Why Wesfarmers's Business Model is so successful?

Get all the answers

Wesfarmers’s Company Overview

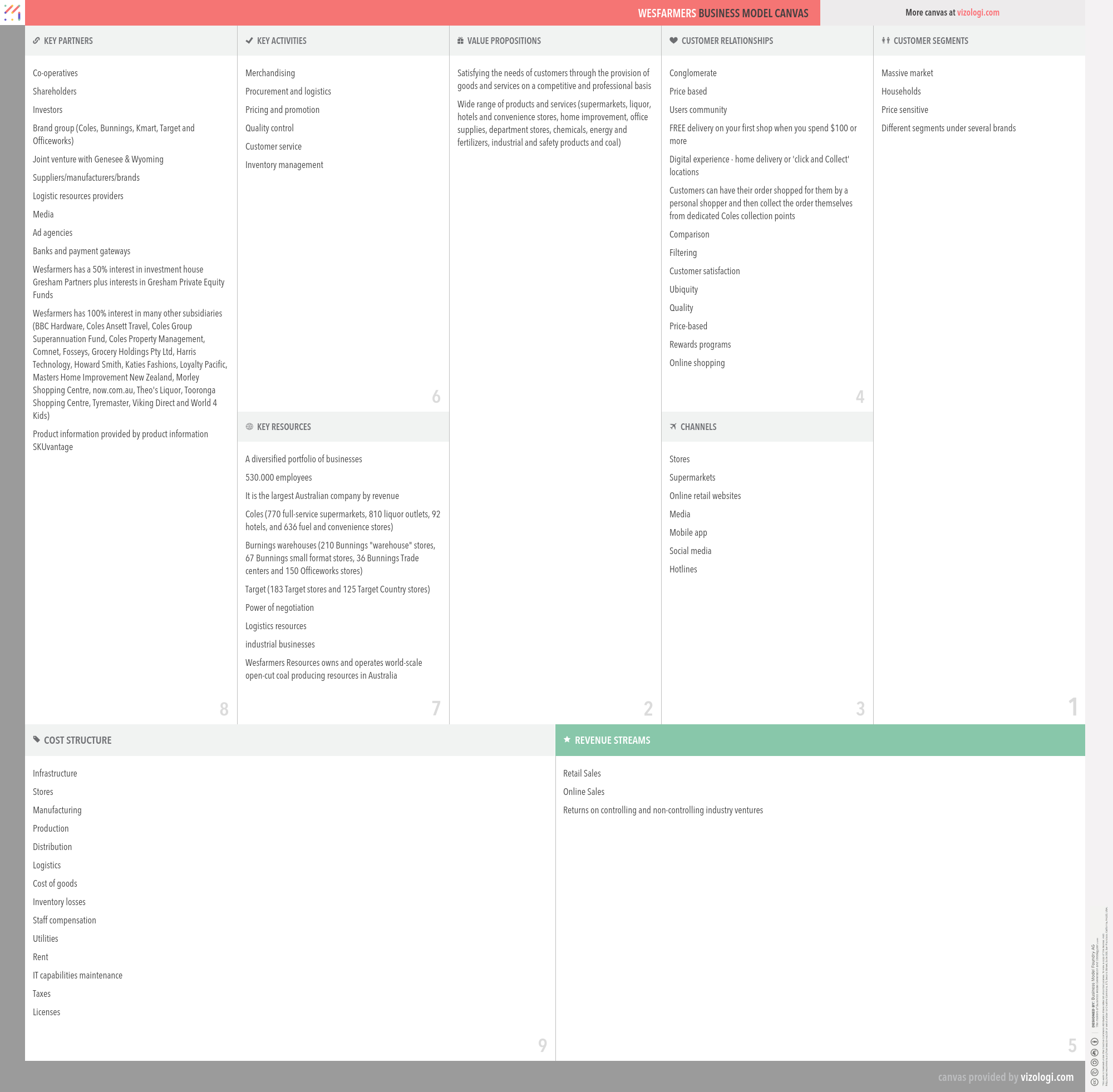

Wesfarmers Limited is engaged in various business operations, such as supermarkets, liquor, hotels and convenience stores; home improvement; office supplies, and an industrials division with businesses in chemicals, energy and fertilizers, industrial and safety products and coal. The Company's segments include Coles; Home Improvement; Department Stores, which includes Kmart and Target; Office Works; Industrials, which includes Resources, WIS and WesCEF, and Other. Coles is a supermarket retailer, which operates over 770 supermarkets. Bunnings is a retailer of home improvement and outdoor living products in Australia and New Zealand. Kmart is a retailer with approximately 210 stores throughout Australia and New Zealand. Target operates a network of over 300 stores and sells a range of products for the contemporary family, including apparel, housewares and general merchandise. Officeworks is a retailer and supplier of office products and solutions for home, business and education.

www.wesfarmers.com.auCountry: Australia

Foundations date: 1914

Type: Public

Sector: Consumer Goods

Categories: Retail

Wesfarmers’s Customer Needs

Social impact:

Life changing:

Emotional: provides access, rewards me

Functional: saves time, simplifies, organizes, connects, quality, sensory appeal, variety, reduces cost

Wesfarmers’s Related Competitors

Wesfarmers’s Business Operations

Advertising:

This approach generated money by sending promotional marketing messages from other businesses to customers. When you establish a for-profit company, one of the most critical aspects of your strategy is determining how to generate income. Many companies sell either products or services or a mix of the two. However, advertisers are frequently the source of the majority of all of the revenue for online businesses and media organizations. This is referred to as an ad-based income model.

