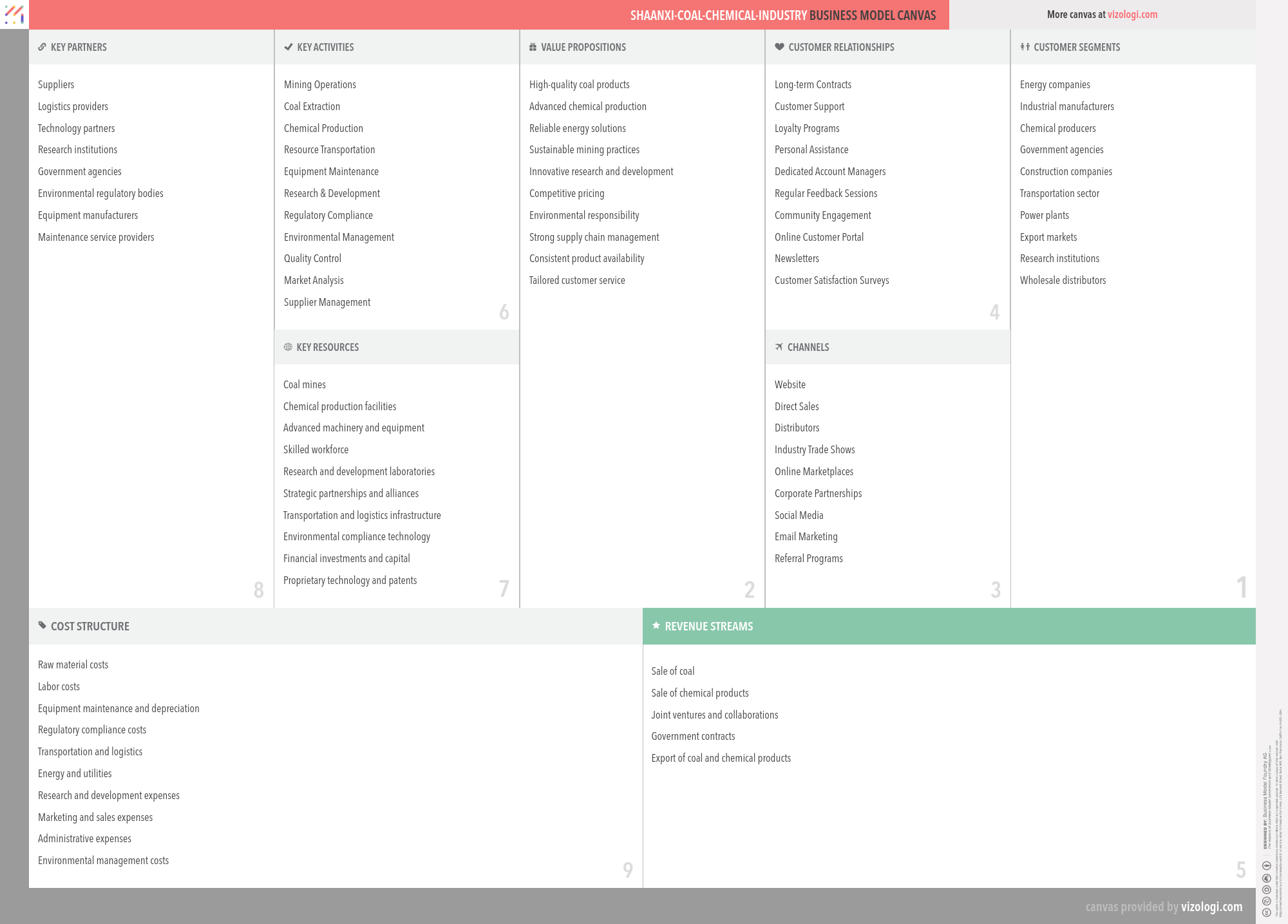

Shaanxi Coal & chemical Industry’s Business Model Canvas

- Suppliers

- Logistics providers

- Technology partners

- Research institutions

- Government agencies

- Environmental regulatory bodies

- Equipment manufacturers

- Maintenance service providers

- Mining Operations

- Coal Extraction

- Chemical Production

- Resource Transportation

- Equipment Maintenance

- Research & Development

- Regulatory Compliance

- Environmental Management

- Quality Control

- Market Analysis

- Supplier Management

- Coal mines

- Chemical production facilities

- Advanced machinery and equipment

- Skilled workforce

- Research and development laboratories

- Strategic partnerships and alliances

- Transportation and logistics infrastructure

- Environmental compliance technology

- Financial investments and capital

- Proprietary technology and patents

- High-quality coal products

- Advanced chemical production

- Reliable energy solutions

- Sustainable mining practices

- Innovative research and development

- Competitive pricing

- Environmental responsibility

- Strong supply chain management

- Consistent product availability

- Tailored customer service

- Long-term Contracts

- Customer Support

- Loyalty Programs

- Personal Assistance

- Dedicated Account Managers

- Regular Feedback Sessions

- Community Engagement

- Online Customer Portal

- Newsletters

- Customer Satisfaction Surveys

- Energy companies

- Industrial manufacturers

- Chemical producers

- Government agencies

- Construction companies

- Transportation sector

- Power plants

- Export markets

- Research institutions

- Wholesale distributors

- Website

- Direct Sales

- Distributors

- Industry Trade Shows

- Online Marketplaces

- Corporate Partnerships

- Social Media

- Email Marketing

- Referral Programs

- Raw material costs

- Labor costs

- Equipment maintenance and depreciation

- Regulatory compliance costs

- Transportation and logistics

- Energy and utilities

- Research and development expenses

- Marketing and sales expenses

- Administrative expenses

- Environmental management costs

- Sale of coal

- Sale of chemical products

- Joint ventures and collaborations

- Government contracts

- Export of coal and chemical products

Vizologi

A generative AI business strategy tool to create business plans in 1 minute

FREE 7 days trial ‐ Get started in seconds

Try it freeShaanxi Coal & chemical Industry’s Revenue Model

Shaanxi Coal & chemical Industry makes money by combining different business models. Below, you will find the list of the different monetization strategies identified for this company:

- State-owned

- Lock-in

- Integrator

- Dynamic pricing

- Cross-subsidiary

- Energy

- From push to pull

- Solution provider

- Make and distribute

- Supply chain

- Performance-based contracting

- Guaranteed availability

- Low touch

- Decomposition

Shaanxi Coal & chemical Industry’s Case Study

Shaanxi Coal & Chemical Industry's CASE STUDY

Introduction

When we delve into the landscape of China's industrial giants, there’s one name that stands out with a towering presence: Shaanxi Coal and Chemical Industry Group Co., Ltd. (SHCCIG). Not just a behemoth in terms of operations, but a hallmark of integration across numerous sectors, SHCCIG serves as an exemplary case of strategic vertical and horizontal integration that propels sustainable growth and economic vitality.

Headquartered in Xi'an, SHCCIG is a multifaceted conglomerate that operates in the mining, chemical, energy, and heavy machinery sectors, among others. Established in 2004, this state-owned enterprise has built an empire around a mission that prioritizes environmental stewardship and economic development—factors that we’ll see have a significant resonance across their entire operational framework.

The Comprehensive Business Model

One of the distinguishing characteristics of SHCCIG is its rigorous integration across the entire value chain—from the resource extraction phase to end-product distribution. This strategic approach ensures an efficient utilization of resources, heightened operational efficiencies, and strict quality control mechanisms. For instance, the company operates over 90 wholly-owned, holding, and joint-stock subsidiaries, each contributing to the value creation process.

Coal Mining and Chemical Production

Coal mining forms the bedrock of SHCCIG’s revenue streams, accounting for a major segment of their financial inflow. The company operates numerous coal mines within Shaanxi Province, leveraging vast coal reserves that are estimated to be among the most abundant in China. According to their latest report, the company extracted over 200 million tons of coal in 2022, an immense figure that highlights its dominance (Source: SHCCIG Annual Report 2022).

In addition to extraction, SHCCIG has a robust coal chemical industry. This sector transforms raw coal into value-added chemical products, thereby enhancing revenue streams and optimizing resource utilization. The dual engines of coal and chemical operations enable the company to leverage its raw material base effectively, simultaneously feeding into other sectors like energy and iron and steel production.

Expanding into Energy and Infrastructure

Energy production is another cornerstone of SHCCIG’s diverse portfolio. With investments in power plants and electric power generation facilities, the company not only supplements its revenue from coal but also ensures a stable and reliable energy supply that powers other industries. According to a 2022 industry report, SHCCIG’s power plants generated approximately 60 billion kWh of electricity, reinforcing their role as a key energy supplier in China (Source: China Energy Statistical Yearbook 2022).

Furthermore, SHCCIG's venture into infrastructure through railway investment and construction projects amplifies its breadth of operations. For example, their railway investments streamline the logistic operations of coal transportation, reducing costs and bolstering efficiency. By controlling both the production and distribution channels, SHCCIG maintains a competitive edge through unparalleled operational agility.

Technological Innovation and Sustainability

Technological advancement and sustainability are pivotal to SHCCIG’s strategy. The company invests heavily in R&D, constantly innovating to improve efficiency and reduce its environmental footprint. Their proprietary technologies in coal chemical processing are touted as industry standards, contributing significantly to their competitive standing.

Additionally, SHCCIG has committed to sustainable mining practices. By implementing advanced environmental management systems, the company mitigates the adverse effects of mining activities. According to a report by the China Coal Chemical Industry Association, SHCCIG has invested over $1 billion into environmental management initiatives over the past decade, emphasizing their role as a responsible corporate citizen (Source: China Coal Chemical Industry Association 2022).

Customer Relationships and Market Presence

For a conglomerate as extensive as SHCCIG, maintaining strong customer relationships is paramount. The company employs a multifaceted approach, which includes long-term contracts, loyalty programs, and dedicated account management to ensure sustained engagement with their diverse customer base. This approach is instrumental in reinforcing their market presence across energy companies, industrial manufacturers, and government agencies.

Their extensive distribution channels—ranging from direct sales and corporate partnerships to online marketplaces—ensure that SHCCIG’s products are accessible globally. According to a study by the China Market Research Group, the company has consistently maintained a strong presence in export markets, accounting for nearly 20% of China’s coal exports in 2022 (Source: China Market Research Group, 2022).

Conclusion

Shaanxi Coal and Chemical Industry Group epitomizes the power of integrated, diversified operations in China’s industrial sector. Through a well-orchestrated synergy of coal mining, chemical production, energy generation, and infrastructure investments, the company ensures a robust and resilient business model. Their commitment to technological innovation and sustainability further sets them apart as a leader in fostering economic growth while safeguarding environmental integrity.

Looking forward, SHCCIG’s blend of traditional industrial prowess and forward-thinking strategies positions them as a cornerstone of not only Shaanxi Province’s economic development but also as a pivotal player in the global industrial landscape. The lessons gleaned from their business model offer valuable insights for industries seeking to balance profitability with sustainability in an ever-evolving market.

In essence, SHCCIG stands as a paragon of strategic integration and operational excellence—an industrial titan whose story continues to shape the future of energy and chemical industries.

If you enjoyed this content, you’re in for a treat! Dive into our extensive repository of business model examples, where we’ve dissected and analyzed thousands of business strategies from top tech companies and innovative startups. Don’t miss out!