Affiliation:

Commissions are used in the affiliate revenue model example. Essentially, you resell goods from other merchants or businesses on your website or in your physical store. You are then compensated for referring new consumers to the company offering the goods or services. Affiliates often use a pay-per-sale or pay-per-display model. As a result, the business can access a more diversified prospective client base without extra active sales or marketing efforts. Affiliate marketing is a popular internet business strategy with significant potential for growth. When a client purchases via a referral link, the affiliate gets a portion of the transaction's cost.

Archetypes of business model design:

The business model archetypes include many business personalities and more than one business model linked to various goods or services. There is a common foundation behind the scenes of each unit, but from a management standpoint, each group may operate independently.

Brands consortium:

A collection of brands that coexist under the auspices of a parent business. The businesses in this pattern develop, produce, and market equipment. Their strength is in copywriting. Occasionally used to refer to a short-term agreement in which many companies (from the same or other industrial sectors or countries) combine their financial and personnel resources to execute a significant project benefiting all group members.

Cash machine:

The cash machine business model allows companies to obtain money from sales since consumers pay ahead for the goods they purchase, but the costs required to generate the revenue are not yet paid. This increases companies' liquidity, which they may use to pay off debt or make additional investments. Among several others, the online store Amazon often employs this business model.

Credits:

A credit arrangement is when a consumer purchases items on credit (without paying cash) and spends the provider later. Typically, trade credit is extended for a certain number of days after the products are delivered. These credits may be deducted from one's tax liability.

Cross-selling:

Cross-selling is a business strategy in which additional services or goods are offered to the primary offering to attract new consumers and retain existing ones. Numerous businesses are increasingly diversifying their product lines with items that have little resemblance to their primary offerings. Walmart is one such example; they used to offer everything but food. They want their stores to function as one-stop shops. Thus, companies mitigate their reliance on particular items and increase overall sustainability by providing other goods and services.

Cross-subsidiary:

When products and goods and products and services are integrated, they form a subsidiary side and a money side, maximizing the overall revenue impact. A subsidiary is a firm owned entirely or in part by another business, referred to as the parent company or holding company. A parent company with subsidiaries is a kind of conglomerate, a corporation that consists of several distinct companies; sometimes, the national or worldwide dispersion of the offices necessitates the establishment of subsidiaries.

Channel aggregation:

Consolidating numerous distribution routes into one to achieve greater economic efficiency. A business model for internet commerce in which a company (that does not manufacture or warehouse any item) gathers (aggregates) information about products and services from many competing sources and displays it on its website. The firm's strength is in its power to create an 'environment' that attracts users to its website and develop a system that facilitates pricing and specification matching.

Channel per purpose:

Creating separate channels for selling and purchasing current goods and services. A marketing plan is a vendor's plan for distributing a product or service to the end consumer through the chain of commerce. Manufacturers and retailers have a plethora of channel choices. The simplest method is the direct channel, which involves the seller selling directly to the consumer. In addition, the vendor may use its own sales staff or offer its goods or services through an e-commerce website.

Decomposition:

Simplifying many product kinds inside a product group or set of goods. A technique for doing business analysis in which a complex business process is dissected to reveal its constituent parts. Functional decomposition is a technique that may be used to contribute to an understanding and management of large and complicated processes and assist in issue solving. Additionally, functional decomposition is utilized in computer engineering to aid in the creation of software.

Direct selling:

Direct selling refers to a situation in which a company's goods are immediately accessible from the manufacturer or service provider rather than via intermediate channels. The business avoids the retail margin and any extra expenses connected with the intermediaries in this manner. These savings may be passed on to the client, establishing a consistent sales experience. Furthermore, such intimate touch may help to strengthen client connections. Finally, direct selling benefits consumers by providing convenience and service, such as personal demonstrations and explanations of goods, home delivery, and substantial satisfaction guarantees.

Discount club:

The discount club concept is built on perpetual high-discount deals utilized as a continual marketing plan or a brief period (usually one day). This might be seen as a reduction in the face value of an invoice prepared in advance of its payments in the medium or long term.

eCommerce:

Electronic commerce, or e-commerce (alternatively spelled eCommerce), is a business model, or a subset of a larger business model, that allows a company or person to do business via an electronic network, usually the internet. As a result, customers gain from increased accessibility and convenience, while the business benefits from integrating sales and distribution with other internal operations. Electronic commerce is prevalent throughout all four main market segments: business to business, business to consumer, consumer to consumer, and consumer to business. Ecommerce may be used to sell almost any goods or service, from books and music to financial services and airline tickets.

Experience selling:

An experience in the sales model describes how a typical user perceives or comprehends a system's operation. A product or service's value is enhanced when an extra customer experience is included. Visual representations of experience models are abstract diagrams or metaphors derived from recognizable objects, actions, or systems. User interfaces use a range of experience models to help users rapidly comprehend what is occurring in the design, where they are, and what they may do next. For example, a software experience model may depict the connection between two applications and the relationship between an application and different navigation methods and other system or software components.

From push to pull:

In business, a push-pull system refers to the flow of a product or information between two parties. Customers pull the products or information they need on markets, while offerers or suppliers push them toward them. In logistics and supply chains, stages often operate in both push and pull modes. For example, push production is forecasted demand, while pull production is actual or consumer demand. The push-pull border or decoupling point is the contact between these phases. Wal-Mart is a case of a company that employs a push vs. a pull approach.

Hypermarket:

Disrupts by 'brand bombing' competitors, often by offering below cost. Hypermarkets, like other large-scale retailers, generally operate on a high-volume, low-margin basis. They typically span a space of 5,000 to 15,000 square meters (54,000 to 161,000 square feet) and stock more than 200,000 different brands of goods.

Long tail:

The long tail is a strategy that allows businesses to realize significant profit out of selling low volumes of hard-to-find items to many customers instead of only selling large volumes of a reduced number of popular items. The term was coined in 2004 by Chris Anderson, who argued that products in low demand or with low sales volume can collectively make up market share that rivals or exceeds the relatively few current bestsellers and blockbusters but only if the store or distribution channel is large enough.

Niche retail:

A marketing strategy for a product or service includes characteristics that appeal to a particular minority market segment. A typical niche product will be distinguishable from other goods and manufactured and sold for specialized purposes within its associated niche market. Niche retail has focused on direct-to-consumer and direct-to-business internet sales channels. The slogan for niche retail is Everything except the brand.

Online marketplace:

An online marketplace (or online e-commerce marketplace) is a kind of e-commerce website in which product or service information is supplied by various third parties or, in some instances, the brand itself, while the marketplace operator handles transactions. Additionally, this pattern encompasses peer-to-peer (P2P) e-commerce between businesses or people. By and large, since marketplaces aggregate goods from a diverse range of suppliers, the variety and availability are typically greater than in vendor-specific online retail shops. Additionally, pricing might be more competitive.

Performance-based contracting:

Performance-based contracting (PBC), sometimes referred to as performance-based logistics (PBL) or performance-based acquisition, is a method for achieving quantifiable supplier performance. A PBC strategy focuses on developing strategic performance measures and the direct correlation of contract payment to success against these criteria. Availability, dependability, maintainability, supportability, and total cost of ownership are all standard criteria. This is accomplished mainly via incentive-based, long-term contracts with precise and quantifiable operational performance targets set by the client and agreed upon by contractual parties.

Regular replacement:

It includes items that must be replaced on a regular basis; the user cannot reuse them. Consumables are products utilized by people and companies and must be returned regularly due to wear and tear or depletion. Additionally, they may be described as components of a final product consumed or irreversibly changed throughout the production process, including semiconductor wafers and basic chemicals.

Remainder retail:

Remainder retail (affectionately referred to as daily deal, flash sale, or one deal a day) is an online business strategy in which a website sells a single product for a period of 24 to 36 hours. Customers may join deal-a-day websites as members and get online deals and invite through email or social media. The deal-of-the-day business model works by enabling merchants to advertise discounted services or goods directly to the deal company's consumers, with the deal company receiving a cut of the retailer's earnings. This enables merchants to foster brand loyalty and rapidly liquidate excess inventory.

Reseller:

Resellers are businesses or individuals (merchants) that acquire products or services to resell them instead of consuming or utilizing them. This is often done for financial gain (but could be resold at a loss). Resellers are well-known for doing business on the internet through websites. One instance is the telecommunications sector, in which corporations purchase surplus transmission capacity or take the call from other providers and resell it to regional carriers.

Spectrum retail:

Utilizes a multi-tiered e-commerce approach. The firm first focused on business-to-consumer connections with its customers and business-to-business ties with its suppliers. Still, it later expanded to include customer-to-business transactions after recognizing the importance of customer evaluations in product descriptions. It now also enables customer-to-customer transactions by establishing a marketplace that serves as a middleman for such transactions. The company's platform enables nearly anybody to sell almost anything.

Supermarket:

A supermarket is a self-service store arranged into aisles and has many foods and home goods. It is bigger and has a greater variety than traditional grocery shops but is smaller and offers a more limited selection than a hypermarket or big-box market. Supermarkets are usually chain shops supplied by their parent firms' distribution centers, allowing for more significant economies of scale. In addition, supermarkets often provide items at competitive rates by using their purchasing power to negotiate lower pricing from producers than smaller shops can.

Supply chain:

A supply chain is a network of companies, people, activities, data, and resources that facilitate the movement of goods and services from supplier to consumer. The supply chain processes natural resources, raw materials, and components into a completed product supplied to the ultimate consumer. In addition, used goods may re-enter the distribution network at any point where residual value is recyclable in advanced supply chain systems. Thus, value chains are connected through supply chains.

Recommended companies based on your search: